- Dogecoin options volume jumps 98%, showing rising trader speculation

- Futures open interest climbs 2.6%, reflecting increased market exposure

- Death cross forms on weekly chart, raising long-term trend caution

Dogecoin is witnessing a surge in derivatives activity, with sharp increases in both options volume and futures open interest. This signals renewed interest from traders expecting heightened volatility in the coming sessions.

At the same time, DOGE has broken out of key chart patterns, pointing to a potential bullish reversal. However, a recent death cross on the weekly timeframe raises caution, suggesting that upward momentum may still face headwinds.

Derivatives Markets Show Aggressive Positioning

Dogecoin’s recent derivatives data points to growing risk appetite among traders. Fresh capital is entering the market as futures open interest has increased 2.6% to $2.11 billion.

Meanwhile, options open interest has risen 23.64% to more than $508,000, indicating aggressive positioning on both ends of the trade.

Options volume also spiked by 98.13% to $164.93 million, which means traders anticipate a big move in price. This is a spike of the magnitude that often accompanies major price transitions or impending volatility.

DOGE’s futures market has also seen volume rise over 8% to over $3.2 billion. This means that the market is becoming more and more participatory and institutions and retail traders are becoming more interested.

A simultaneous rise in both volume and open interest is usually an indication of strong conviction in price direction.

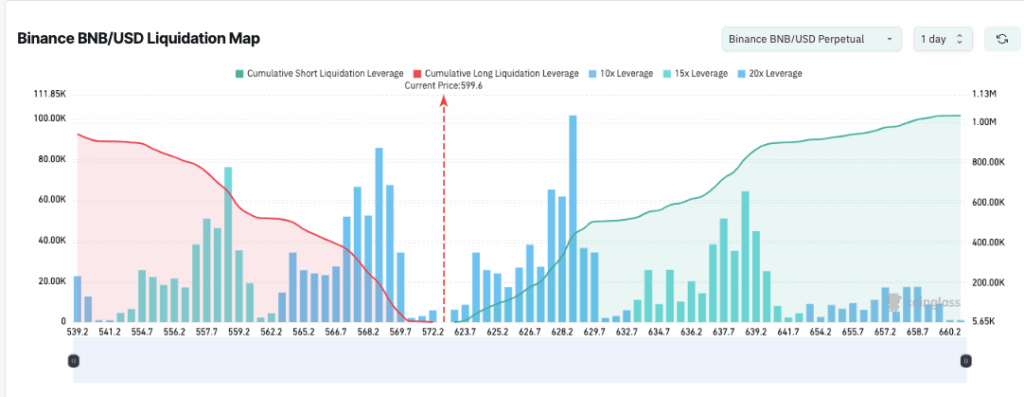

But also, an increasing open interest can signal that there is a great deal of leverage building. That means it raises the risk of large liquidations.

Technical Patterns Signal Breakout, But Volume Lags

On the 30-minute chart, DOGE recently broke above a symmetrical triangle, which is often a bullish continuation pattern.

However, DOGE is still near the breakout zone, and it needs follow-through volume to stay in the momentum.

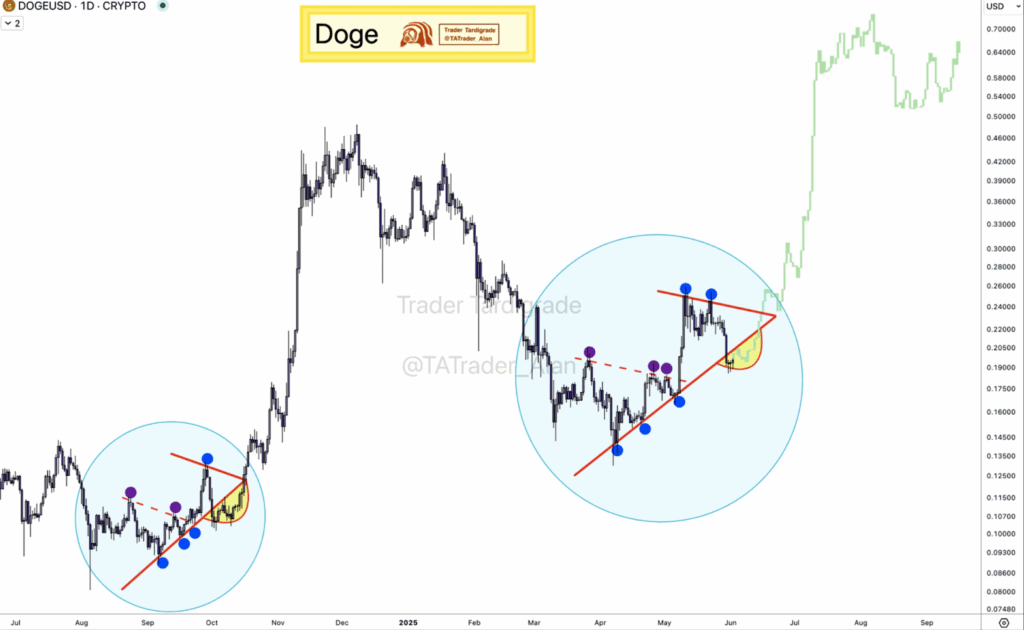

Additionally, on the daily chart, Dogecoin is building a pattern similar to the one it had before its last big rally. The falling wedge ended with a breakout in the same way as late 2023’s accumulation period. According to Trader Tardigrade, this pattern could suggest more gains if the current price levels are maintained.

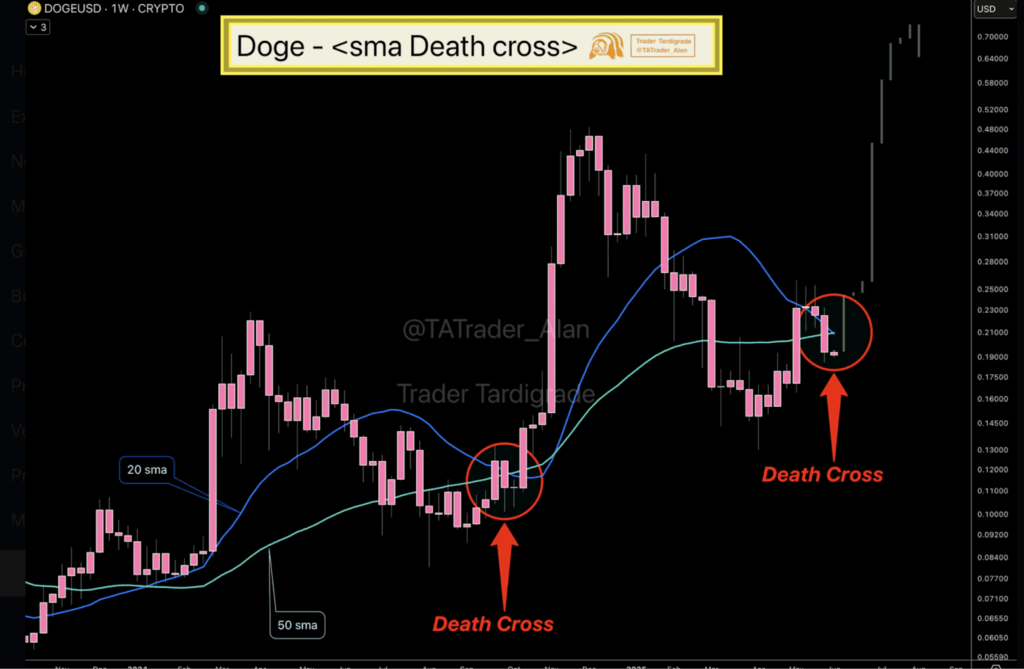

But caution is still advised. On the weekly chart, a “death cross” has printed, as the 20-week SMA crosses below the 50-week SMA.

This pattern tends to be seen as a bearish long-term signal and has historically preceded price corrections in major assets. This signal must be invalidated by the current uptrend by moving above key resistance levels.

To the mixed picture, spot trading volume continues to fall. Charts show DOGE trading activity has been consistent in its decline since March, with volume dropping from $60 billion to under $5 billion.

This means the current rally is more likely being pushed by leveraged derivatives rather than organic buying interest.

Developer Activity Stable But Still Limited

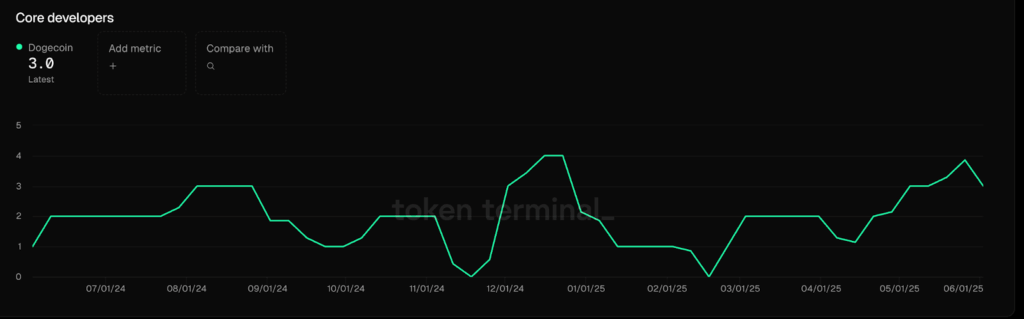

The network fundamentals of Dogecoin have not changed much, and there has not been a big change in core development activity.

Over the last 12 months, there have been an average of 3.0 core developers. This is a small number compared to other Layer 1 ecosystems that are more actively developed.

Since March 2025, the developer count has had a small uptick, but it has not yet translated into visible upgrades or new features.

Development activity is a key indicator for long-term investors of the project’s health and adaptability. A stagnant developer base could stifle DOGE’s utility and innovation potential over time.

Dogecoin’s popularity and liquidity keep it an attractive speculative asset despite the low developer count. The coin’s meme-driven appeal coupled with growing derivatives activity means it is a heavily traded coin. But, in the long run, sustained price growth may depend on stronger fundamentals and broader ecosystem development.