Key Insights:

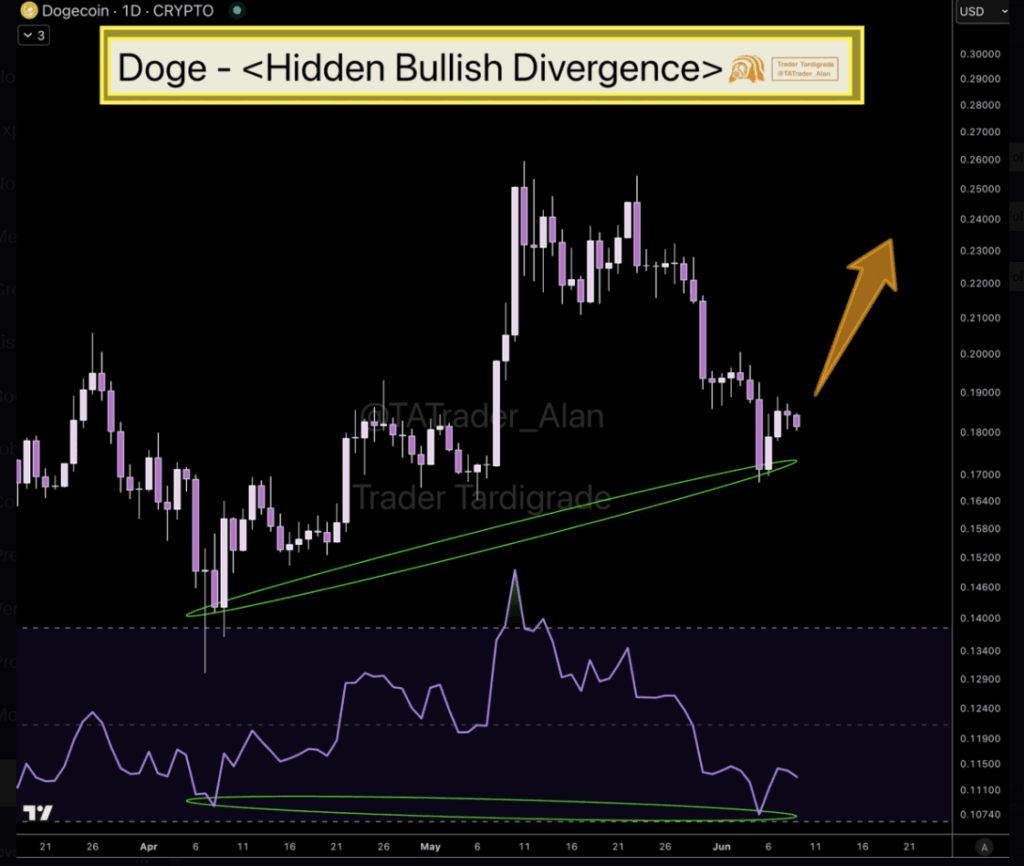

- DOGE has formed hidden bullish divergence, hinting at trend strength even as price consolidates near support.

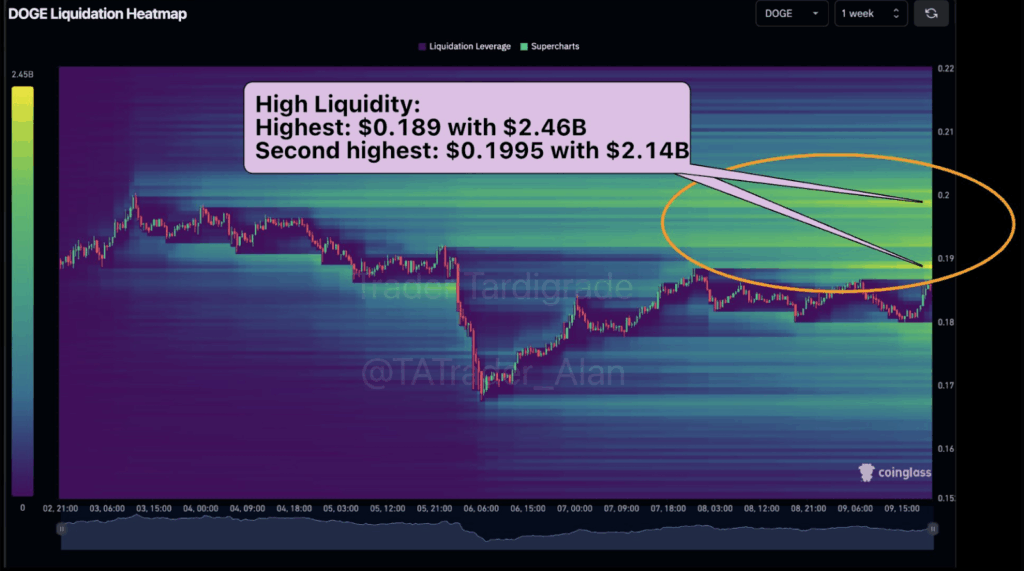

- Over $4.6B in liquidation liquidity sits between $0.189 and $0.1995, a critical magnet zone for price movement.

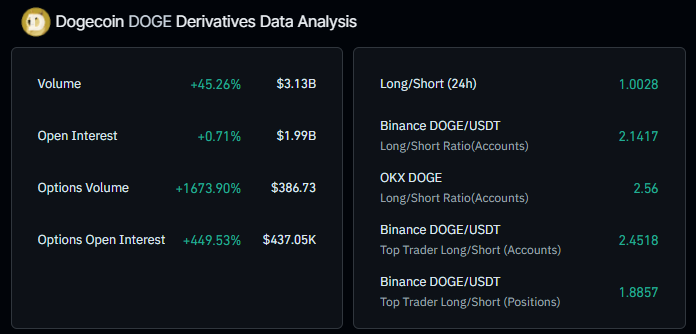

- Derivatives metrics soar with a 45% volume jump and 1,673% spike in options trades, showing strong market interest.

Dogecoin is at a critical point as technical indicators and derivatives activity continue to rise.

Analysts point out that the $0.19 – $0.1995 area is a key liquidity cluster to watch as the price hovers near $0.186.

DOGE has over $4.6 billion in liquidation liquidity stacked above the current price, which could mean it is preparing for a squeeze.

At the same time, bullish divergence and increasing interest in options markets suggest the breakout move is in the cards.

Liquidity Builds Near $0.19 as Dogecoin Eyes a Potential Breakout

At the moment, DOGE is orbiting around a tight range just below two major liquidation levels. They are $0.189 with $2.46 billion in potential short liquidations behind it and $0.1995 with $2.14 billion in risk. This liquidity clustering is the perfect setting for sudden upward spikes.

Often, such levels are market maker targets or catalysts for forced buying when breached. When the price reaches these zones, shorts may start to get liquidated, which could help propel a quick breakout.

These liquidity levels are among the most crowded in the current market structure, as the heatmap confirms. Whether DOGE will break through these resistances or not will determine its next trend.

Bullish Divergence on the RSI Signals Hidden Strength for Dogecoin

Dogecoin is holding support, building hidden bullish divergence on the daily RSI, according to analyst Tardigrade.

When price makes lower or equal lows, and RSI forms higher lows, this means that there is internal strength. That’s a signal that buyers are taking pressure and getting ready for higher bids.

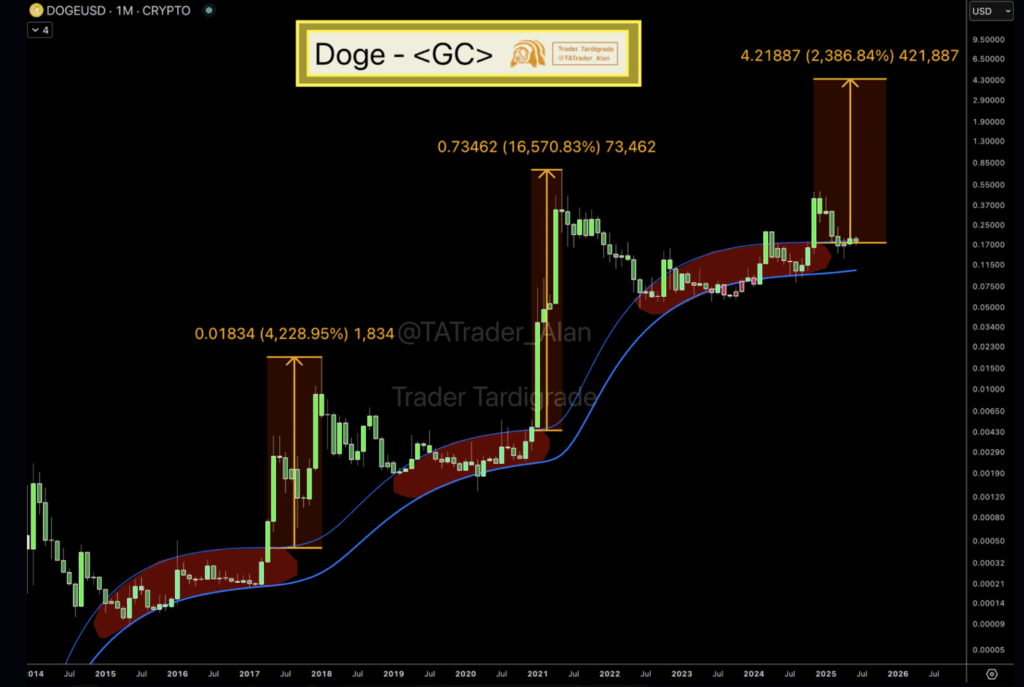

The ascending support trendline from several weeks ago remains in play for the price action. The base that is rising here matches past pre break out formations where DOGE compressed before the surge. Historically, volume returns gradually before the continuation of bullish cycles in altcoin cycles.

Moreover, the DOGE is riding its mid band, which it usually respects before upward movement on the Gaussian channel.

This structure formed the last time, and DOGE rallied more than 16, 000% over the following months. Momentum holding is an indicator that another strong move could be in development.

Additionally, Binance and OKX funding rates are still positive but not overheated. This implies that long traders are paying a premium and there is not extreme leverage. Such conditions are usually conducive to a healthy continuation rather than a blow off top.

Rising Speculation and Futures Activity Could Point to a Bigger Move Ahead

Trader participation in DOGE was also on the rise, as futures volume saw a 45.26% increase to $3.13 billion in 24 hours.

Open interest is up 0.71% to $1.99 billion, options volume is up 1,673.9% to $386.7 million. As a rule, this sharp rise in speculative activity indicates that a strong directional move is building.

DOGE options open interest also soared 449.53% to $437.05K, indicating large amounts of hedging or directional positioning.

And not only are traders betting on volatility, they are allocating capital to the upside. This comes in line with the structural bullish cues from the spot and technical charts.

Binance and OKX are leaning long/short ratios heavily long: 2.45:1 and 2.56:1, respectively. All these are pointing to Dogecoin coming back on the radar of institutions and speculators.

DOGE’s options market is also maturing, with more traders employing complex strategies as opposed to simple leverage.

The more confident people get, the more capital they bring into breakout setups like this, as long as macro conditions support altcoin rotations.