- SUI price records $13.59B in monthly DEX volume, marking its all-time high despite a 39% weekly volume decline.

- SUI leads major crypto assets with a 55.54% price gain over the past two months, outpacing ETH, SOL, and BTC.

- Daily active users and core developer activity decline, even as Sui commits $10M to ecosystem audits and support.

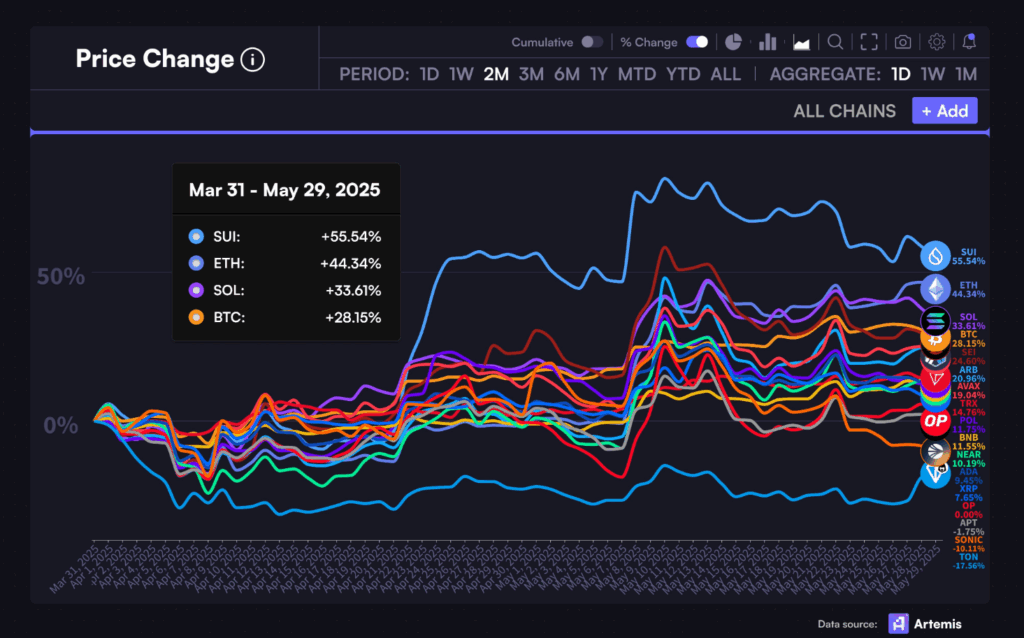

Layer 1 performance charts have been led by SUI, which has surged 55.54% over the past two months, beating Ethereum, Solana and Bitcoin. The protocol also hit an all-time high in monthly DEX volume at $13.59 billion, which coincides with this price rally.

However, the price and the liquidity metrics of the token are still strong, but the daily user activity and core developer contributions are decreasing. The network is now facing both growth and security challenges, and on-chain data and recent ecosystem updates suggest a mixed outlook.

SUI Tops Crypto Price Performance While DEX Volume Hits Record High

Between March 31 and May 29, 2025, SUI rose 55.54%, outperforming ETH (44.34%), SOL (33.61%) and BTC (28.15%).

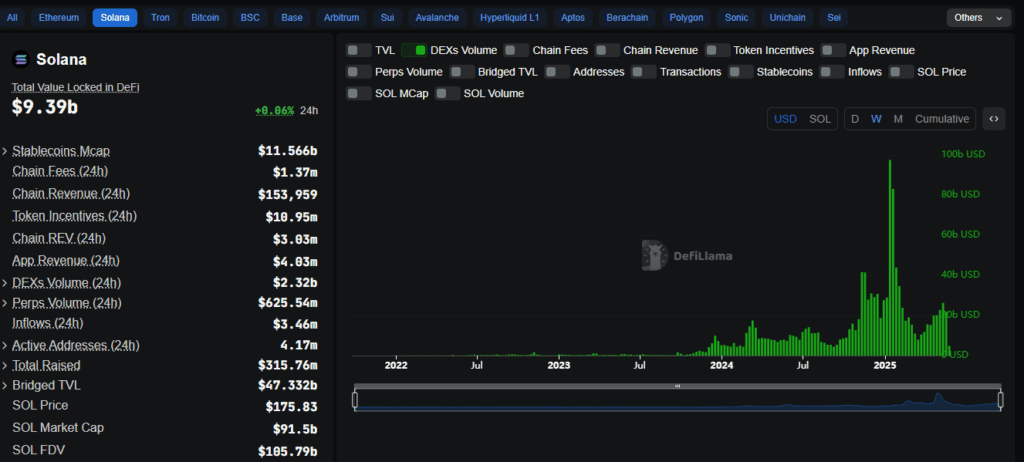

Meanwhile, Sui’s monthly decentralized exchange (DEX) volume shot up to an all-time high of $13.59 billion, while weekly volume fell by 39.41%.

The daily DEX volume also stood at $403.82 million, which proved that the market was active despite volatility.

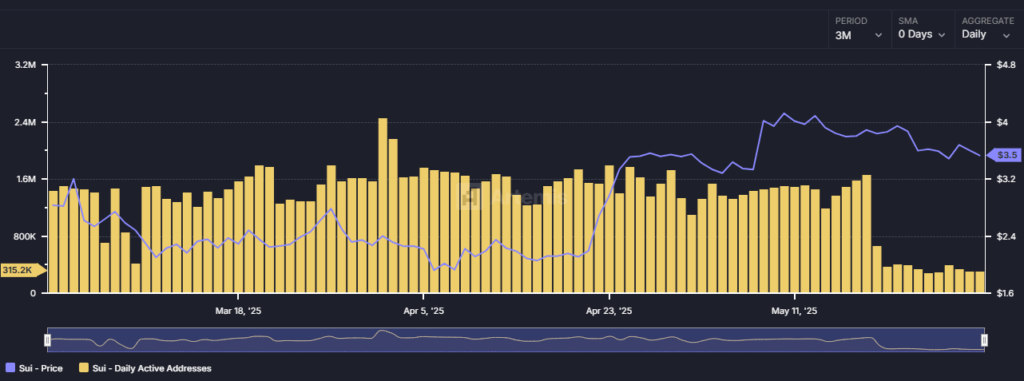

SUI’s price climbed as high as $3.59 before retracing to $3.2, which is an over 9% intraday drop. Moreover, according to CoinGlass data, open interest also fell 10.42% to $1.56 billion, and long/short ratio decreased to 0.9516, showing some bearish pressure.

Trading volume, however, increased 42.27%, indicating active market participation at these price levels.

The correction was not enough to reverse the bullish structure, as chart data shows a pattern of impulsive rallies followed by consolidation phases.

If the token continues its consolidation trend, the current zone around $3.30 could act as support. Sentiment has changed and analysts are still watching to see if SUI will continue its uptrend or retrace further.

On-Chain Activity Weakens as Developer Engagement Slows

Price and liquidity surged, but Sui’s daily active addresses plummeted from over 1.7 million in April to 315,000 in late May.

This is a visible drop in user engagement over the past month, which is worrying for sustained usage. At the same time, the number of core developers dropped from over 120 to 82 weekly contributors according to data from Token Terminal.

The recent increase in early 2025 was followed by this drop in developer participation, which may be seasonal or project-specific.

However, fewer active developers usually means slower feature deployment and ecosystem expansion. Reduced users and developer slowdown combine to create uncertainty about Sui’s long-term network momentum.

The Sui Foundation responded by announcing $10 million in additional support for builders, including co-sponsored audit grants for major protocols.

This is an initiative to improve code security and encourage development on the Move-based chain. It also shows the network’s attempt to keep trust after a large security incident.

Governance Vote and Cetus Exploit Prompt Security and Governance Action

On May 30, Sui Foundation called a governance vote on the recovery of stolen assets associated with the Cetus exploit. A majority of 90.9% of staked tokens voted ‘Yes’ in favour of moving impacted funds to a multi-signature wallet. The vote had over 50% turnout and majority approval and met all requirements.

Cetus Protocol had earlier confirmed that an attacker stole about $223 million in user funds. The team was able to pause $162 million of the stolen assets, and recovery efforts continue with help from the Sui Foundation.

The attack is under investigation, and a full incident report is pending, but the attack prompted tighter scrutiny on protocol-level security.

In response to the breach, Sui has pledged to conduct deeper audits and provide more oversight for big, community-relevant protocols. These moves are meant to increase user confidence and long-term resilience.

Additionally, new DeFi protocols like Kai Finance are gaining traction with the project doubling its TVL to $40 million and providing 25% of USDT–USDC liquidity on Bluefin.