Key Insights:

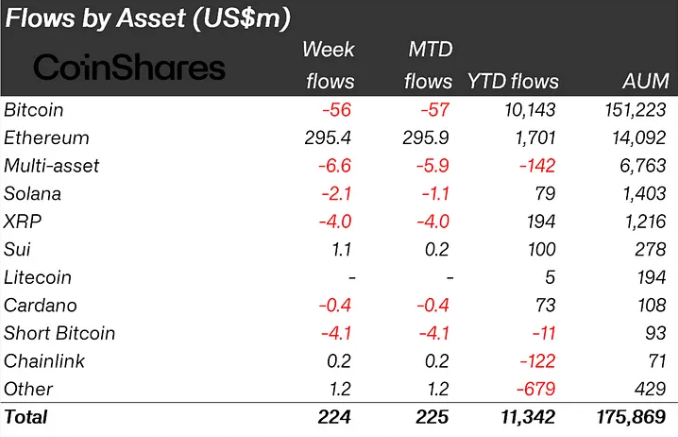

- Ethereum saw $296.4M in inflows, accounting for 10.5% of global ETH fund assets under management.

- Bitcoin had $56.5M in outflows, its second straight week of negative institutional flows.

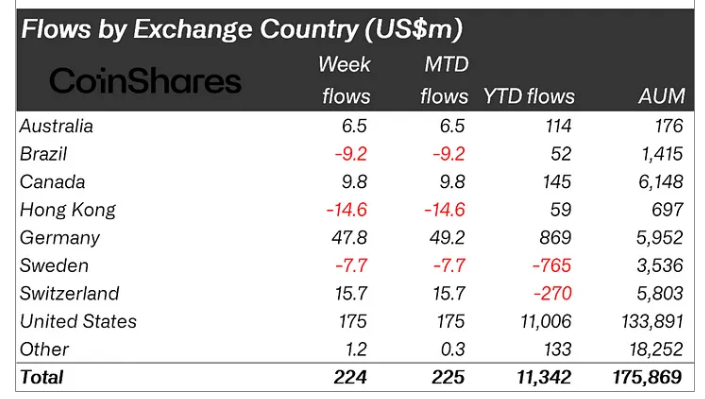

- U.S. funds led with $175M inflows, while Hong Kong and Brazil recorded net outflows.

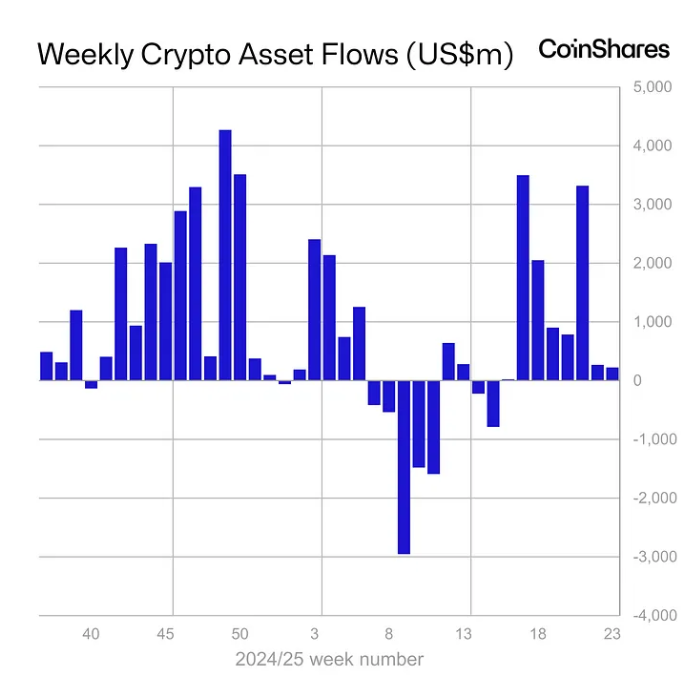

Digital asset fund inflows last week were led by Ethereum with $296.4m, its strongest streak since late 2024. Meanwhile, outflows from Bitcoin amounted to $56.5 million as caution grows.

Regional flows changed amid policy uncertainty, with the U.S. and Germany gaining while Hong Kong and Brazil were redemptions.

Ethereum Leads Global Inflows with Renewed Institutional Demand

Digital asset investment products saw the strongest inflows last week, with $296.4 million flowing into Ethereum products. This marks Ethereum’s seventh straight week of positive flows, totalling about $1.5 billion.

With 10.5% of global Ethereum fund assets under management (AuM), this level is a big share for a single asset.

All of these flows came from U.S.-based spot Ethereum exchange-traded funds, which pulled in $281.3 million. Now, these ETFs have enjoyed 15 straight trading days of net inflows, raking in $837.5 million during that time.

The inflows are consistent, and as ETH-based investment vehicles become more accessible and regulated, the interest from institutions is growing.

Ethereum’s latest inflow streak is its strongest since the U.S. election at the end of 2024. Investor optimism was high at the time due to more clarity on regulatory expectations.

Ethereum is gaining popularity now for similar reasons, with staking capabilities, DeFi exposure and general network utility over other assets.

Bitcoin Sees Second Week of Outflows as Sentiment Cools

On the other hand, Bitcoin investment products saw $56.5 million in net outflows, the second consecutive week of negative flows.

Uncertainty over U.S. monetary policy continued to weigh on broader sentiment, and investors continued to cut exposure. The outflows are a result of reduced risk appetite, especially by institutions waiting for policy signals.

Short-Bitcoin investment products also saw redemptions, which indicates that investors did not reposition into bearish positions but rather moved capital out completely.

This means the market is neutral as opposed to moving towards short selling. Bitcoin’s underperformance may also be related to the fact that it has fewer yield-generating capabilities than Ethereum.

A number of altcoins followed the trend of Bitcoin. Outflows of $6.6 million were recorded for XRP, which is its third week in a row of redemptions.

Meanwhile, Solana also suffered $2.1 million in outflows, which continues its relatively weak performance in recent weeks. But Sui saw $1.1 million of inflows, which is indicative of selective optimism for newer Layer 1 projects.

All in all, the outflows from Bitcoin and major altcoins show that investors are taking a more cautious approach to crypto allocations. In the sector, macro headwinds such as inflation and interest rate uncertainty continue to be the main drivers of capital movement.

It seems that institutions are more prepared to wait for regulatory and economic clarity before allocating large amounts.

Regional Trends Highlight Diverging Investment Behaviour

In the United States, the region that led fund flows, $175 million flowed into digital asset products. This continued strength shows continued confidence in U.S.-regulated crypto products, especially the newly launched Ethereum ETFs. Next up was Germany with $47.8 million in inflows, followed by Switzerland with $15.7 million.

More modest inflows were posted by Canada and Australia, of $9.8 million and $6.5 million, respectively. These numbers show that asset managers in those regions are active but cautious.

But there were some regions that posted notable outflows. Last week, Hong Kong, which had seen record-breaking inflows recently, reported $14.6 million in outflows.

Brazil also had redemptions of $9.2 million. These figures indicate that local economic factors or profit-taking may be behind the movement of assets in these areas.

The regional variation highlights that the sentiment of investors is influenced by national policy, local economic conditions and access to regulated investment products.

The U.S. and Germany are seeing consistent inflows because they have clearer frameworks and product offerings. At the same time, pullbacks are happening in regions that are economically volatile or lack regulatory support.

Last week’s fund flow data was overall one of a growing divide between assets and regions, as regulation, utility and monetary expectations are being factored in. Right now, Ethereum is the one that is benefitting the most from this dynamic, while Bitcoin and other cryptocurrencies adjust to a more cautious investment climate.