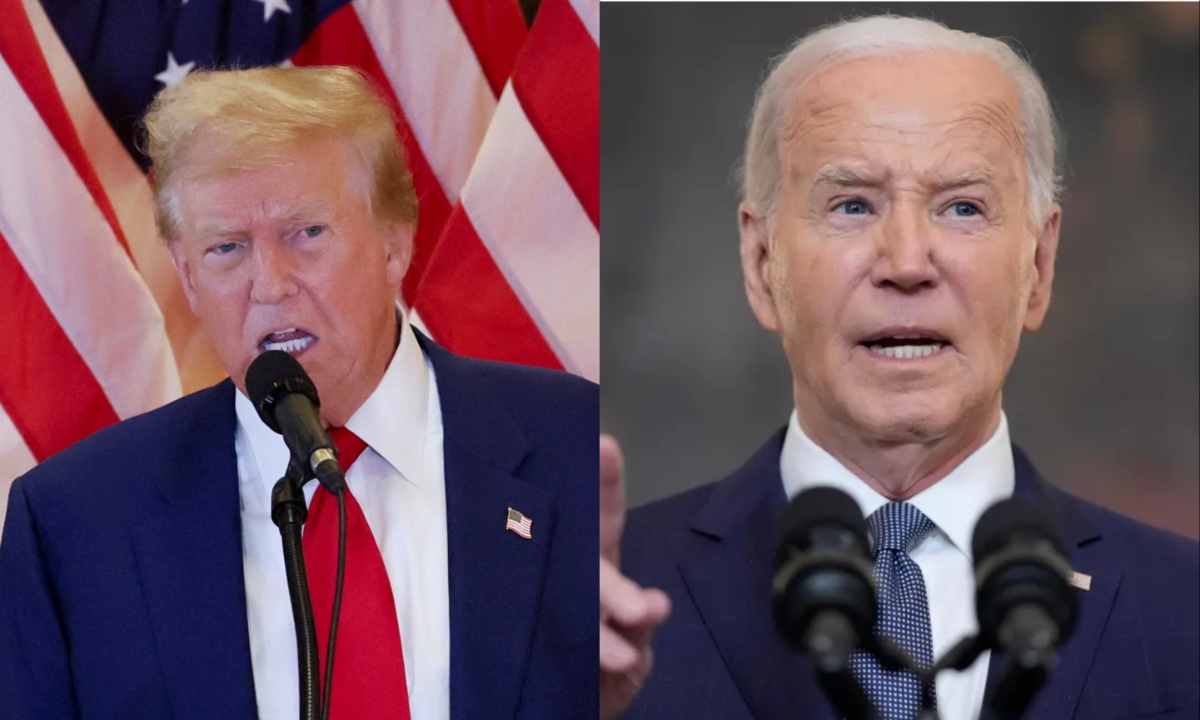

President Biden’s re-election campaign is actively shaping public perception of former President Trump’s business acumen as Trump prepares to address a gathering of nearly 100 CEOs at the Business Roundtable event in Washington, D.C.

Hosted by Larry Kudlow, the event is seen as a pivotal moment for Trump to court support from corporate leaders ahead of the upcoming general election. Trump is expected to highlight his extensive corporate experience, positioning himself as a seasoned leader capable of steering the nation’s economy.

In contrast, Biden’s campaign is pushing a narrative that challenges Trump’s business credentials. Biden spokesperson, James Singer, characterized Trump as incompetent and fraudulent, alleging that Trump’s tenure as both a businessman and president left the country economically devastated.

The campaign pointedly criticized Trump’s track record with bankruptcies in casinos, hotels, airlines, and his eponymous university, aiming to underscore what they perceive as a legacy of failed ventures.

Highlighting Biden’s economic achievements, the campaign emphasized a booming economy characterized by low unemployment rates, rising wages, and reduced inflation.

They credited these improvements to Biden’s policies, contrasting them with what they view as Trump’s economic missteps. The campaign positioned Biden as the candidate capable of sustaining economic growth and addressing the needs of American workers and families.

Conversely, Trump’s campaign defended his business record vigorously, asserting that he successfully built a billion-dollar real estate empire and fostered what they described as the greatest economy in American history during his presidency.

Trump’s spokesperson, Karoline Leavitt, criticized Biden’s economic policies for allegedly exacerbating inflation and increasing the cost of living without offering viable solutions. She portrayed Trump as a strong leader capable of revitalizing the economy and reaffirmed his popularity in recent polls as evidence of his enduring appeal.

The White House, represented by chief of staff Jeff Zients in Biden’s absence, sought to maintain a presence at the Business Roundtable event. With Biden traveling to the G-7 Summit in Italy, the administration continued to advocate for Biden’s economic agenda, aiming to counter Trump’s narrative directly to the corporate leaders in attendance.

The upcoming event represents a clash of narratives between Biden and Trump regarding economic stewardship and leadership qualities. Both campaigns are strategically leveraging Trump’s business background and Biden’s economic achievements to sway public opinion and corporate support ahead of the critical upcoming election.