Key Insights:

- Ethereum surged to $1,860 on April 28, marking its highest price since April 2.

- ETH price broke above the $1,800 resistance level and maintained its position through April 29.

- The bullish breakout has increased the probability of ETH targeting the $2,000 price level soon.

Ethereum’s (ETH) recent surge to $1,860 marks its highest price since April 2, showing strong upward momentum.

The ETH price is gaining traction, supported by rising demand and bullish technical signals. The current market conditions suggest that ETH could reach the $2,000 mark in the near future.

The digital asset exceeded its essential $1,800 resistance level while maintaining trading above this threshold until April 29.

This move comes as momentum builds across the Ethereum network and spot ETF market. Technical signals along with trend indicators demonstrate short-term potential to rise in value.

Literature reviews from market analysts identify this breakout as a potential force behind altcoin growth provided Ether survives its present market strength.

Trader attention remains fixed on the $1,800 support level that has acquired significant importance in the market. If the ETH price holds above this, the path to $2,000 becomes more likely.

Ethereum ETF Inflows Point to Growing Institutional Confidence

Ethereum-based exchange-traded funds recorded $64.1 Million in net inflows on April 28, continuing a strong demand trend.

The exchange-traded funds linked to Ethereum registered $151.7 Million inflow during the week ending April 25.

The surge in activity reflects renewed confidence among institutional participants in Ethereum’s long-term potential.

Additionally, investment products tied to Ethereum attracted $183 Million last week, ending an eight-week streak of outflows.

Etherum benefits from capital inflow at the market level when broader macroeconomic conditions engage global participants.

Digital asset interest has been reviving because U.S. dollar strength has lost its power.

Organizations subject to financial regulations are expanding their ETH exposure via regulated products which generates continuous buying pressure.

As more funds enter Ethereum vehicles, available supply shrinks, potentially supporting the ETH price climb. Both retail investors and institutional players show rising interest at present.

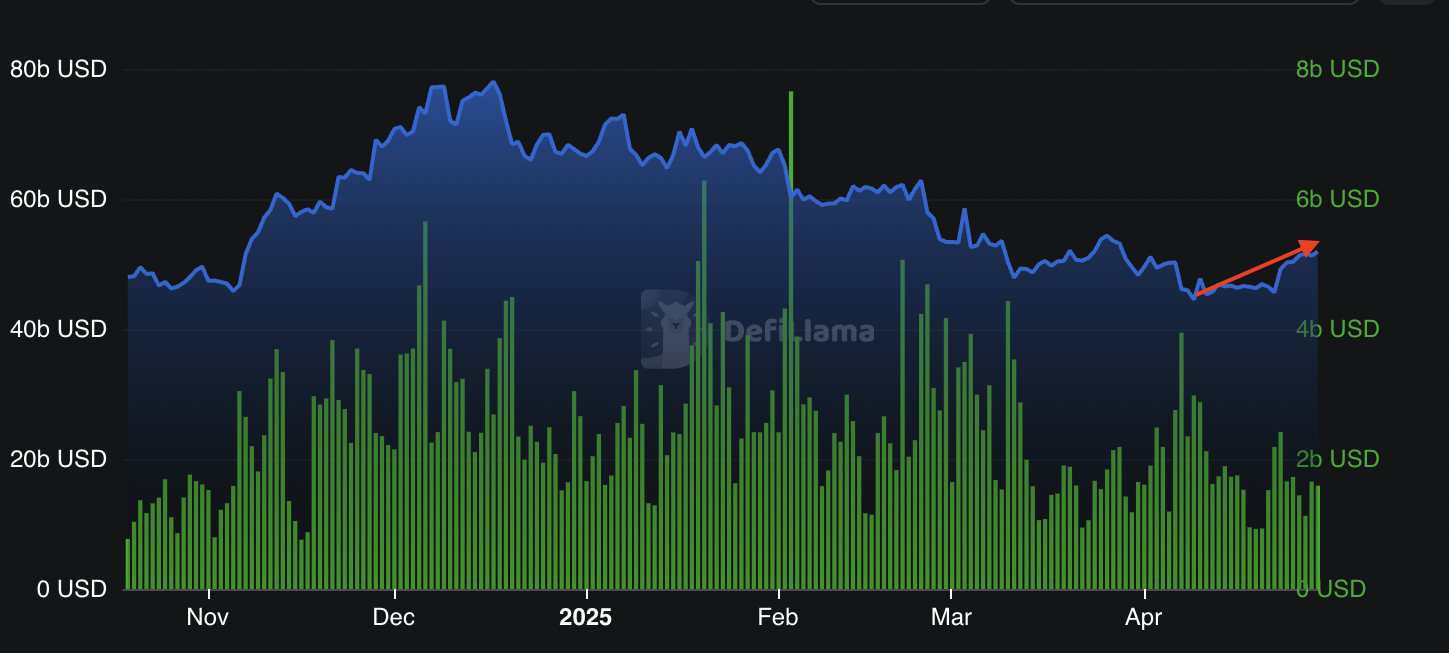

Ethereum TVL Rises to $51.8 Billion

Total value locked (TVL) on Ethereum rose to over $51.8 Billion, highlighting growing participation in the ecosystem.

Over the past seven days, Ethereum’s TVL increased by 16%, showing strong network demand and user confidence.

The increase in value locked in DeFi protocols was driven by several major platforms, which led to the rise.

The TVL growth was spearheaded by Aave, which increased by 13.5% and EigenLayer and Lido as well as Ether.fi displayed identical rises.

These projects reflect heightened Ethereum-based activity amid rising token prices and increased staking.

Combined, they strengthen Ethereum’s position as the leading layer-1 network by DeFi engagement.

Ethereum’s TVL growth outpaced most other networks except SUI, which saw a 47% jump.

Despite this, Ethereum maintains a significant lead in total value and infrastructure adoption. Continued activity on the platform may offer further support for the ETH price.

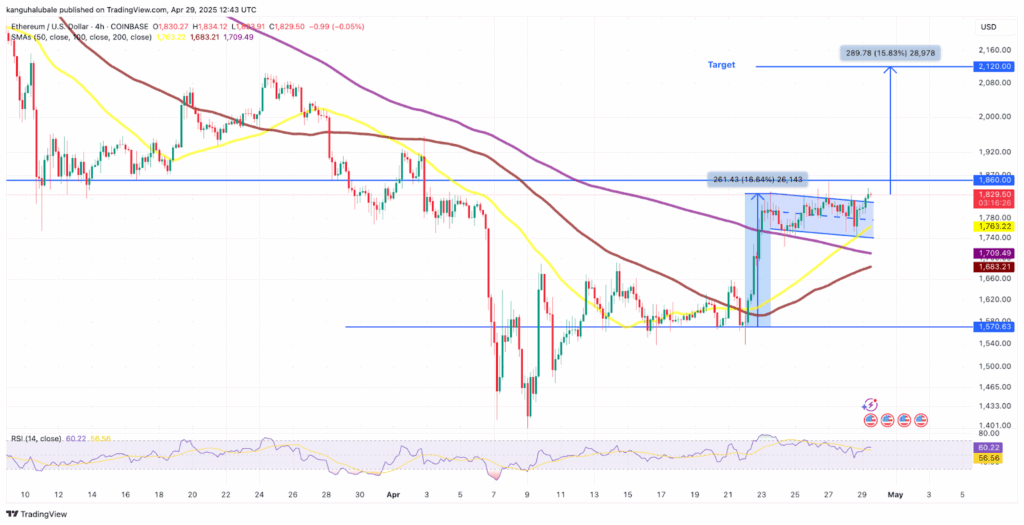

ETH Price Forms Bull Flag Pattern

ETH price formed a bull flag pattern on the four-hour chart, typically seen before a continued upward move.

The bull flag validation became official when prices exceeded $1,800 on April 29. This technical structure now projects a potential ETH price target near $2,100.

Evaluation of the flagpole height indicates a potential price rise of 15% from the current value.

The bullish outlook receives additional backing from momentum indicators because the relative strength index (RSI) maintains a position above 60.

The market situation suggests that buyers maintain control which enables them to drive prices even higher.

Some market analysts project price rejection at $1,860 but ETH maintains its strength among investors.

The upward trend will continue to exist when ETH maintains a position above $1,800.

Continued buying volume would confirm the breakout and drive the ETH price closer to $2,000.