Key Insights:

- Ethereum whales and institutions seized the price dip and bought millions of dollars worth of ETH.

- ETH could crash to the $2,150 level if it fails to hold the $2,400 support level.

Ethereum price prediction has become a key topic of discussion amid the ongoing Israel-Iran conflict. The conflict had a severe impact on the overall market, causing it to plummet significantly and resulting in billions in liquidations.

However, during this period, whales and institutions appear to be capitalizing on the market dip and have been significantly accumulating ETH from exchanges. Some whales seem to be borrowing funds from AAVE to buy ETH, while others appear to be utilizing a dip-buying strategy.

Whales and Institutions Make Big Bets on ETH — Is It Time to Buy?

Institutions like SharpLink Gaming and Galaxy Digital have purchased $463 million and $435 million worth of ETH, respectively, as reported by blockchain transaction tracker Lookonchain and crypto analyst Arthur Avdalyan on X (formerly Twitter) and LinkedIn.

With a purchase of 176,271 ETH, SharpLink Gaming has officially become the largest publicly traded ETH holder, acquiring it at an average price of $2,626 per ETH.

Meanwhile, the whale wallet address 0xe87ed and two others likely belonging to the same whale purchased 3,810 ETH worth $9.64 million through FalconX, and an additional 4,521 ETH worth $11.73 million at an average price of $2,593 following the asset’s price dip.

This substantial ETH purchase by institutions and crypto whales is raising questions about whether now is the right time to buy ETH. However, the current market sentiment and the anticipated bull run suggest that this could be an ideal buying opportunity.

Despite the notable interest and confidence shown by ETH crypto giants, the asset’s price remains stagnant. As of writing, ETH was trading near $2,520 with a modest gain of 0.50% in the past 24 hours.

During this period, its trading volume has dropped by 55%, indicating lower participation from traders and investors compared to the previous day.

This drop in trading volume hints at weak momentum in the asset and reflects how retailers and some traders are hesitant to participate in trading the token.

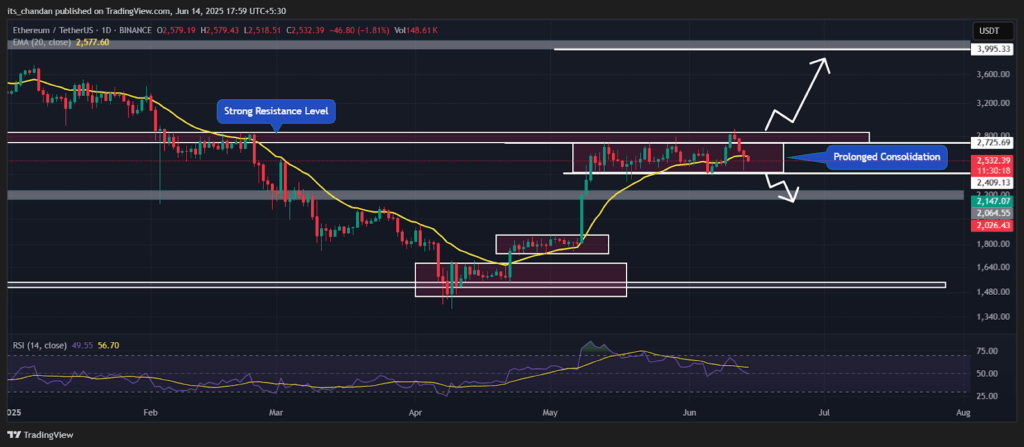

Ethereum (ETH) Price Action and Technical Analysis

According to expert technical analysis, despite the recent price dip and fears of war escalation, ETH’s price remains sideways and continues to move within its prolonged consolidation zone.

The daily chart reveals that ETH has been trading within a range between $2,409 and $2,730, creating an accumulation zone for investors as the price hovers near the lower boundary.

Based on recent price action and historical momentum, whenever the asset’s price approaches the lower boundary of this range, it tends to experience an upward rally.

Given the current market sentiment and structure, if the ongoing Israel-Iran conflict escalates and ETH fails to hold its lower boundary, Ethereum price predictions suggest that it could experience a notable dip and may reach the $2,150 level in the coming days.

On the other hand, if the ongoing war comes to an end, Ethereum price predictions suggest that ETH could remain sideways until a major development occurs.

At press time, Ethereum’s Relative Strength Index (RSI) stands at 49, indicating neutral momentum, where neither buyers nor sellers have a clear advantage.

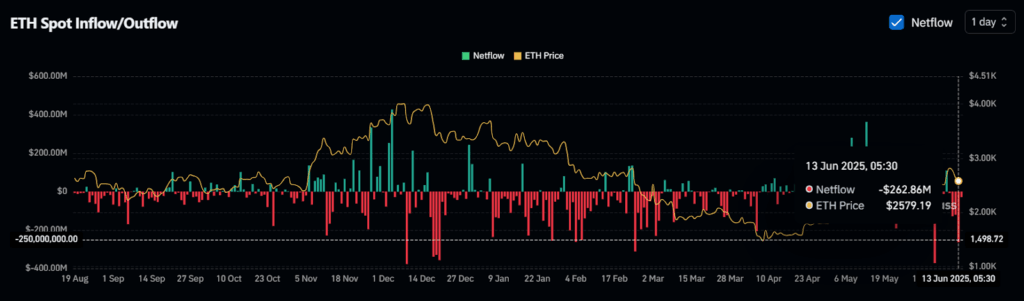

$290 Million Worth of ETH Outflow

Despite the price having the potential to move sideways, retailers and long-term holders are also seen mirroring the actions of whales, as reported by the on-chain analytics tool Coinglass.

Data from spot inflow/outflow reveals that exchanges have witnessed a significant outflow of $290 million worth of ETH over the past 48 hours.

This substantial outflow, amid the current market sentiment, suggests potential accumulation, which is currently lowering selling pressure and helping to keep ETH’s price above the key level.