Key Insights:

- Whale opens $60M 25x leveraged ETH long position near $2,666 with rising unrealized profits.

- Ethereum breaks from a 1.5-year bullish wedge pattern, pointing toward a potential $6K+ target.

- BlackRock’s ETH Trust sees $24.86M daily inflow, with total inflows reaching $4.35B.

Ethereum price rises after a major investor opened a $60 million leveraged long position, demonstrating great confidence. This move comes as ETH is approaching a major resistance zone at $2,700.

At the same time, demand from institutions is rising. U.S.-listed spot Ethereum ETFs have gained over $249 million in the last ten days. This surge has contributed to a rising market trend.

Ethereum Price Gains Momentum: Major Trade & ETF Inflows Signal Institutional Interest

The market is watching a major Ethereum trade. A large investor with much capital recently took a $60 million long position on ETH using Hyperliquid’s 25x leverage. Ethereum price started at $2,666 in the trade. It has now climbed to $2,678, marking an early gain.

ETFs tracking Ethereum are gaining interest in the U.S. Between May 13 and May 22, U.S. spot ETH ETFs saw $249 million in new investments. This is the largest inflow since these ETFs began. The data suggests more institutions are investing in Ethereum as its price rises.

Technical Structures Signal Uptrend Potential

ETH has formed a big breakout pattern on the daily chart. A right-angled descending broadening wedge has formed over the past 18 months.

If the Ethereum price breaks past the $2,700 resistance, it could gain strong momentum. This might push its value toward the $6,000–$7,000 range.

ETH/BTC trading pair is gaining momentum as its value rises. It has broken out of a descending triangle pattern, signaling a potential upward trend.

At press time, it was trading at approximately 0.0244 BTC. This breakout could lead to increased buying interest and further gains.

It appears that Ethereum is becoming stronger than Bitcoin, which may cause investors to shift their funds toward ETH. If the price holds at its current level, continuation targets are near 0.026 BTC.

On-Chain Flows and Funding Rates Reflect Trader Confidence

More investors are becoming bullish about the market. On May 22, Ethereum-related products saw net inflows of $110.54 million. This pushed their total net assets to $9.33 billion, according to SoSoValue.

These inflows occur as the Ethereum price increases. They follow weeks of positive daily flows after a slow start to the year. Moreover, open interest and perpetual futures data show that more people are becoming confident in their positions.

ETH perpetual contracts now have favorable funding rates and are rising. The weighted funding rate is above 0.0107%, showing that long positions dominate. Traders are paying a premium to maintain their bullish stance.

Nevertheless, the market is not yet overheated because funding is still below the levels that once led to big corrections. ETH is approaching the psychological $3,000 level, which many believe will cause additional resistance for traders.

The last time ETH got close to this level, the price experienced a pullback. At this time, a combination of whale actions, ETF buying, and ongoing funding suggests that the situation has improved.

Ethereum Network Activity and Ecosystem Trends

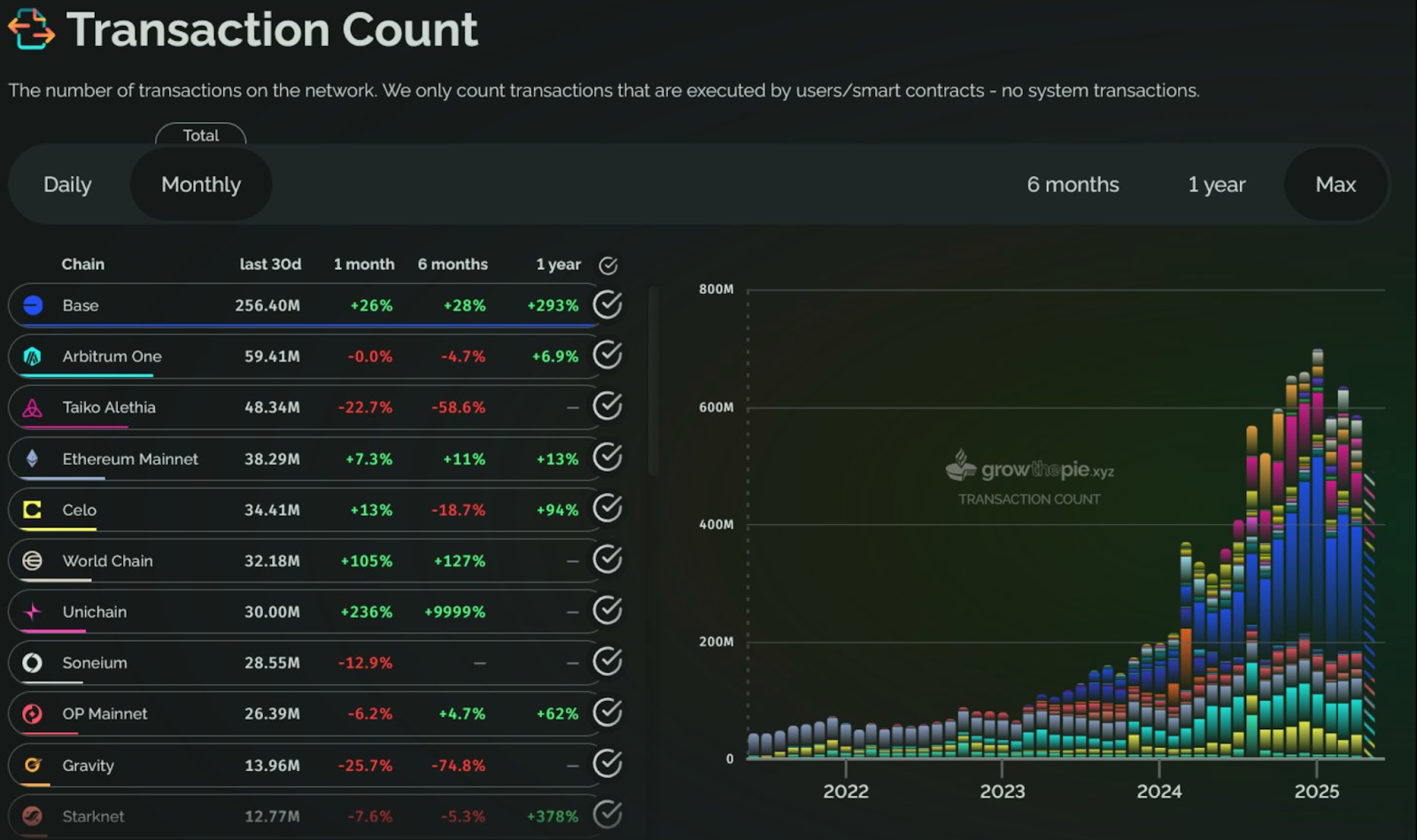

Even as more people show interest in Ethereum, its main network is still active. The number of transactions on the Ethereum Mainnet in the past month was 38.29 million.

It is 7.3% higher than the previous month, according to Growthepie. The steady rise over the past two quarters indicates that users and developers are active on the network.

New blockchain networks like Base and Unichain are proliferating, with millions of transactions last month. However, Ethereum remains the top platform for DeFi, NFTs, and smart contracts.

ETH’s usefulness in many areas supports its value when markets are unstable. iShares Ethereum Trust data shows that BlackRock has gradually increased its ETH investments.

On May 21, $24.86 million was netted in inflows, and $363.27 million was traded. Currently, total inflows are $4.35 billion, and the company manages $3.28 billion in assets.