Key Insights:

- ETH futures price climbs toward $3K to close CME gap.

- Realized cap jumps from $240.8B to $244.6B post-upgrade.

- ETH/BTC pair bounces from multi-year low, signaling rotation.

Ethereum is trading close to $2,600 and is gaining strength after regaining support above $2,400. The next important level is $3,000, as it lines up with an open gap on the CME futures chart.

Meanwhile, the realized cap of Ethereum has gone up once more after a period of decline, which is helping to push prices higher. As both technical and on-chain data get better, ETH could keep rising in the near future.

Ethereum Futures Push Higher to Fill $3K CME Gap

There is a clear gap between $2,916 and $3,028 on the Ethereum CME futures chart. This gap was created when prices fell sharply earlier this year and now attracts trading activity. ETH futures are currently priced at $2,600, an increase of 3.26% in the last session.

Often, these gaps close up as the market conditions improve. Gaps are used by traders to find areas where the price might tilt to. After ETH moved past the $2,400 zone and broke through resistance, the next main level is $3,000.

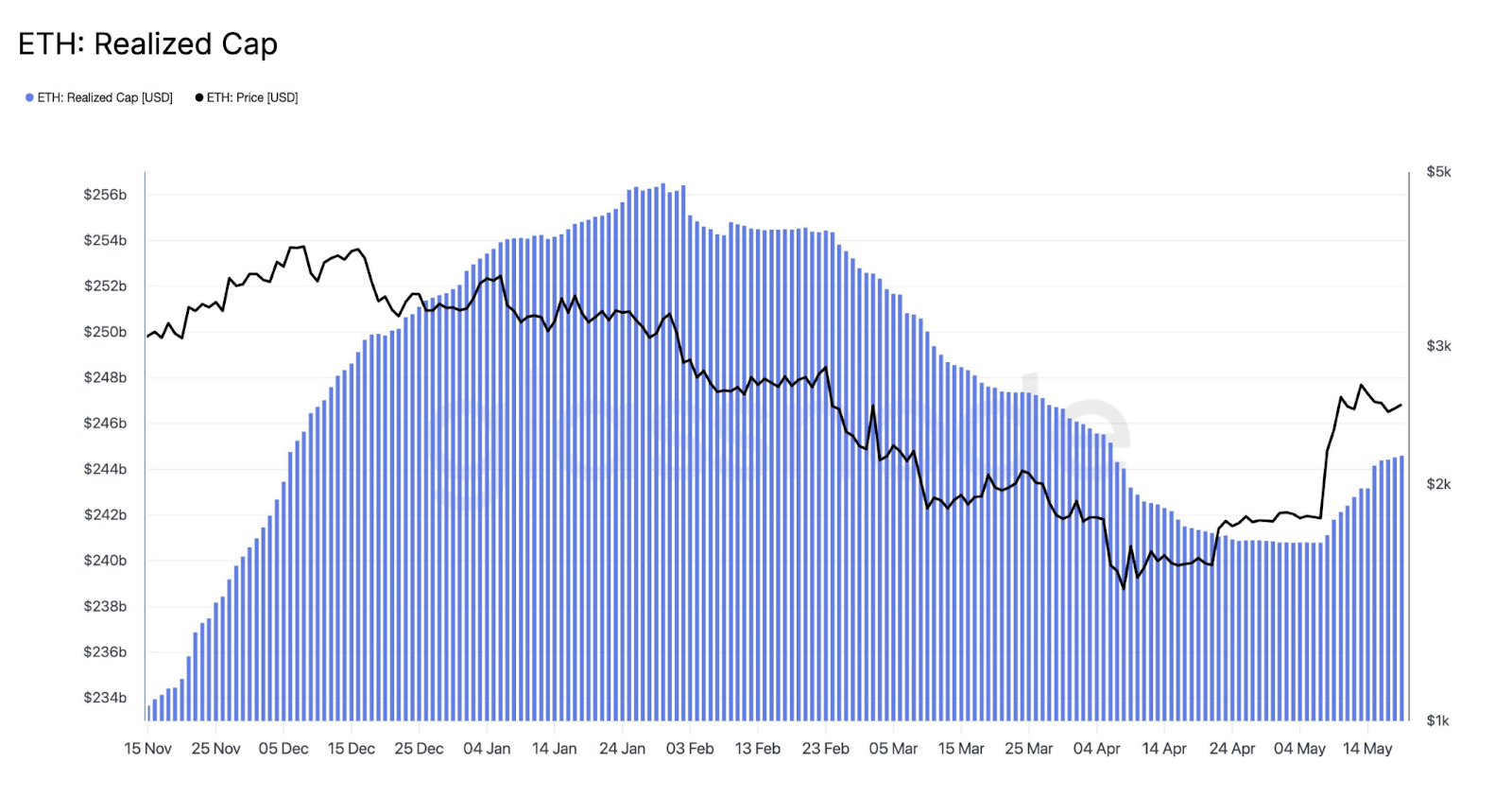

Realized Cap Rises After Three-Month Decline

The realized cap of Ethereum, reflecting the price at the last transaction, is beginning to improve.

After the recent update to the Pectra network, the amount increased from $240.8 billion to $244.6 billion. This signals the close of a downtrend that started in early February 2025.

When the realized cap increases, it means investors are exchanging coins at higher prices. This means that more money is being invested in the network, and people are no longer selling at lower prices.

Also, when the realized cap goes up, it usually reflects increased trust in the asset. It shows that the average cost basis of ETH is higher now, and many investors are either holding their shares or waiting for more gains.

ETH/BTC Pair Shows Bounce From Multi-Year Support

Meanwhile, ETH/BTC recently recovered from a key support level at 0.02. The same level worked as a bottom in 2016 and 2019, and is now doing the same in 2025. Before ETH outperformed BTC in previous cycles, it often experienced a similar bounce.

If Ethereum’s price increases against Bitcoin, many investors move their money from BTC to other cryptocurrencies.

Some refer to this change as the beginning of an “altcoin season,” in which ETH and other altcoins do better than Bitcoin. The ETH/BTC chart is starting to suggest a change, as the pair has jumped from a record low.

So, this increase in the ETH/BTC ratio supports a bullish attitude. As the trend goes on, ETH could draw more interest from traders who want to transfer their funds from Bitcoin.

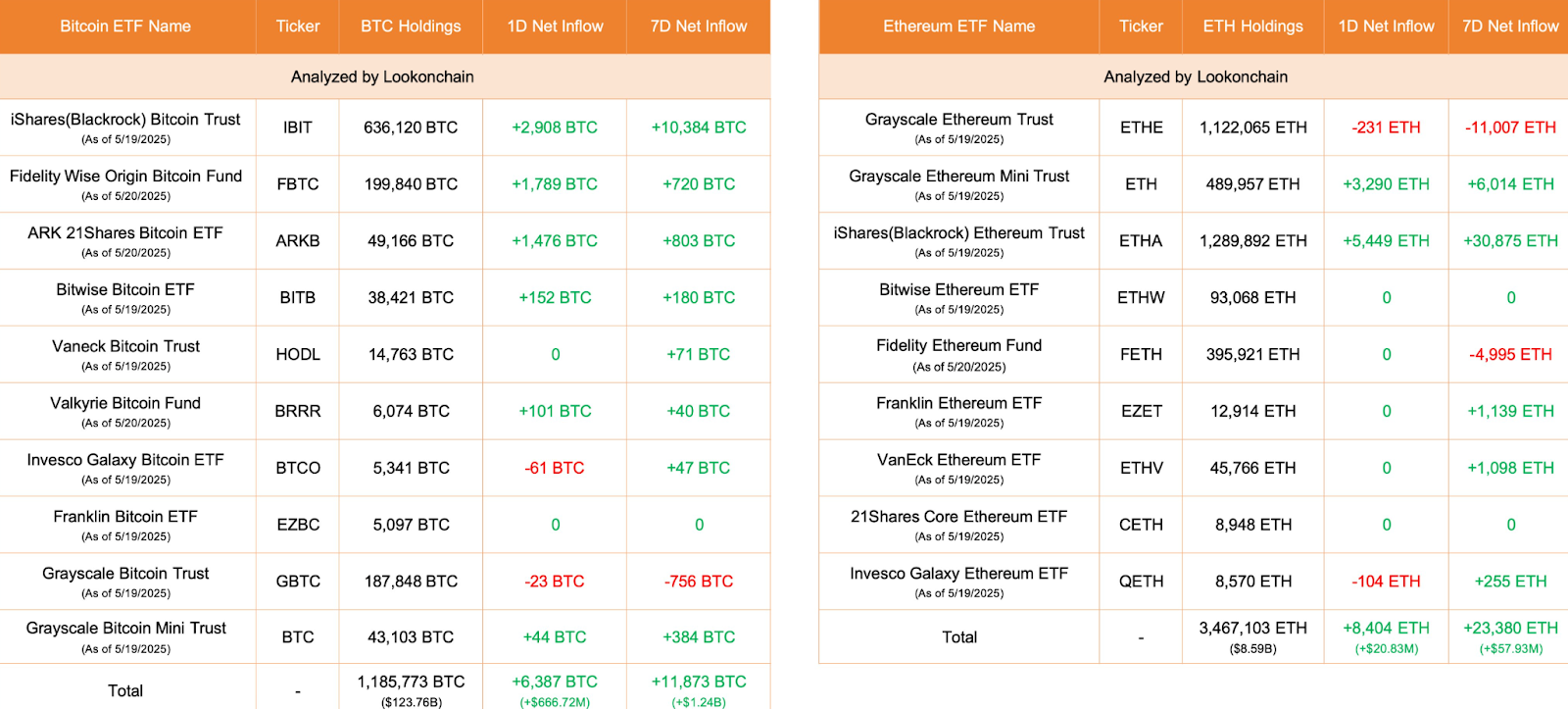

ETF Inflows Add to Buying Pressure

On May 20, the total ETH invested in Ethereum ETFs increased by 8,404 ETH which is worth around $20.83 million. BlackRock’s iShares Ethereum Trust received the largest amount of ETH, with 5,449 ETH valued at about $13.5 million. There are now 1.29 million ETH held by the ETF which is worth $3.2 billion.

Increased ETF inflows indicate that institutional investors are becoming more involved. It is evident from these flows that ETH is being bought by both small traders and large investment funds.

Besides, this is happening as ETH’s technicals and on-chain signals are starting to agree. A higher realized cap, more ETFs investing in Ethereum, and a gap on the futures chart are all supporting Ethereum move higher.