Key Insights :

- A $2.4 billion Ethereum options expiry on May 30th could trigger a price surge if ETH stays above $2,600.

- Institutional interest in Ethereum is growing, with major ETF inflows in late May.

- Macroeconomic conditions and regulatory news are major external factors that could influence Ethereum’s price.

Ethereum is again under the spotlight as the crypto market braces for a major options expiry event. On 30 May, $2.4 billion worth of ETH options are set to expire. This event will likely set the stage for a price surge if the bulls maintain momentum.

ETH has been performing well, but its future depends on key factors like network activity and macroeconomic trends. These influences could push it past $2,700 or lead to a sharp decline. Here’s what to know.

Incoming Opportunity for Ethereum Bulls

ETH has seen a nearly 48% rise since early May, after rallying from $1,790 to $2,675. Cryptocurrency has been down throughout the year, despite its recent resurgence. Meanwhile, the general market has seen a 5% increase this year.

This said, Ethereum’s recovery is impressive but lags behind the industry average. This would also mean that the 30 May options expiry is very important.

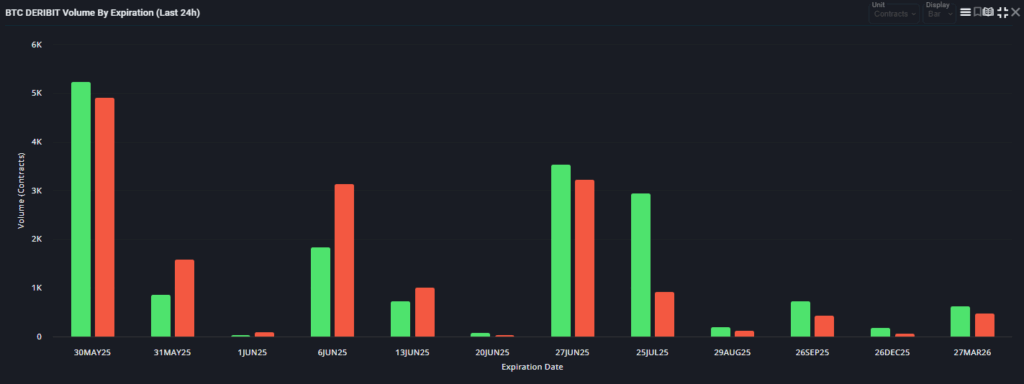

For context, call options make up most of the $2.4 billion total open interest, with $1.3 billion in bullish bets. Conversely, $1.1 billion in put options (or bets that ETH will fall) are mostly set up at or below $2,600.

If Ethereum can stay above that level, 97% of those bearish options will expire worthless and tilt the advantage heavily in favour of the bulls.

Institutional Interest Growing, but Network Activity Weakens

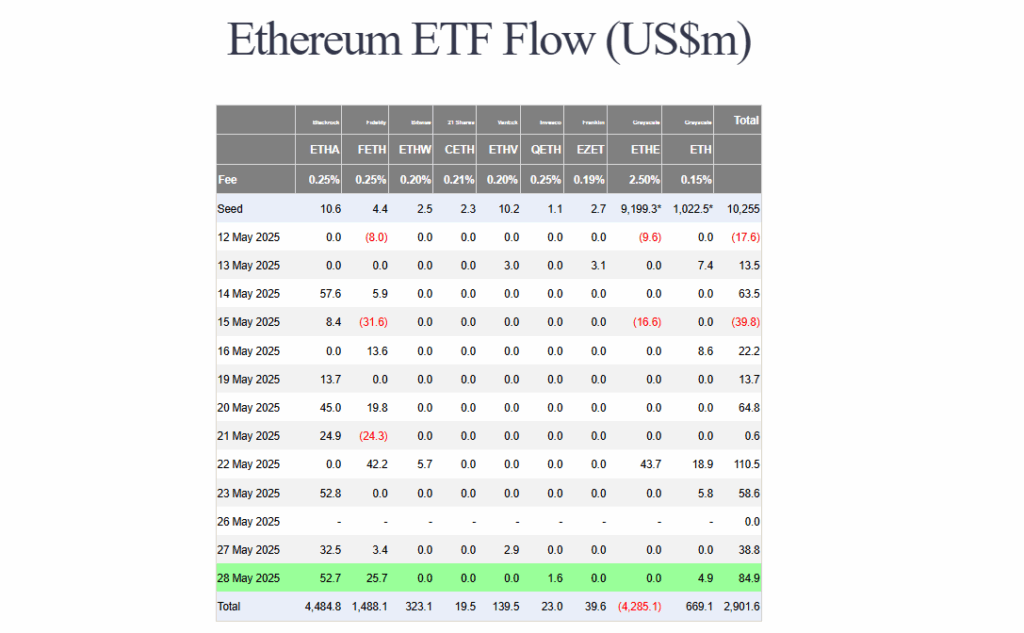

One bright spot for Ethereum is institutional confidence. The introduction of spot Ethereum ETFs in the United States has attracted around $287 million in net inflows from 19 to 27 May. Professional investors are becoming more optimistic about ETH’s long-term future.

However, Ethereum’s on-chain metrics tell a different story. Deposits and user activity on the network have dropped, with competitors like Solana, BNB Chain, and Tron gaining ground against Ethereum.

Ethereum also no longer ranks among the top 10 protocols in terms of fees generated, which is a disturbing indicator. The decline in usage may intensify inflationary pressure on ETH. Staking and gas fee revenues are struggling to keep up with token issuance.

External Factors Could Limit the Upside

Even if technical indicators and the options market favor the bulls, macroeconomic conditions could complicate the picture. For example, Ethereum’s price is still influenced by the traditional financial market (much like Bitcoin and assets like the S&P 500 and Nasdaq).

Any negative shift in interest rates, inflation data, or corporate earnings could ruin risk appetite and create friction for ETH. Moreover, the crypto market tends to react sharply to regulatory news.

While the U.S. spot ETH ETFs are a positive development, any unexpected announcements from the SEC or other financial regulators could introduce short-term volatility.

Can Ethereum Hit $5,000 in 2025?

More than the May expiry, many analysts are already looking ahead. ETH could break the $5,000 resistance and set a new all-time high in 2025.

Crypto analyst Javon Marks predicts Ethereum could soon hit $4,811. If momentum holds, it might even surge to $8,500.

Marks based his analysis on a long-term breakout from Ethereum’s downward trend that began in 2022. If Ethereum’s rally continues, it could spark an altcoin season. Layer 1 altcoins like Solana, Cardano, and Avalanche might see strong bull runs as a result.

However, not all predictions are this optimistic. Some analysts believe ETH may consolidate between $2,400 and $2,900 through May, possibly increasing to $3,200 by August.