Key Insights:

- Bitcoin has reached a new all-time high of $111,800 with strong buyer dominance.

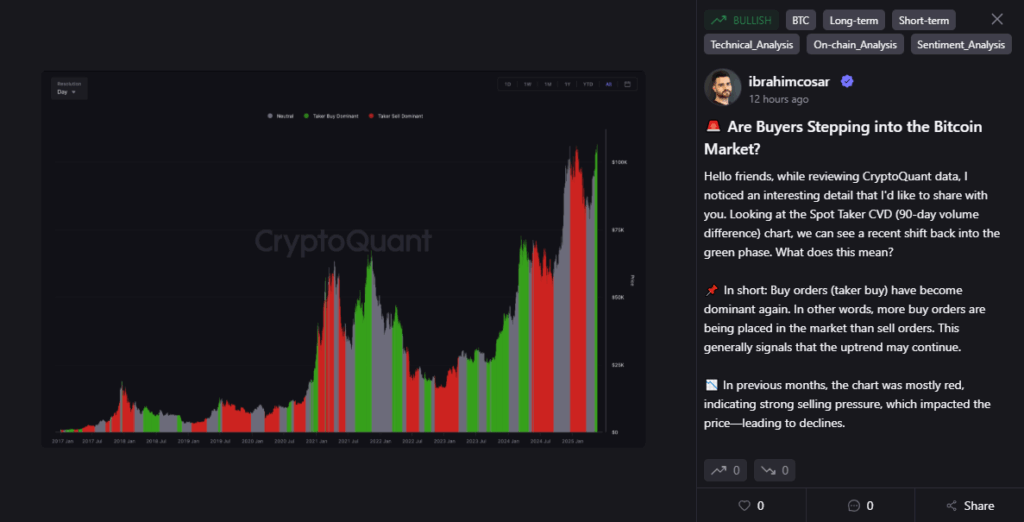

- On-chain data from CryptoQuant shows that spot buy orders are outperforming sell orders.

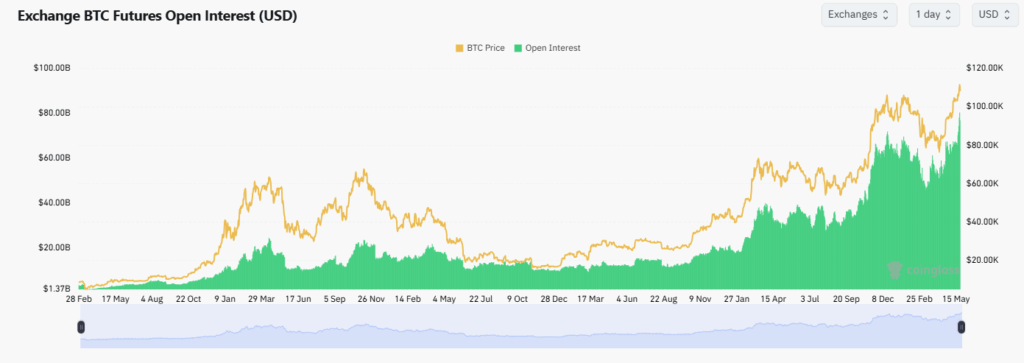

- Bitcoin futures open interest has surged to a record high of over $80 billion.

Bitcoin is once again testing new all-time highs. However, unlike past bull runs, this rally comes with a twist of its own. This time around, buyers do not seem to be backing down despite the high prices.

Recent data from major analytics platforms show that the crypto market could be getting ready for a new wave of buying pressure that could push prices higher.

When combined with relatively muted selling from the bears, Bitcoin could be ready for another strong upward move. Here’s an unpacking of what is happening in the market and what could come next.

Buyers Take the Driver’s Seat as Bitcoin Hits $111K

Bitcoin recently surged past the $110,000 mark and hit a new all-time high of $111,800 on 22 May.

Normally, such a strong price movement to the upside tends to create profit-taking behavior among the bears. However, things just might be different this time.

According to data from on-chain analytics platform CryptoQuant, buyers (specifically spot buyers) are firmly in control of the market. According to the platform’s 90-day cumulative volume delta (CVD), buy orders have clearly beaten sell orders. The author of the quick-take piece, Ibrahim Cosar, noted that “buy orders (taker buy) have become dominant again.”

This trend typically points towards continued upward momentum and could be just what Bitcoin needs to make a difference. Besides, this is important because previous highs on the market tended to create hesitation among traders.

In contrast, today’s data shows that traders are not only holding their positions, they are also increasing their exposure.

A Bullish Setup in the Futures Market

More evidence of this optimism among traders also comes from the futures market. According to insights from CoinGlass, open interest in Bitcoin futures has soared to more than $80 billion.

This stands as a record high, and a 30% increase in just three weeks. In essence, traders are betting more on continued price growth, instead of against it.bKeep in mind that Open interest (OI) represents the total amount of open futures contracts that have not been settled.

When open Interest rises, it shows that new capital is entering the crypto space, which can lead to higher volatility. Moreover, when many traders take leveraged positions, even a small price dip can cause a wave of forced liquidations and create strong dips.

However, the risk of this happening is being balanced by major inflows into the spot Bitcoin ETF market. These funds saw over $2.5 billion in new capital this week alone, which shows strong institutional confidence in the value of Bitcoin over the long term.

Options Market Shows Optimism Too

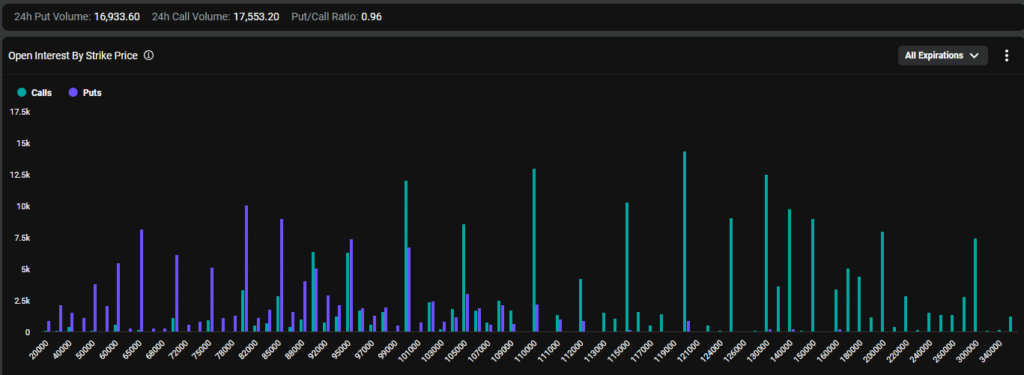

The bullish sentiment isn’t limited to futures alone. In the options market, traders appear to heavily be betting on even higher prices. According to data from Deribit, over $1.5 billion in open interest at strike prices of $110,000 and $120,000. More major positions sit at $115,000, $125,000, and $130,000.

These strike prices show just where traders expect Bitcoin to land in the future, and the fact that there are so many of them, shows that traders are indeed bullish. Interestingly, Coinglass has the put/call ratio at 1.2%, which means that there are more puts (bets that the price will fall) than calls (bets that the price will rise).

This might seem bearish at first glance. However, it is important to note that they could also be an indicator of hedging activity by large investors. Overall, while short-term volatility is always on the table, the trend remains clearly upward.