Key Insights:

- Ethereum ETFs pulled $84.9M in inflows on May 28, signaling rising institutional demand.

- ETH leads RWA tokenization with $11.65B, far ahead of other chains.

- Over 600M transactions processed across the Ethereum ecosystem in May, led by Base and World Chain.

Ethereum is still attracting institutional capital, with $84.9 million in ETF inflows on May 28, led by BlackRock’s iShares. Meanwhile, Ethereum still holds the top spot in the real-world asset (RWA) sector, with $11.65 billion locked in value. Investor confidence also seems to be growing as activity across Layer 2s speeds up.

On-chain engagement remains robust, with over 600 million transactions processed this month across Ethereum-linked networks. Institutions are strategically positioning in ETH as tokenisation, staking, Layer 2 growth acceleration, and ETF flows and adoption continue to increase.

ETF Inflows Hit $84.9M as BlackRock Leads Accumulation

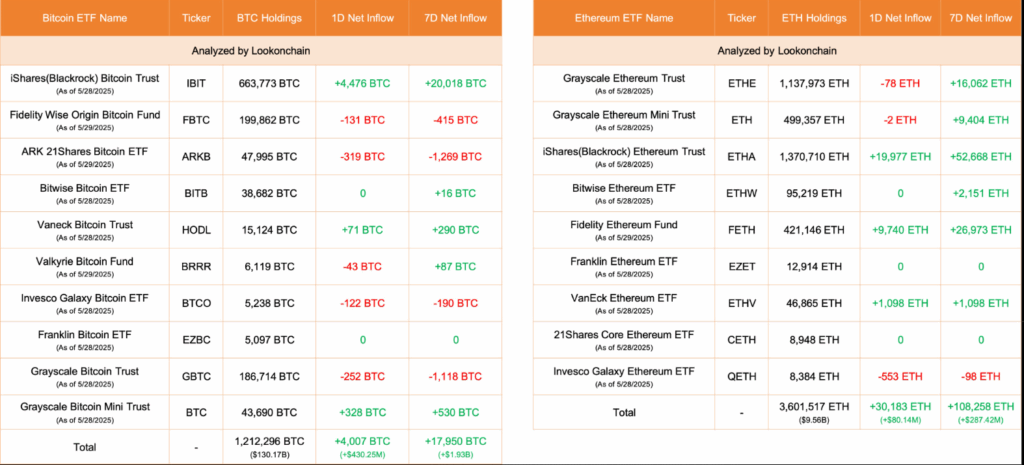

On May 28, Lookonchain data shows that Ethereum ETFs had net inflows of 30,183 ETH, worth $84.9 million. The group was led by BlackRock’s iShares Ethereum Trust, which held 19,977 ETH or over $53 million in a single day. Bitwise and Fidelity came in second and third with 1,098 ETH and 9,740 ETH inflows, respectively.

ETH has remained above $2,600 which is indicative of strong institutional conviction as these inflows came in the face of market volatility.

However, Grayscale’s Ethereum Trust and Galaxy’s QETH reported small outflows, suggesting a preference for lower fee ETFs. Now, the total Ethereum ETF holdings are over 3.6 million ETH, which is worth about $9.56 billion.

Institutional participants are buying the dip and the broad based demand signals that they think ETH is undervalued in this cycle.

In addition, the fresh capital flowing into Ethereum ETFs is one of the strongest daily inflows since their approval. This is a trend that shows renewed interest in ETH’s long term potential.

Ethereum Expands Lead in Real-World Asset Tokenization

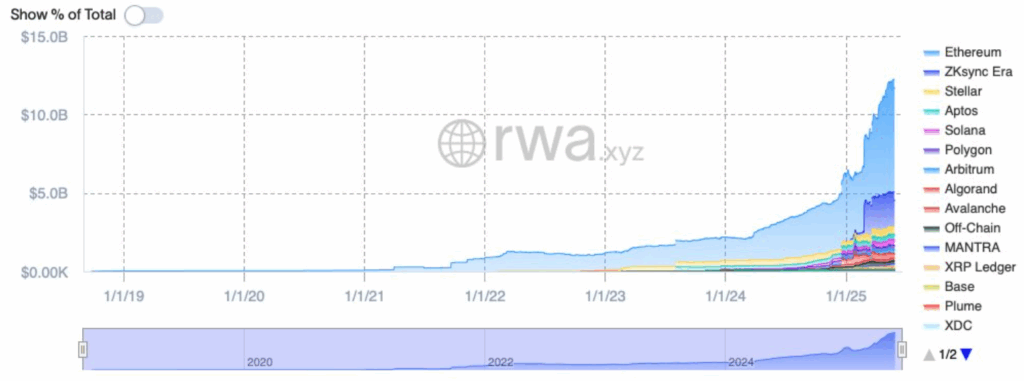

According to data from rwa.xyz, Ethereum still commands a large lead in the RWA space, with over $11.65 billion of tokenized assets on chain.

Emerging ecosystems such as Stellar, Solana and Polygon account for a small fraction of the RWA market, but it is the majority. This shows how Ethereum is the infrastructure backbone for institutional grade asset tokenization.

An Ethereum Layer 2, ZKSync Era, has over $2.2 billion in tokenized RWAs and has seen rapid adoption within the scaling ecosystem. Ethereum and its L2s are together the largest venue for tokenized government bonds, real estate and treasuries. This dominance backs the long term thesis of Ethereum as a financial layer.

Ethereum is still the preferred RWA platform because it is secure, liquid and compatible with the regulatory frameworks.

Its architecture is being integrated into financial institutions to issue and trade tokenized assets efficiently. This comes as traditional markets are being brought on chain more broadly.

On-Chain Activity Surges as L2 Networks Scale

Meanwhile, in May, Ethereum’s broader network processed more than 600 million transactions, largely thanks to high-throughput Layer 2 chains.

In the past 30 days, Base recorded 273 million transactions, a 344% increase year over year. Starknet and Unichain also saw explosive growth, with World Chain following with 35.25 million transactions.

This activity surge is indicative of growing user adoption of Ethereum’s Layer 2 solutions, which provide faster and cheaper transactions.

Ethereum’s shift towards modular execution is supported by strong growth across multiple chains that are contributing to the scalability narrative. ETH-linked networks are starting to become the place where developers and users are both gravitating towards for real-world applications.

Along with renewed bullish sentiment from institutional traders, the sustained rise in transaction volumes is a good sign. The momentum was further added by an ETH whale opening a recent $22 million long position.

Breakout Structure and Treasury Demand Boost Price Outlook

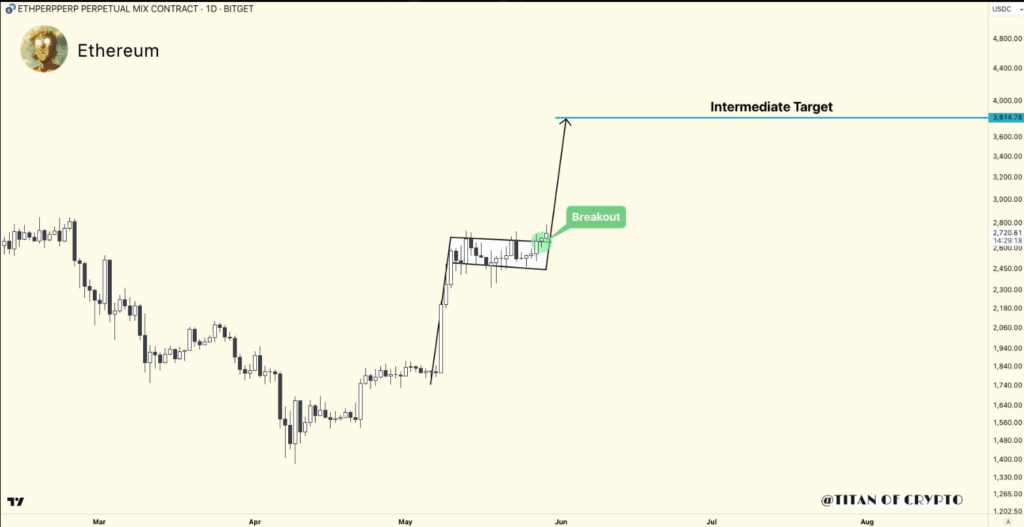

ETH recently broke out of a consolidation pattern and confirmed a bullish flag formation according to technical analysis.

Support is now building at $2,600 and chart projections now target $3,814 as the next intermediate price level. This setup represents growing confidence in Ethereum’s medium term strength.

At the same time, corporate treasuries have been paying attention to Ethereum. On Monday, SharpLink Gaming announced a $425 million fundraise to acquire and stake ETH. MicroStrategy’s Bitcoin play is mirrored by the move, and it may be the start of ETH’s own treasury adoption cycle.

CME data shows hedge funds are still net short as Ethereum’s fundamentals improve, but asset managers are turning neutral or long. This divergence will make way for a potential short squeeze if bullish catalysts continue.