Key Insights:

- BNB Chain reported $70.8 Million in Q1 2025 revenue, a 58.1% increase from the previous quarter.

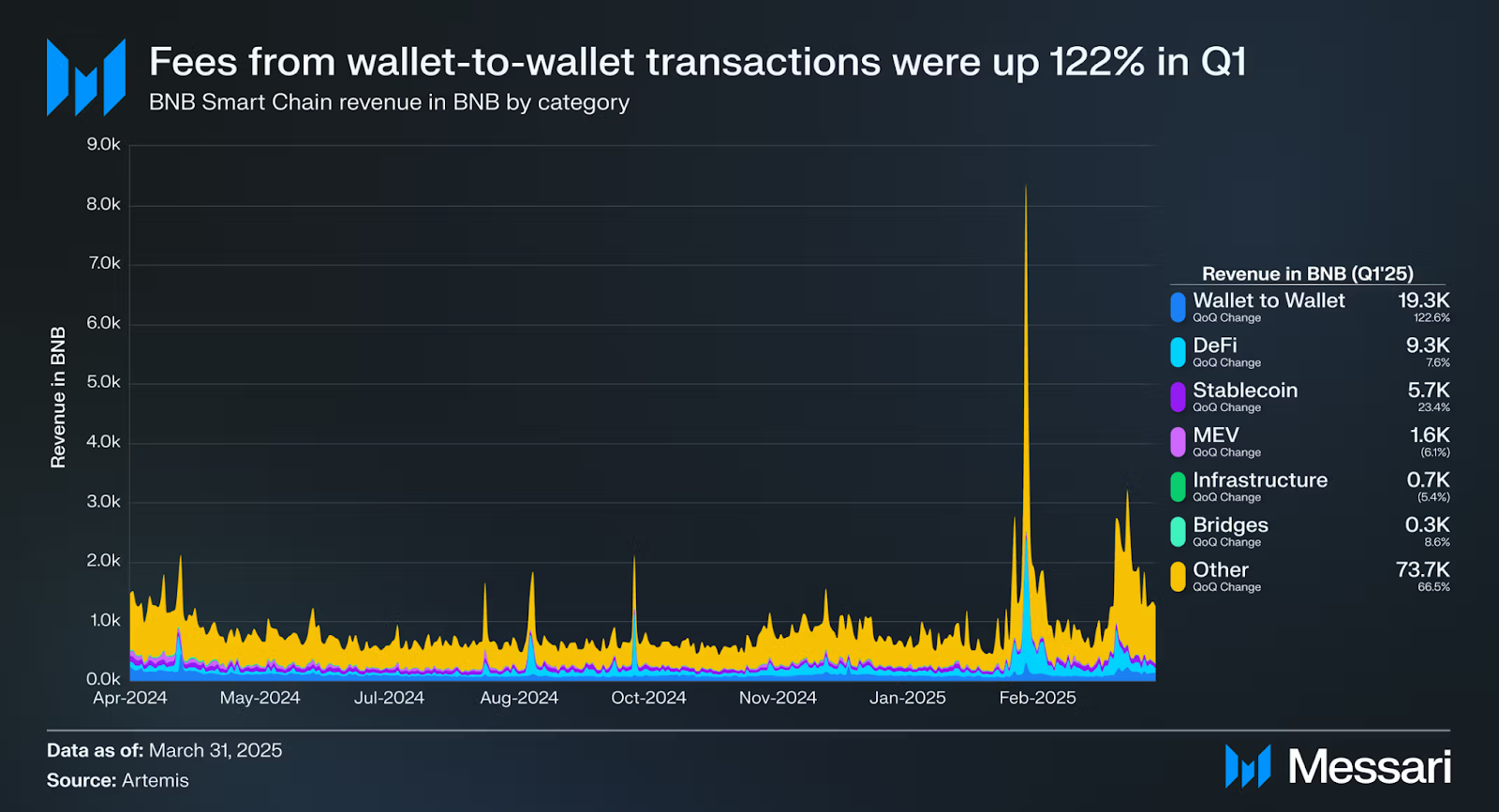

- Wallet-to-wallet transaction fees surged by 122.6% and became the top revenue contributor, surpassing DeFi.

- Unique on-chain users reached an all-time high of 517 million on February 11.

Despite a 14.8% decline in market cap, BNB Chain closed Q1 2025 with strong growth across revenue and network activity.

The network reported $70.8 Million in quarterly revenue, marking a 58.1% increase compared to the previous quarter.

Significant traction in wallet-based transactions, protocol upgrades, and DeFi utility fueled this upward momentum.

BNB Chain Leads Q2 Revenue Growth

BNB Chain experienced a sharp increase in wallet-to-wallet transaction fees, which became the primary revenue source in Q1.

The total fees grew 122.6% throughout the second quarter to become the main source of revenue, exceeding DeFi activities.

BNB’s revenue increased to 109,800 after starting at 69,500 because these figures included both traditional currencies and digital tokens.

The total number of unique users on the chain crossed 517 million when measured on February 11. TST memecoin went live at the time when daily network activity reached its peak.

The influx of network participants substantially affected financial gains and network activity measures.

The chain managed to maintain its fourth-ranking position as a crypto asset by market capitalization even though BNB coin prices had declined.

Fields like Bitcoin and XRP took positions ahead of BNB during the market assessment, as BNB demonstrated more value than Solana and Ethereum over the quarter.

Ethereum lost 45.2% in market value, while Solana experienced a 29.6% decline in its market value from April to June 2022.

BNB TVL Climbs Despite USD Decline

Smart Chain transaction activity on BNB reached 4.9 million daily operations at the end of the quarter because of a 20.9% increase.

The rise in daily active addresses reached 26.4% in Q1, demonstrating an average of 1.2 million user participation.

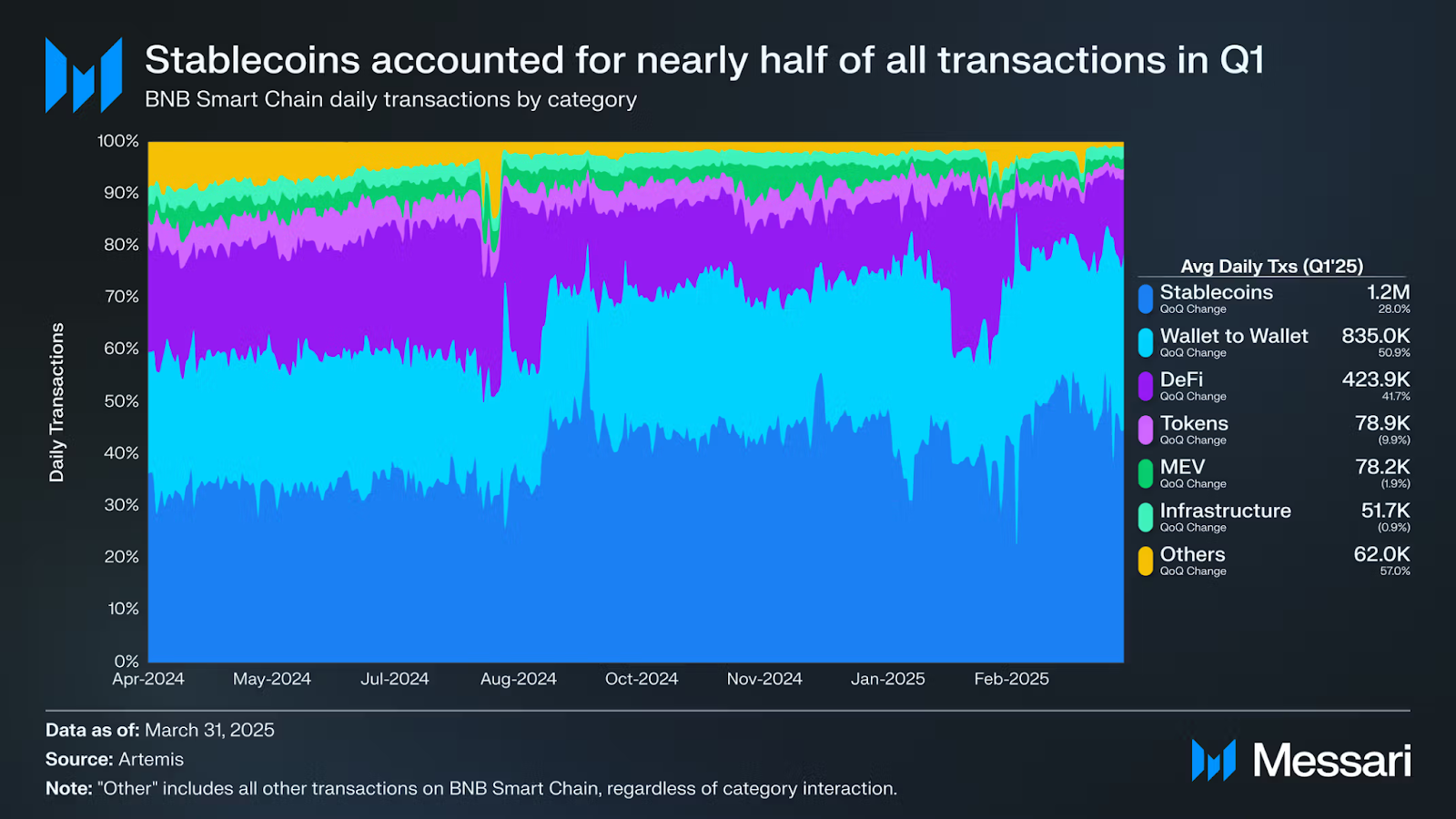

The number of stablecoin transfers combined with wallet-to-wallet payments constituted 74.4% of all blockchain transactions during the quarter.

Total stablecoin usage increased 28% throughout Q1, reaching 1.2 million daily transfer transactions.

Transactions between wallets increased 50.9% throughout the period, reaching 835,000 per day. The two segments delivered most of the network’s transaction speed and operational intensity.

The revenue generated from stablecoin-related usage reached 5,745.1 BNB, a 23.4% increase from the previous quarter.

Stablecoin revenue decreased to represent only 5.2% of the total revenue metric because other business segments expanded at a faster rate.

The total DeFi revenue reached 9,274.9 BNB, growing 7.6% in the past quarter, although it slipped to the second position as wallet fees increased.

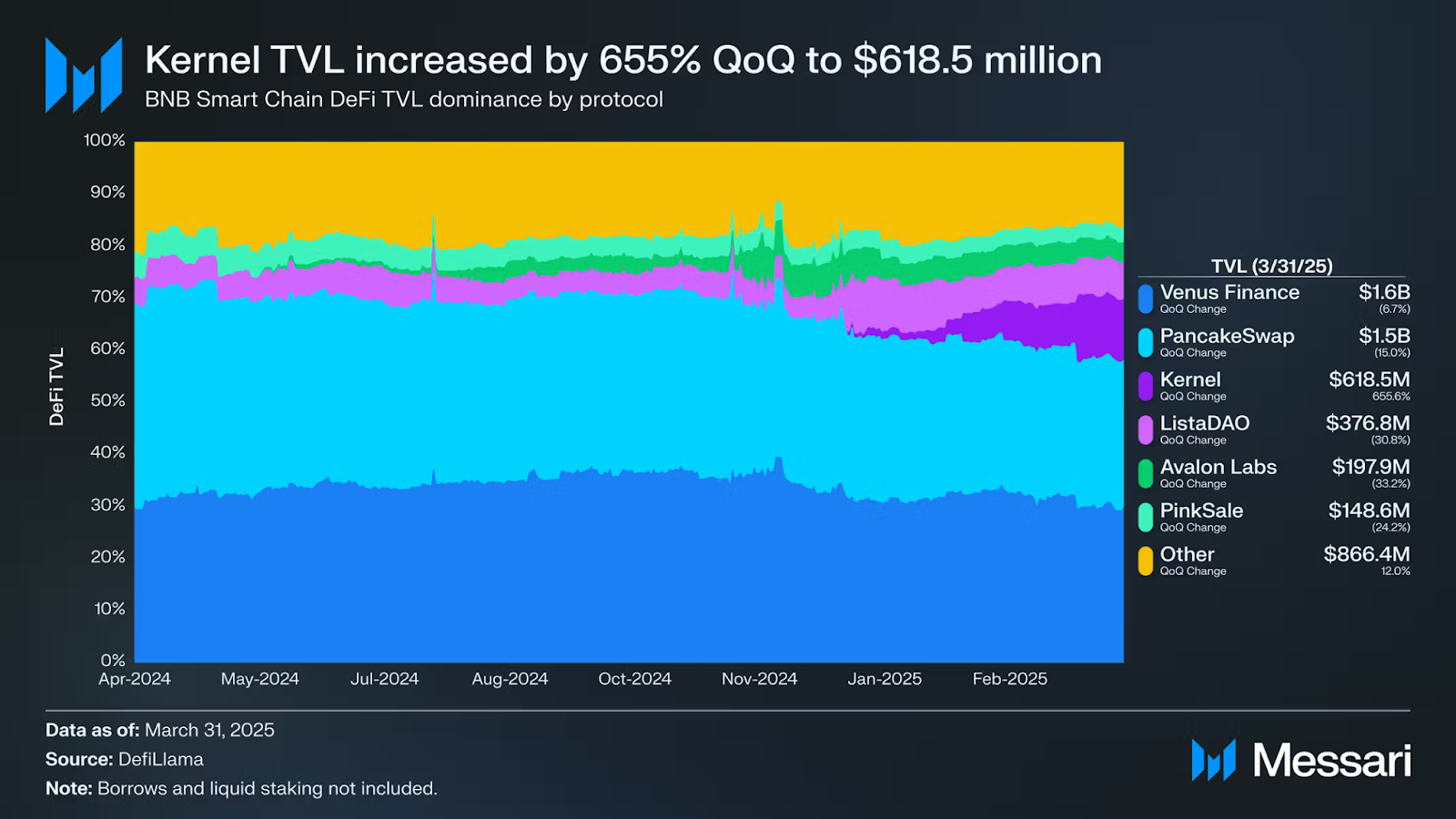

The USD expression of Total Value Locked decreased by 1.2% to reach $5.3 Billion. The total value locked in BNB terms experienced a 14.7% increase because BNB staking and restaking programs became more popular.

The consequent growth enabled BNB Smart Chain to surpass one competitor chain and achieve its position as the fourth-ranked in the TVL rankings.

Pascal Upgrade Enhances BNB Chain Capabilities

The Pascal hard fork brought additional technical benefits to the BNB Smart Chain during Q1.

Through Pascal, the EIP-7702 smart contract wallets and BLS12-381 cryptography became available on the Ethereum platform.

Other enhancements were implemented through gas abstraction, together with batch transaction support.

During this period, the network upgraded its gas limit feature from 120 million to 140 million gas units.

The infrastructure modification allowed for advanced blockchain transaction processing of high transaction volumes. Pascal is the first of three scheduled upgrades planned for BNB Chain in 2025.

The overall volume on decentralized exchanges (DEX) soared to $2.3 billion daily, representing a 79.3% rise.

Trading activity on PancakeSwap, constituting 91.8% of all DEX usage, experienced a 95.2% increase in volume.

This represented PancakeSwap’s leading position in the sector. The TVL of Kernel expanded 655.6%, while Venus Finance participated in boosting the platform.

Restaking incentives at Kernel increased TVL from $81.9 Million to exceeding $500 Million. Venus Finance’s TVL dominance remained consistent, although they experienced a minimal reduction in borrowing activities.

Together, these platforms strengthened BNB Chain’s DeFi ecosystem and transaction throughput.

Revenue from bridge fees increased 8.6%, reaching 275.1 BNB, while MEV and infrastructure revenue decreased slightly.

However, the overall composition of BNB Chain’s earnings remained diverse and stable.

The network implemented an even distribution of segments to establish stability that would help it endure market instability.