Key Insights:

- Volatility Shares will launch the first XRP Futures ETF in the United States on Nasdaq under the ticker XRPI.

- The fund will invest in cash-settled XRP futures contracts instead of directly holding XRP tokens.

- A leveraged version, the Volatility Shares 2X XRP ETF with ticker XRPT, will begin trading tomorrow.

Volatility Shares will launch the first-ever XRP Futures ETF in the United States tomorrow, expanding its digital asset offerings. Nasdaq has listed the fund, which will trade under the ticker symbol XRPI, also listed under the Volatility Shares Trust.

The development is key for XRP-linked investment products, signaling increasing institutional demand. XRP Futures ETF aims to expose XRP price movements through regulated futures contracts instead of direct token ownership.

It will invest in cash-settled XRP futures to mirror daily performance without holding XRP. It is practical since this structure meets U.S. market regulatory requirements and keeps targeted exposure.

Volatility Shares is the fund adviser. A May 21 SEC filing confirmed the ETF’s construction. The expense ratio is capped at 0.94% until May 2026, with fees at 1.15%. Investments are made through a Cayman Islands subsidiary to meet RIC criteria.

Volatility Shares Expands with 2X XRP Futures ETF

In addition to the XRP Futures ETF, Volatility Shares is launching a leveraged version, the Volatility Shares 2X XRP ETF (ticker: XRPT). This product aims to amplify the daily performance of the XRP token, achieving twice its usual movement.

It does this by using leveraged futures exposure to enhance returns. This aims to turn XRP’s daily price action into an opportunity for short-term traders. The 2X XRP Futures ETF adjusts daily to keep its leverage consistent. It seeks to mirror twice the percentage change of XRP.

It further adopts the Cayman Islands subsidiary structure to comply with U.S. tax rules for commodity-based funds. The crypto-linked offerings from Volatility Shares will now include XRPT, which will also trade concurrently with XRPI on Nasdaq.

Management expects the leveraged product to attract market participants. These participants seek increased exposure to XRP but prefer not to handle futures directly.

The fee structure is similar to XRPI. It remains free until May 2026. At least 80% of assets will be held in XRP-linked instruments. These include futures and derivatives. Both ETFs will face the same risks and benefits as crypto trading.

Teucrium’s Existing XRP Product Provides Market Context

Teucrium Investment Advisors manages a leveraged XRP product. This provides perspective on the kind of demand possible for this ETF. The Teucrium 2x Long Daily XRP ETF has about $120 million assets and sees $35 million in daily trading.

Teucrium is already in the market, so that Volatility Shares will face competition from futures-based XRP. However, demand for futures-based XRP exposure is expected to grow.

The presence of two issuers may enhance liquidity and awareness, attracting broader participation in XRP futures products. Now, both firms are contributing to developing the competitive ecosystem of ETFs.

In the first half of 2017, Teucrium’s double product fund experienced growth despite a volatile market. This expansion was influenced by ongoing market fluctuations and regulatory shifts.

Performance on the product has closely followed XRP’s price action, further validating commitments made around futures-based structures.

XRP Consolidates Between Key Price Levels

XRP is trading at $2.387, recording a 1.25% gain for the day while remaining above key support levels. The price briefly pulled back after touching a high of $2.429, but it’s still on an upward thrust. Technical indicators suggest that XRP has room for further movement.

The relative strength index (RSI) is 54.10, in the neutral zone, but it has not been overbought, so further upside is possible. The RSI-based MA signal at 59.67 means price momentum stays still. As a result, XRP’s technical setup aligns with the launch timing of the new futures ETF.

MACD indicators show mild bearish divergence with a slight crossover. This suggests a pause in momentum, not a trend reversal.

The MACD line is currently at 0.05331, with the signal line above at 0.06223. We see weak pressure at -0.00892, which might be reconfirmed with a higher buying volume.

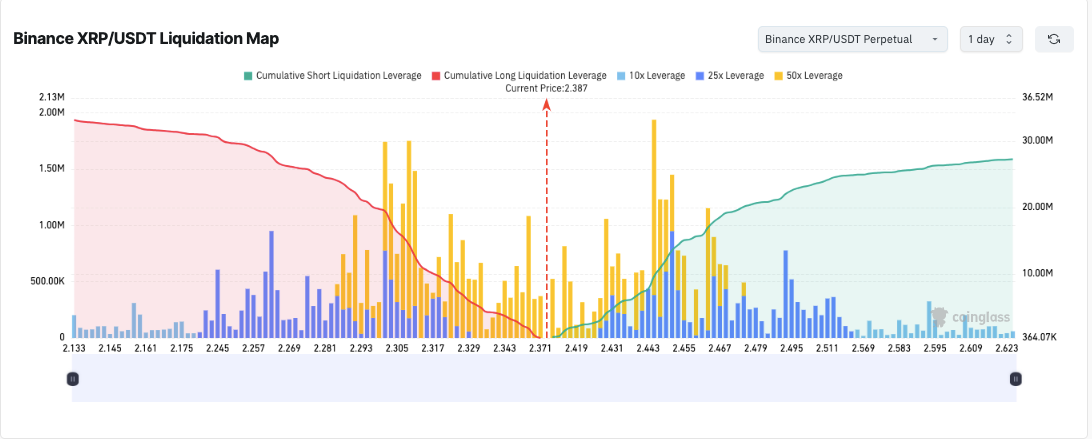

Binance’s liquidation map highlights pressure points near current price levels in XRP’s trading range. However, a stack of cumulative short liquidations noted above $2.43 foretells breakouts to the upside. Should the price move above this level, liquidations would move the price higher, too.

However, this is on the downside and there are supports around $2.33, where longs are increasingly at risk of being liquidated. XRP has stayed within a tight range between $2.33 and $2.43, consolidating ahead of the ETF launch.