Key Insights:

- Bitcoin’s recent recovery from $100,500 to $105,500 shows an incoming short squeeze that could liquidate $15 billion in bearish positions.

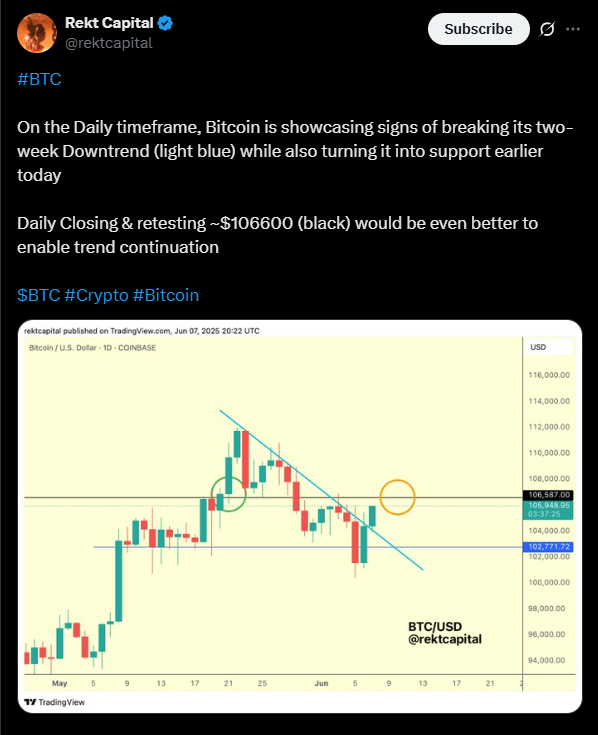

- Analyst Rekt Capital notes that Bitcoin has just broken a two-week downtrend, with a daily close above $106,600.

- A 10% upward move in Bitcoin’s price could trigger $15.1 billion in short liquidations, as opposed to only $9.6 billion for a 10% downside move.

Bitcoin’s price action is heating up, and traders are watching the $100,000–$110,000 zone for a breakout in either direction.

After enduring a short-lived correction down to $100,500, BTC is back to showing signs of strength, with some analysts predicting a possible short squeeze.

The interesting part about this short squeeze is that it could liquidate over $15 billion worth of bearish positions. Here’s how multiple indicators are flashing bullish signals and the levels to watch in the days ahead.

Bulls Return as Bitcoin Reclaims Support

Bitcoin’s price dipped to around $100,500 earlier in the week. However, it has since rebounded and is hovering near the $105,500 mark by the 8 June weekly close. The recovery has since made investors more optimistic, as analysts continue to bet on a continued uptrend.

According to crypto analyst Rekt Capital, Bitcoin has now broken out of a two-week downtrend on the daily chart. This breakout, if followed by a daily close above $106,600, would indicate that BTC is turning prior resistance into support.

So far, Bitcoin has completed a daily close above the 10-day simple moving average, which means that the bulls are winning on the short-term as well.

This means that the rise to the upside has great chances of remaining intact.

Why a Short Squeeze Could Be Close

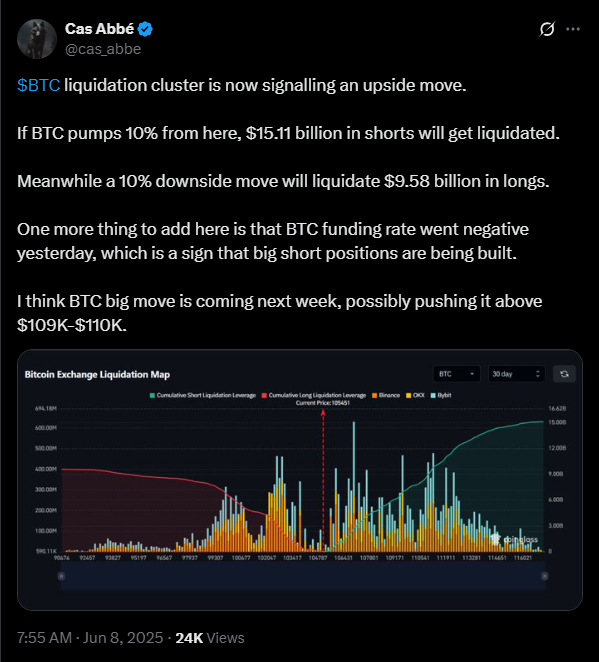

Market data shows that a huge concentration of short positions currently hanging in the balance. In a now viral Twitter (now X) post, Cas Abbe, a well-followed crypto analyst, pointed out the possibility of a short squeeze.

Think of a short squeeze as a scenario where rising prices force short-sellers to buy back their positions. This results in an even stronger uptrend, alongside massive liquidations.

According to Abbe’s analysis, a 10% price increase from current levels could trigger the liquidation of approximately $15.1 billion in short positions. In contrast, a 10% move to the downside would only result in about $9.6 billion in long liquidations.

This imbalance shows that the market is currently skewed in favor of bearish bets.

Considering how the market tends to do the opposite when it comes to investor sentiment, a bullish surge could be inbound.

“BTC liquidation cluster is now signaling an upside move,” Abbe noted.

He also pointed out that funding rates had turned negative over the weekend. This shows that traders are aggressively shorting the market. If Bitcoin were to rally beyond $109,000–$110,000, many of these short positions would be forced to close.

$100K Holds as Psychological and Technical Support

While many eyes are on the upside, others are still focused on the strength of Bitcoin’s $100,000 support level. Trader CrypNuevo mentioned that he was building long positions near the $100K mark, considering its status as the strongest psychological support area.

He also pointed out that it offered “easy invalidation,” which means that it is a clear stop-loss level for managing risk.

Rekt Capital agrees with this, stating that the $104,400 level was important for confirming a successful support retest. A weekly close above this level would mark four consecutive higher closes, which is a sign of growing bullish conviction.

CryptoKing, another trader, described the current price action as the “calm before the storm.” With BTC compressing just below the $107,800 resistance, he pointed out a classic volatility squeeze, saying “If we flip resistance this time, the next stop is $120K.”