Key Insights:

- Over 99% of BTC UTXOs are in profit—levels seen before past cycle tops.

- Whales are slowing accumulation while smaller wallets keep buying amid rising prices.

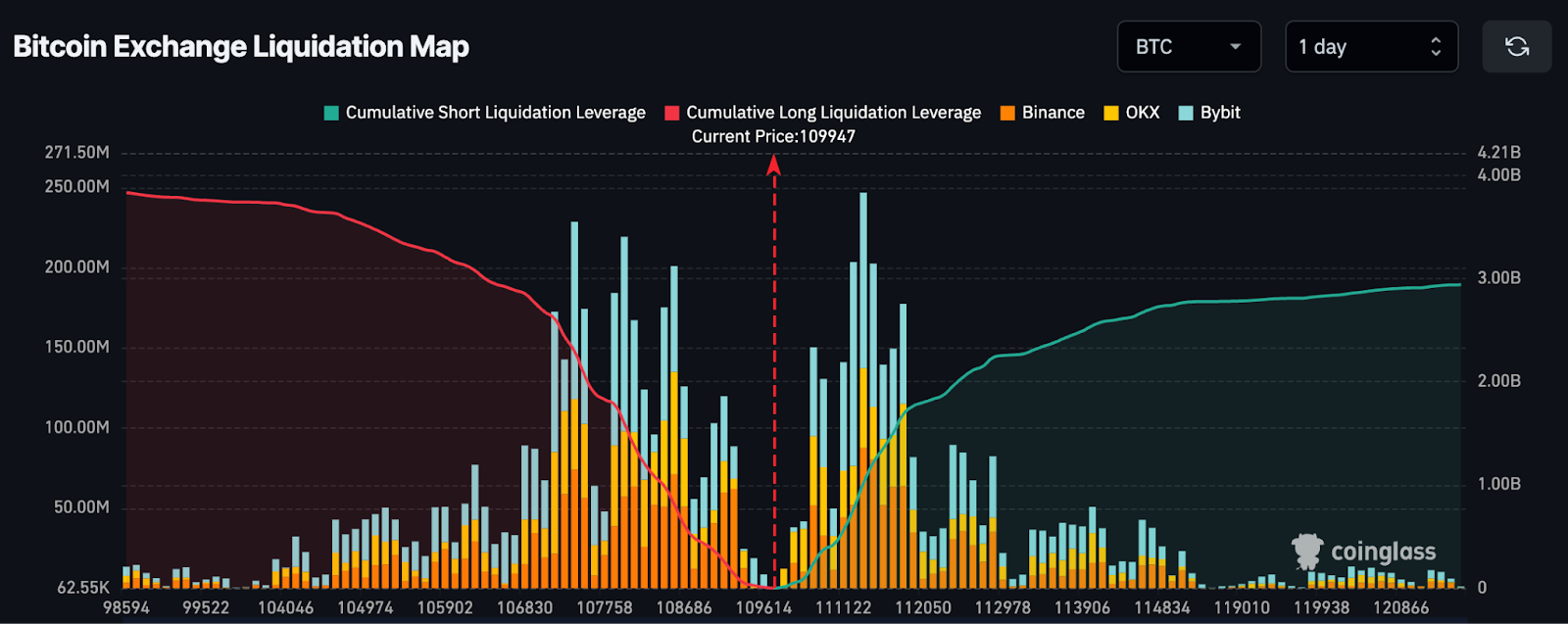

- $2.3B in long leverage could unwind if Bitcoin dips below $107,410.

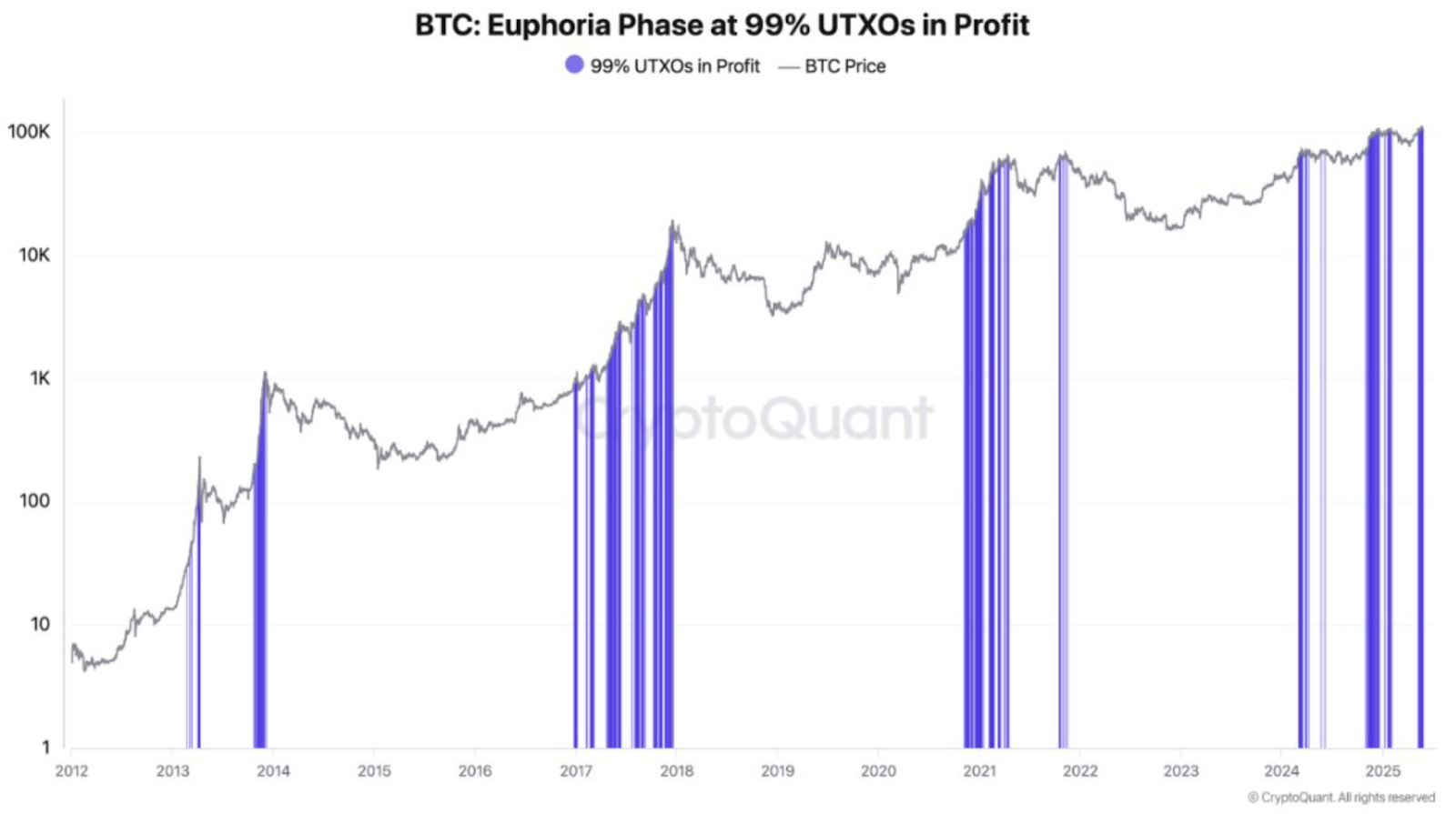

Bitcoin’s recent rally to over $109,000 has pushed the majority of its unspent transaction outputs (UTXOs) into profit, as on-chain data shows. Historically, this metric has coincided with peak market sentiment and been followed by corrections in past cycles. This current setup is similar to what was seen in 2013, 2017 and 2021.

With price still high, whale accumulation is decreasing. However, retail holders are still buying actively, which is in contrast to what is happening. Unrealized profit charts and exchange flows support the idea that the market is in an euphoric phase, but leveraged positions could amplify downside risk.

UTXOs in Profit Near Cycle-Top Levels

According to CryptoQuant, 99% of the unspent transaction outputs (UTXOs) are in profit. Only near cycle tops has this level been reached, including December 2013, December 2017 and April 2021.

This condition usually indicates widespread unrealized gains throughout the network when it occurs.

This percentage shows how many Bitcoin holders hold coins purchased below the current market price. The market is saturated, with 99% now in profit.

According to analyst Darkfost, historically, when profits are this high, price corrections have followed. When this metric drops, it usually causes more selling as holders take their gains.

Furthermore, CounterFlow’s Net Unrealized Profit/Loss (NUPL) chart has gone into the red zone, which historically corresponds with peak euphoria.

Similar NUPL readings occurred at local tops in 2017 and 2021. Once price momentum weakens, unrealized gains can turn into realized losses quite quickly. If BTC can’t stay above $109,000, that shift could begin again.

Whales Slow Accumulation as Retail Buys More

According to Glassnode data, whale activity has dropped sharply over recent weeks. Cohort tracking heatmaps show wallets with more than 1,000 BTC have changed their net accumulation rate from red to blue. This reduction started in April and has continued into May.

In contrast, retail wallets with less than 10 BTC are still buying. Rising prices tend to attract these smaller wallets, which tend to enter on strong uptrends.

Bitcoin has climbed from $65,000 in November 2024 to above $109,000 from November 2024 to May 2025. Smaller holders became more active, and larger wallets slowed down during this move.

In the past, this divergence has been a sign of growing risk. Exposure increases near tops in retail buying and decreases in experienced holders. Newer holders may be more likely to exit quickly if selling begins, which will increase price volatility.

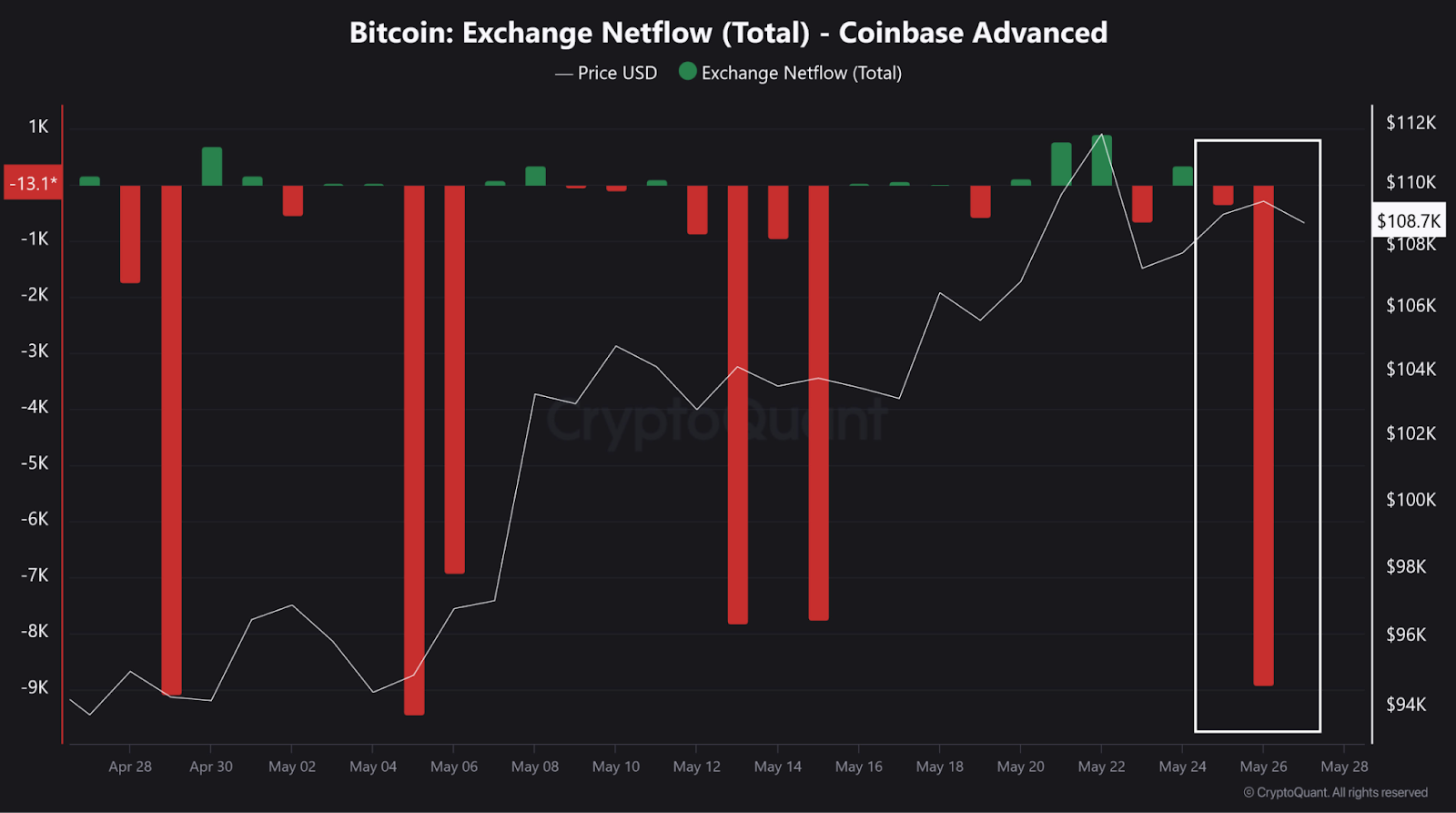

However, CryptoQuant shows that whales have withdrawn 9,000 BTC from Coinbase in a single transaction, the highest outflow in over two weeks.

BTC moving off exchanges is usually a sign that it is going into cold storage, lowering the short-term risk of selling. But this doesn’t mean accumulation is rising, it means whales are holding or making gains.

Major platforms have turned negative on exchange netflows in May. BTC is leaving more than it is entering, reducing the available supply for spot selling. Yet without whale accumulation, price weakening will leave the market without a strong base of support.

Leverage Builds Below $109K With Risk Zones Forming

Meanwhile, according to Coinglass, leveraged long positions are now at risk near the $107,410 level. Long liquidation leverage is cumulative at $2.30 billion. If Bitcoin falls below this key level, it could cause many open long positions to be forced sold.

Liquidation maps also show clusters of leveraged longs just below the current price. The market is sensitive to small downward moves because of these clusters.

A breach will trigger a wave of automated liquidations, which will exacerbate selling pressure and further accelerate downside moves.

For now Bitcoin is still above the danger zone, but with open interest increasing and more traders entering leveraged positions, the risk is still building. Derivatives markets could amplify the reaction if prices fall just a few percent.