Key Insights:

- Bitcoin is consolidating near the $107,500 resistance, necessary for a breakout to new all-time highs.

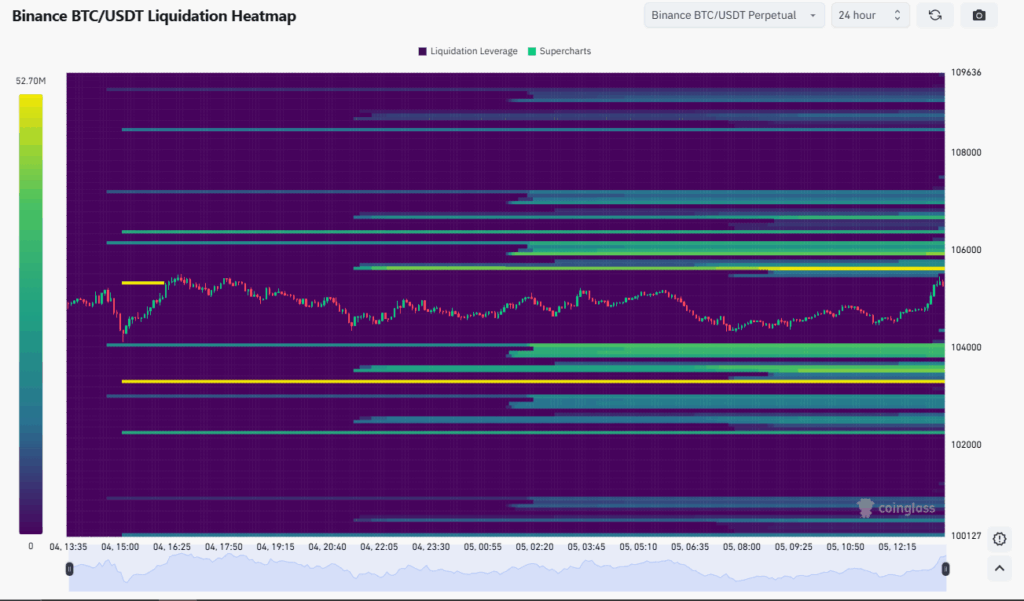

- Massive liquidity has built up around Bitcoin’s current price range ($104,500-$107,500).

- Analyst Michaël van de Poppe has identified the $107,500 level as important for Bitcoin’s next upward trend.

The crypto market is again breathing as Bitcoin holds just below a critical resistance zone. Traders and analysts closely watch the $107,500 zone, calling it a possible launchpad for a new all-time high.

While momentum indicators show bullish presence, the data has cautionary signs. Macroeconomic conditions aren’t doing much to push the needle in either direction. The $107.5K mark is Bitcoin’s most crucial price.

Liquidity Builds as Traders Expect a Breakout

At press time, Bitcoin was trading in a tight range around $106,000. Interestingly enough, its price movement targets liquidity above and below this level.

On June 4, a brief spike nearly pushed the price towards $107,000 before pulling back and taking out short positions. This was quickly followed by a dip that cleared out long positions near $105,000.

This up-and-down price action between $104,500 and $107,500 has created a zone of strong liquidity that traders must be wary of. According to data from CoinGlass, both ends of this range are becoming liquidity hotspots.

Traders are setting large orders just beyond the current price range. This helps them capitalize on volatility or protect key support and resistance levels.

Why the $107.5K Level Is So Important

According to insights from crypto analyst and trader Michaël van de Poppe, the $107,500 mark is a fundamental Bitcoin price level. Van de Poppe stated that breaking above this level is crucial. He believes it could lead to new all-time highs.

He also noted that such a move could push Ethereum to $3,000.

A powerful upward trend could follow if Bitcoin breaks through $107.5K with volume and follow-through. This uptrend could overshadow the previous ATH and push prices to new highs.

Lack of Macro Triggers Keeps Market Directionless

Despite this technical setup, the general market isn’t offering much in terms of a catalyst. Bitcoin is behaving like other risk assets and is hovering in a range. It also lacks strong momentum and is waiting for something to happen.

According to its latest market bulletin, trading firm QCP Capital reported that Bitcoin is currently trading in a “rangebound” state.

According to QCP, indicators like market skew and open interest show little directional conviction from investors. They also warned that Q3 might be painful for investors: “Tariff-related impacts may begin filtering into macro data,” QCP wrote.

Additionally, looming U.S. fiscal issues like the debates around debt ceilings and spending bills could introduce headline-driven volatility.

Bitcoin’s 50-Day Moving Average Hits Record High

Another major factor to consider is Bitcoin’s 50-day simple moving average (SMA) behavior. For the first time, the indicator has crossed into six figures, and is currently sitting just above $100,000. This has historically been a sign of incoming bullish action. However, there’s a catch.

The spread between the spot price and the 50-day SMA is narrowing. When Bitcoin closely follows this moving average after a rally, momentum weakens.

This often signals an upcoming market correction. This is similar to what was observed late last year when Bitcoin dropped from above $100,000 to as low as $75,000.

Profit-Taking Indicates Bull Fatigue

On-chain data further supports this narrative because more holders are taking profits. Investors are adopting a more cautious approach. They are securing profits instead of risking a continued bull run.

This behavior is not necessarily bearish. Still, it does show that Bitcoin making a new ATH may require a new source of momentum. Something massive has to hit the news, or Bitcoin has to break above a major technical level.