Key Insights:

- Pump.fun is reportedly planning a native cryptocurrency launch with a $1 billion token sale and a $4 billion valuation.

- The rumored token launch has divided the crypto community, with speculators split between the token as a good idea, and as a tool for “degenerate gambling.”

- Despite controversy, Pump.fun has generated nearly $700 million in cumulative revenue from almost 11 million created tokens.

Pump.fun, the viral Solana-based platform that lets users mint memecoins instantly, is reportedly preparing to raise $1 billion through a token sale.

According to multiple anonymous sources cited by Blockworks, the token sale could come with a $4 billion valuation. As such, this could place Pump.fun among the most highly valued crypto startups in 2025.

Rumors began to swirl on June 3, when a user on X claimed the token would launch within two weeks.

Not only this, the token would also be accompanied by a 10% community airdrop and listings on centralized exchanges.

While the speculation has drawn massive attention, Pump.fun has yet to deny or confirm anything across its public channels.

The Community is Divided

Unsurprisingly, the crypto community is split over what this token could mean for the industry as a whole.

Supporters like influencer Ansem, seem to be excited about the possibility, especially if the token gets listed on perpetuals-focused DEXs like Hyperliquid.

Ansem sees the move as a natural next step for a platform, which played a major role in the Solana memecoin craze during 2024.

However, others are less optimistic. Ash Crypto for example, strongly criticized the platform. He claimed that Pump.fun has damaged the crypto space by turning legitimate investors into degenerate gamblers.

“PumpFun has ruined crypto,” he wrote. He also argued that the platform has “extracted” hundreds of millions in value while most token buyers have lost money.

$700 Million in Revenue, But What’s Next?

Despite the controversy, there’s no denying Pump.fun’s financial success. According to data from DefiLlama, the platform has generated a staggering $677 million in cumulative revenue as of early June 2025.

Users have created nearly 11 million tokens on the platform, with a combined market cap of roughly $4.5 billion.

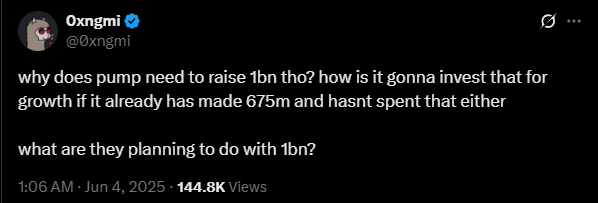

These impressive figures have created further questions about how necessary a new fundraising round would be. For example, developer 0xngmi, a DefiLlama contributor, questioned why Pump.fun would raise $1 billion if it’s already sitting on close to $700 million. “What are they planning to do with $1bn?” the developer asked on X.

If the rumours of the token sale are true, then Pump.fun would need to raise funds from both public and private investors.

However, the lack of clear information about token utility or governance mechanisms has left even Pump.fun’s loyalists in the dark.

Declining Revenues and a Memecoin Market Slowdown

The rumors come at a time when Pump.fun’s own revenue is in sharp decline. In May, the platform pulled in $46.6 million, which is a massive 66% drop from its January peak of $137 million.

This trend could indicate that interest is either waning in memecoins, or simply that the Pump.fun ecosystem is saturated.

This dip in earnings also coincides with the general market’s slowdown, particularly in the memecoin sector.

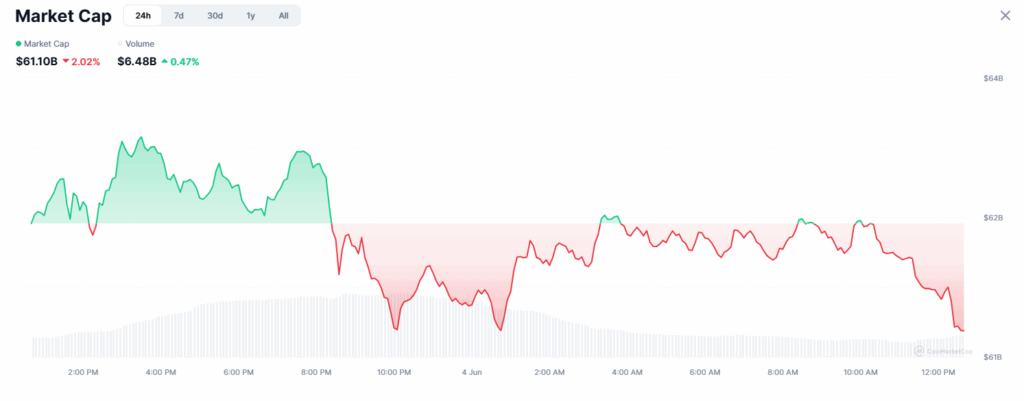

According to CoinMarketCap, the total market cap of meme-based tokens has fallen to $61 billion as of June 4.

This comes as a 54% plunge from its December high of $137 billion. Considering the fewer high-performing memecoins and a more skeptical investor base, the golden era of instant token launches might be losing steam.

So far, the Pump.fun token idea looks like a favourable one, but analysts generally aren’t so sure.

What a Pump.fun Token Could Mean for Crypto

If Pump.fun does move forward with a token launch, the implications could be massive for the crypto space. On the one hand, it could bring more attention, users, and liquidity to the Solana ecosystem.

Moreover, a successful listing on major exchanges could also improve sentiment around memecoin launchpads as serious crypto ventures.

On the other hand, it could fuel more reckless speculation and increase arguments that crypto is becoming less about innovation and more about gambling.

The irony will become that Pump.fun, which started as a tool for fun and experimentation, may now become a symbol of loss and “degenerate behavior” that has been plaguing the crypto industry for the past two years.