Apple’s highly anticipated hearing health features for the AirPods Pro 2 were released today via a firmware update.

While you can update your AirPods Pro now to access these features, they won’t be usable until October 28, when iOS 18.1 is officially launched.

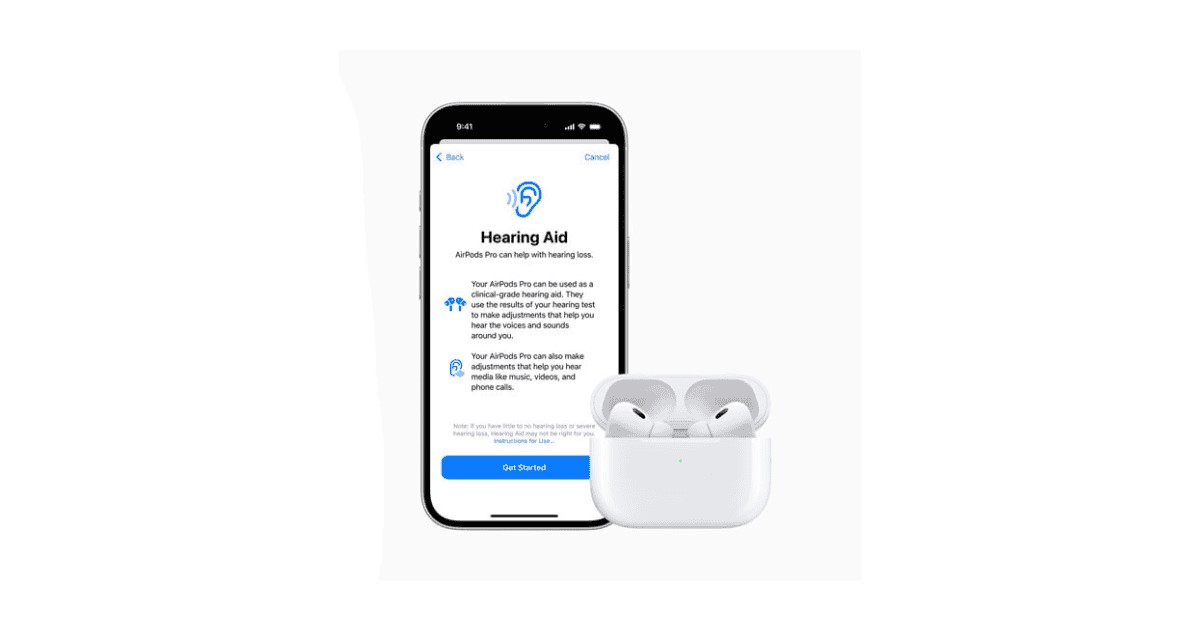

This hearing health update introduces three key features: a hearing test, hearing aid functionality, and active hearing protection. All features are free to use and compatible with both iPhone and iPad, provided they’re running iOS 18.1.

The first feature enables at-home hearing assessment, offering a convenient and cost-effective way to diagnose potential hearing loss.

At a hearing health briefing, Apple highlighted that millions of Americans unknowingly live with hearing loss, often misinterpreting it as only complete deafness, though hearing loss varies widely in degree.

Regular checkups are vital to monitor and understand one’s hearing health over time.

Conducted in the iOS Health app, the hearing test takes around five minutes and involves responding to a series of tones by tapping on your screen.

Upon completion, you receive individual scores for each ear along with an interpretation, such as “Your test indicates moderate hearing loss.”

These results are stored in the Health app, allowing you to track changes over time, and can be downloaded to share with a healthcare provider.

The second feature turns your AirPods Pro into hearing aids, amplifying certain frequencies for clearer and more vibrant sound. They also make real-time intensity adjustments based on your environment.

Although designed to aid those with hearing loss, this feature can benefit anyone by enhancing the sound quality, making it useful for healthy listeners who simply want better audio on their AirPods.

The third feature protects your ears in loud environments. In settings that reach up to 110 dBA, such as a fitness class (100 dBA) or lawn mowing (90 dBA), the hearing protection feature reduces the sound level at a rate of 48,000 times per second to alleviate strain on your ears.

This protective function works across all listening modes, with the silicone ear tips providing additional noise reduction.