Key Insights:

- Bull case: BTC could hit $150K–$175K if the ratio breaks and holds above 1.0.

- Consolidation: BTC may range between $90K–$110K as firms like NVIDIA quietly accumulate.

- Correction: A drop below 0.75 may trigger profit-taking and send BTC back to $70K–$85K.

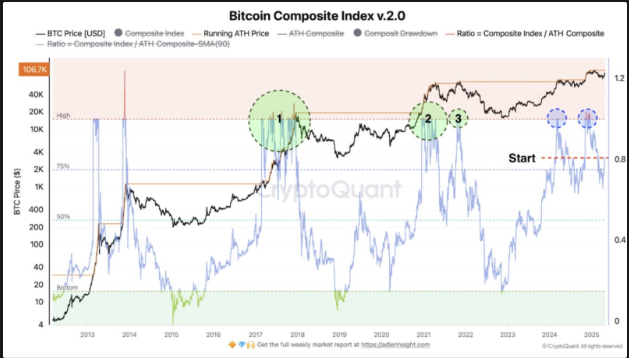

On-chain indicators are showing the start of a potential new trend in Bitcoin’s market structure. Currently, the Bitcoin Composite Index, which measures current price performance against historical all-time highs, is close to the 0.8 ratio. Historically, this zone has been the beginning of major rallies.

‘The ratio is currently at 0.8, or 80% of the peak of the previous cycle, which is what we call the ‘start’ rally zone,’ analyst Axel Adler Jr. said.

Therefore, there are three possible scenarios over the next six months, depending on how this ratio evolves.

Scenario 1: Optimistic (Bull Case)

The most positive scenario is that Bitcoin’s ratio breaks above 1.0 and holds it. In that case, Net Unrealized Profit/Loss (NUPL) and Market Value to Realized Value (MVRV) are expected to show new bullish momentum.

Historically, a breakout of this kind has resulted in strong rallies based on prior cycles in 2017 and 2021.

In this case, Bitcoin could rise to a range of $150,000 to $175,000. This potential is supported by the Composite Index chart, as the ratio crossing above 1.0 in the past was followed by sharp upward price action. This zone served as the transition from consolidation to exponential growth in both of the previous cycles.

This scenario is strengthened by additional cycle comparisons. When we overlay past market cycles from 2011, 2015, and 2018, the current 2022+ cycle is tracking almost identically to previous mid-cycle patterns.

In the past, steep upward movements were seen at the 24- to 28-month post-bottom mark, suggesting the current phase could be a similar rally as those earlier rallies.

Scenario 2: Base Case (Consolidation)

In the consolidation scenario, the ratio stays between 0.8 and 1.0, and Bitcoin stays in a wide range of $90,000 to $110,000.

This range indicates a market that is neither breaking out too strongly nor falling sharply. Traders may stay in their current positions, but few would take on large positions at this stage.

In this case, the market would likely have steady inflows and controlled outflows, moderate volatility and low directional conviction.

Short-term sentiment would be shifting based on macro or regulatory cues and momentum indicators will remain stable. Before more decisive moves, this type of phase has happened in past cycles.

Scenario 3: Pessimistic (Correction)

If the ratio goes below 0.8 and approaches 0.75 or lower, short-term investors may start taking profits. This may lead to a correction and a fall of the BTC price to $70,000–$85,000.

The analyst considers this scenario less likely, as there was already a correction in the recent pullback. But renewed selling pressure or some macroeconomic event could drive the market back to previous support levels.

Macro Trends and Broader Adoption Support the Bull and Base Case

There are larger macro trends that still point to more adoption. CZ, founder of Binance, recently said that a few countries have already started to build Bitcoin reserves. This could put long-term price pressure on supply if more nations follow.

And there is a new rumour to add to the intrigue. According to reports, the White House might be finalizing a plan to reevaluate or sell parts of its gold reserves in order to accumulate Bitcoin.

If confirmed, this would be a major policy change and could change the way governments treat digital assets.

While unverified, such speculation bolsters the bullish case. Bitcoin’s current cycle is building layers of support and complexity, together with corporate interest from firms like NVIDIA and institutional activity from players like Grayscale.

The 0.8 ratio level is still the focus of all eyes, as it could be the point of breakout for the next breakout or the market remaining range bound.

This is supported by reports that NVIDIA, the world’s third largest company by market capitalization, is planning to add an undisclosed amount of Bitcoin to its corporate balance sheet.

According to the reports, the decision is made with the desire for financial ‘stability’. If true, it would be a landmark in corporate adoption and might inspire other big tech companies to act likewise.

Such accumulations from strategic players will help build a solid demand base and stabilize prices in a well defined corridor.

Institutional movement offers clues here. The latest transfer of 9,645 BTC (worth over $911 million) by Grayscale may indicate that large players are moving positions.

It is unclear whether the transfers were internal, redemptions or custody shifts, but they happened at the same time Bitcoin was approaching key levels. Often, these moves come before price volatility or rebalancing activity.