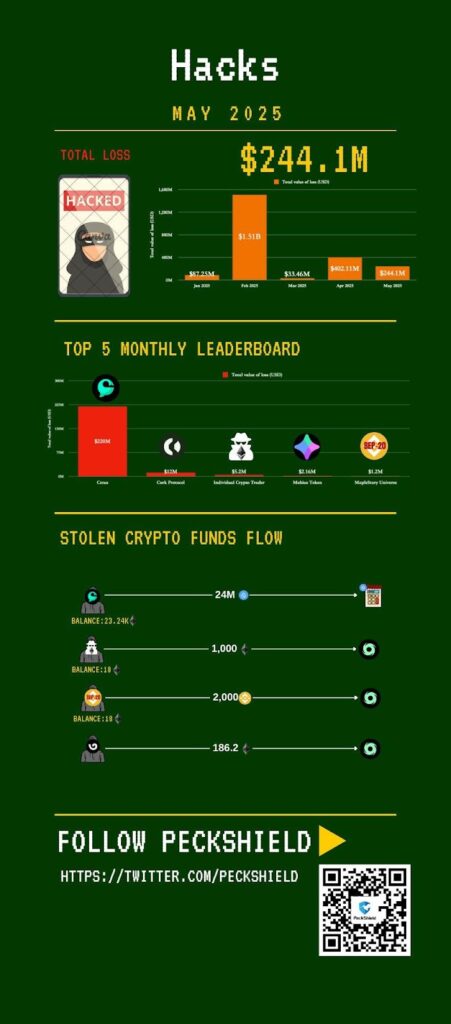

- Crypto hackers stole $244.1 million last month. Despite such a large amount, this stands as a 39% decrease from April’s losses.

- The Cetus DEX exploit alone made up nearly 90% of May’s thefts, with a total of $223 million siphoned off.

- Approximately $157 million (71%) of the funds stolen from Cetus DEX were successfully recovered.

The crypto industry continues to be a major target for cybercriminals, especially with hackers stealing a staggering $244.1 million in May.

While this number might come as a shock at first glance, it actually represents a 39% drop from April’s losses. This means that blockchain security could be improving on a micro scale.

According to data from blockchain security firm PeckShield, the bulk of last month’s damage came from a single exploit. Here’s a breakdown of May’s biggest crypto thefts and what they mean for the future.

The Cetus DEX Exploit

The biggest incident in May happened on May 22, when decentralized exchange Cetus DEX was hit by hackers. The attacker made off with nearly $223 million, which stands as nearly 90% of the total funds stolen during the month.

The breach was traced to a vulnerability in the Most Significant Bits (MSB) check, which is a special smart contract security checker that makes sure that liquidity parameters are proper at all times.

By manipulating this flaw, the attacker was able to artificially increase their position in the pool, and then drain it in the process. Despite the severity of the attack though, it wasn’t a total loss.

Thanks to the quick collaboration between Cetus DEX and the Sui Network, around $157 million of the stolen funds (or around 71%) were successfully frozen and recovered.

Other Major Crypto Hacks in May

While the Cetus DEX exploit was the largest crypto theft within the month, several smaller but still damaging attacks occurred throughout May: The Cork Protocol Hack was the second-largest exploit of the month, and saw hackers steal 3,761 wstETH (Wrapped Staked Ether), worth around $12 million.

The stolen tokens were later converted to Ethereum, in what made recovery even more difficult. The DPRK Incident was suspected to be tied to North Korea’s Lazarus Group. This hack resulted in losses of around $5.2 million.

In addition, the MBU Token Exploit led to losses of about $2.2 million, alongside the MapleStory Universe Attack which saw the loss of around $1.2 million.

Signs of Progress?

Even though the figures are still high, the $244.1 million stolen in May is a major reduction from April’s $400 million+ in losses. It’s also a positive development compared to February, when a single exploit from Bybit accounted for over $1.53 billion in losses.

According to PeckShield, the total losses in Q1 reached $1.63 billion, with January’s losses adding another $87 million. When compared to the numbers from May, it already seems that crypto platforms are starting to take security more seriously. While the decline in thefts is promising, it would be a mistake to become lax in security or vigilance.

Hackers are always improving their strategies, and new attack vectors are likely to surface as the space grows. Smart contract platforms must continue to perform security audits, bug bounty programs, and formal verification.

Meanwhile, end users should be on high alert, especially when interacting with lesser-known defi protocols or investing in new tokens.

The Cetus exploit shows that even major platforms can fall victim to a single vulnerability. However, the fast response shows that damage can be controlled, if the right tools are in place.

May 2025 proved that the crypto space is far from winning its fight against hackers. While the total value stolen has declined so far, the industry cannot afford to let its guard down.

The crypto community, from developers to investors, must treat security not as an afterthought, but as a major part of innovation.