- Nasdaq filed to list XRP and Litecoin ETFs, boosting crypto adoption.

- Experts note that XRP ETF has 65% chances of approval this year.

The ongoing market speculation regarding the potential approval of XRP ETF has boosted market optimism about the upcoming price rally.

Ripple (XRP) price saw an intraday price surge of over 2.66% as Nasdaq is seeking SEC approval to list the XRP ETF.

Amidst the current market positioning of XRP crypto, the market has remained hopeful that the upcoming ETF approval could kickoff a significant price rally.

Nasdaq Seeks to List XRP ETF: SEC Decision Looms

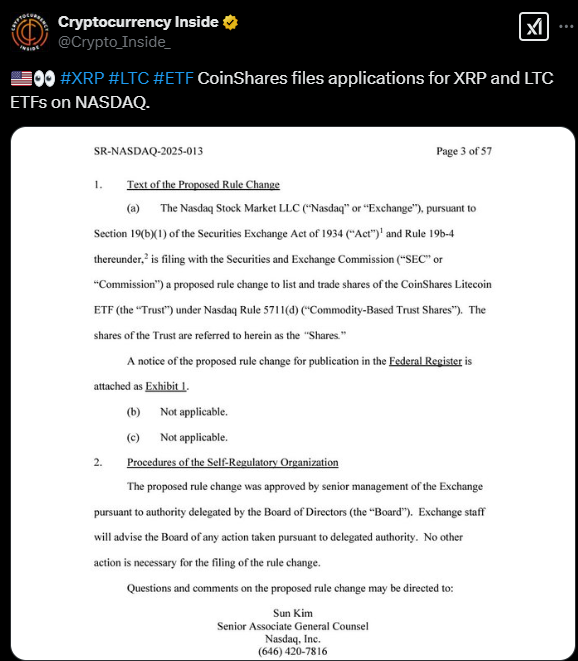

The Nasdaq Stock Market LLC presented its proposal to the U.S. Securities and Exchange Commission (SEC) for listing and trading Coinshares XRP ETF shares following Nasdaq Rule 5711(d).

The exchange-traded fund (ETF) operates as a Delaware Statutory Trust to present XRP investment opportunities to investors while eliminating the need for asset ownership or custody.

Bloomberg analysts Eric Balchunas along with James Seyffart indicated the positive prospects for regulatory approval of upcoming crypto ETF filings covering Litecoin, Dogecoin and XRP and Solana.

In a recent X post, the ETF analysts detailed that XRP ETFs could achieve approval with a 65% likelihood rate while the other three cryptocurrencies followed with different approval percentages.

However, the SEC’s ongoing non classification of Ripple-affiliated cryptocurrency causes significant hurdle for its approval.

Ripple Strengthens Ties with CFTC: What it Means for XRP

XRP faces regulatory changes in the crypto market which brings this critical update with it. The U.S. Commodity Futures Trading Commission engaged in discussions with Ripple regarding XRP’s regulatory status.

The CFTC functions differently than the SEC by accepting selected digital assets as commodity registrations.

The CFTC launched a pilot program to examine digital assets backed by stablecoins as financial market collateral.

An essential court ruling favored Ripple when it proved certain XRP trade deals failed to fulfill securities definition regulations.

Expert analysts expect this court decision to develop new regulations that will define US cryptocurrency laws. XRP maintains backing from big institutions despite the ongoing legal battles.

XRP Price Prediction: Is a Bullish Rally Incoming?

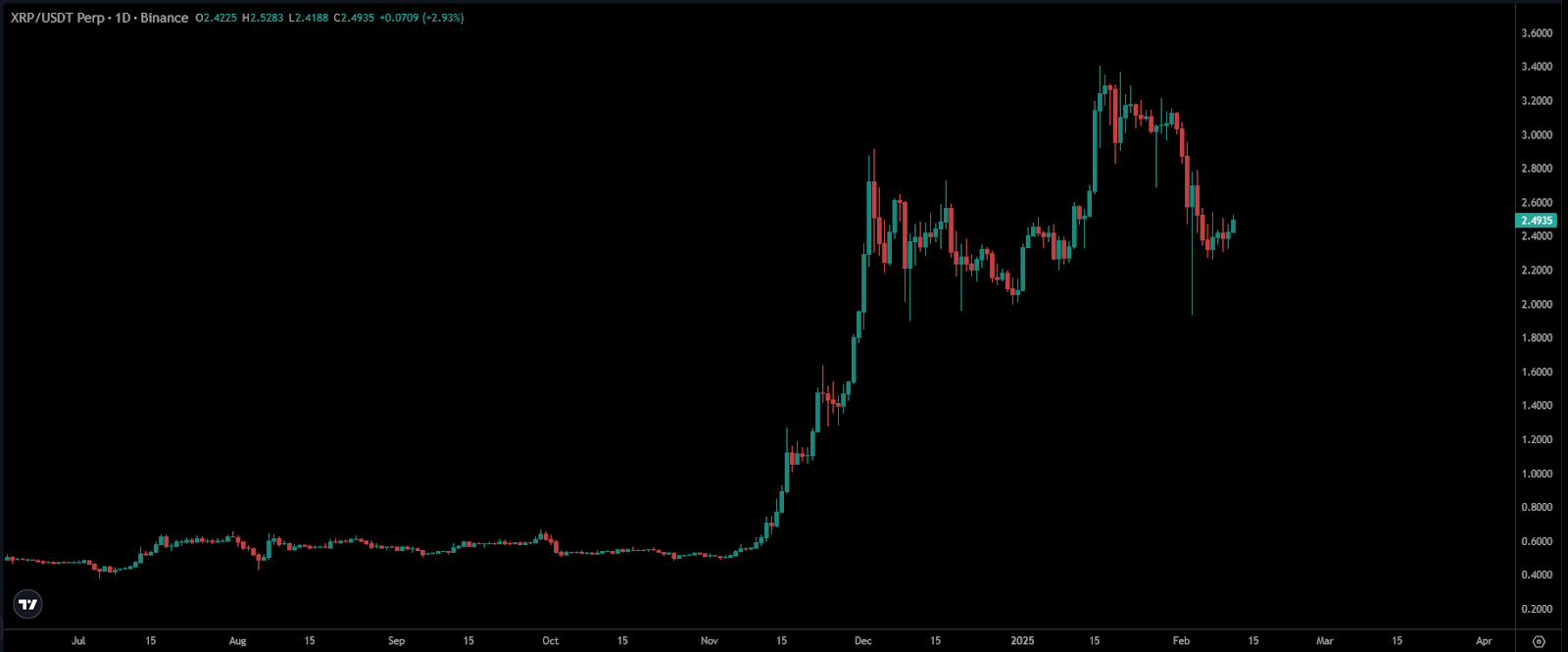

Amidst the recent XRP ETF filing, XRP price reflected bullish momentum and saw accumulation on the charts.

Despite a sharp shock in the first week of February, XRP held its ground and saw a quick bounceback.

Afterward, a significant price consolidation was observed and XRP price was aiming to break the 20 day EMA mark for further upward push toward the $3 mark.

In case of further selloff, the immediate support zones were $2.20 and $1.80, whereas if XRP price moved past the $3 mark, it could see an upsurge toward the $3.20 and $3.60 mark in the coming sessions.