A surge in climate-related shareholder resolutions marks a record-breaking year for North American companies’ annual meetings. Despite some decline in support from major asset managers, interest in combating global warming persists.

Investors and corporate executives prioritize countering rising temperatures, as evident in the tailored resolutions filed this year.

Specific details targeting companies, like those seen in a recent resolution at Jack in the Box, garner significant support from top fund managers.

Tailoring Resolutions for Impact

Crafting resolutions with company-specific details proves effective in swaying support from investors and executives.

The resolution at Jack in the Box, for instance, received 57% support, urging the restaurant operator to report greenhouse gas emissions and reduction goals.

Kirsten Snow Spalding from Ceres Investment Network notes the importance of clarity and specificity in resolution wording, enhancing the business case for climate action.

Despite opposition from companies like Jack in the Box, tailored resolutions gain momentum in the fight against climate change.

Overcoming Challenges in Climate Action

While climate-focused resolutions dominate corporate meetings, support has waned since 2022. Some companies, like Jack in the Box, oppose such proposals, citing prematureness pending regulatory clarity.

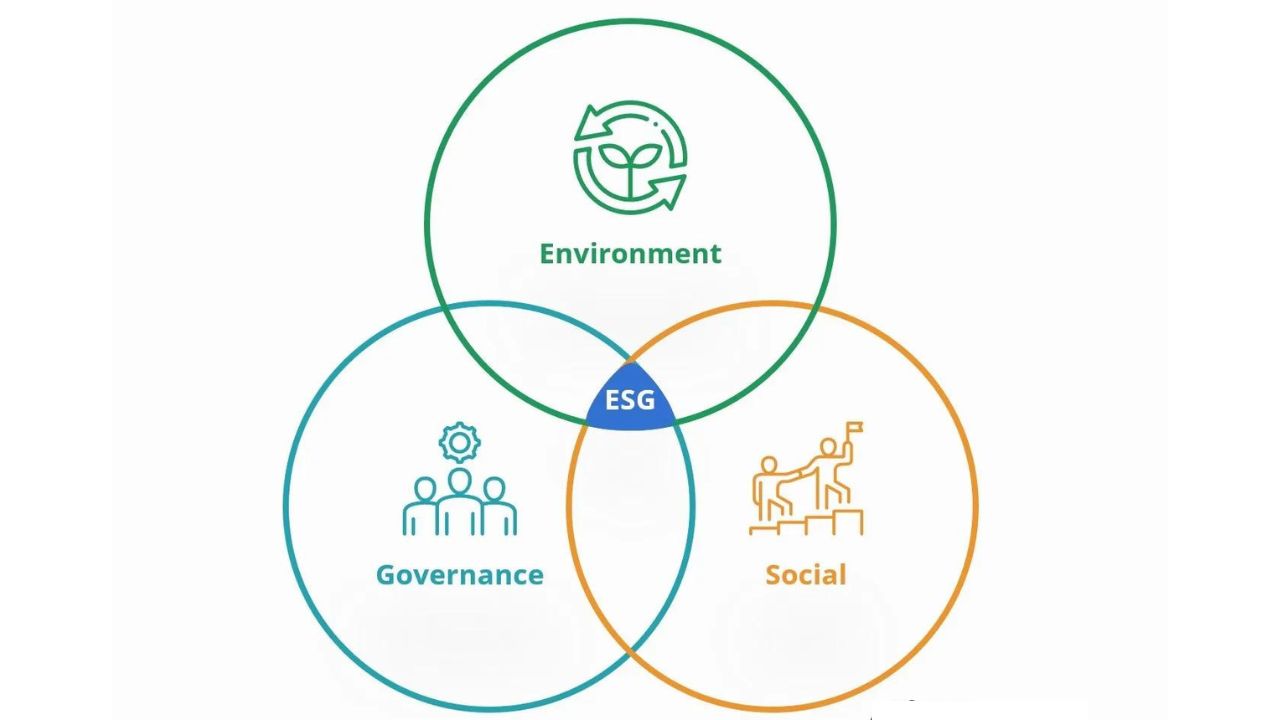

Amid challenges, the push for environmental, social, and governance (ESG) initiatives remains vital. Shareholders and organizations like Ceres continue advocating for climate action, aiming to drive impactful change despite obstacles.