Key Insights:

- Blockchain security firm reports that investors have lost over $2.5 billion to crypto scams and hacks this year alone.

- 45.45% of June 2025 stolen funds came from Ethereum-based protocols.

In this rapidly evolving digital asset industry, crypto scams continue to trouble investors, traders, as well as blockchain and crypto-based firms.

Since the beginning of 2025, the overall market has continued to face several hacks and exploitations, resulting in billions of dollars in crypto losses.

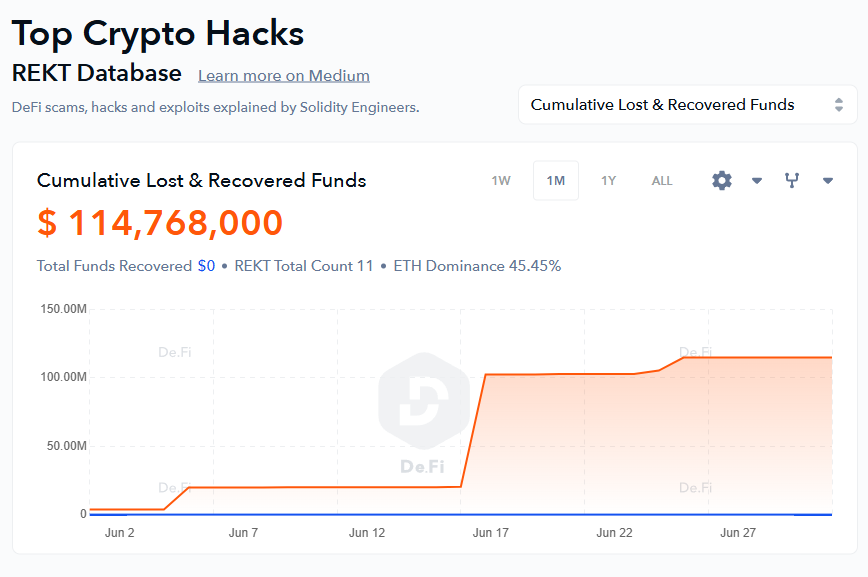

$114 Million Lost in June Alone, REKT Database Reveals

Data from the on-chain security firm REKT Database reveals that over $114.7 million worth of crypto was lost in several DeFi exploits and wallet hacks during the past month alone. The platform tracked 11 major incidents in June 2025, with no funds recovered so far.

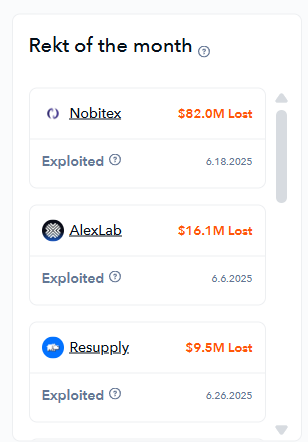

The data also revealed that the largest hack recorded was the Nobitex exchange breach, which resulted in a loss of $82 million on June 18, 2025. Nobitex is an Iranian crypto exchange.

The attack was claimed by the pro-Israel hacktivist group Gonjeshke Darande, which also threatened to leak the platform’s internal source code and data.

Following the incident, to ensure the safety and security of users’ funds, Nobitex shared a post on X (formerly Twitter), stating: “Users’ assets are completely secure according to cold storage standards, and the above incident only affected a portion of the assets in hot wallets.”

The post further added, “All damages will be compensated through the insurance fund and Nobitex resources.”

Other Major Crypto Scams: AlexLab and ResupplyFi

Meanwhile, AlexLab was the second-largest crypto scam in June 2025, losing $16.1 million worth of cryptocurrency due to a critical flaw in its token listing logic, recorded on June 6, 2025.

ResupplyFi, a decentralized stablecoin protocol that leverages the liquidity and stability of lending markets, reportedly lost nearly $9.60 million worth of crypto.

Following the incident, the firm posted on X, stating, “Resupply has experienced an exploit in the wstUSR market. The affected contract has been identified and paused. Only the wstUSR market was impacted, and the protocol continues to function as intended. A full post-mortem will be shared as soon as a complete analysis of the situation has been conducted.”

Ethereum-based protocols accounted for 45.45% of the stolen funds in June 2025, indicating the continued dominance of the Ethereum ecosystem as a primary target for exploits.

$2.5 Billion Lost So Far in 2025

Additionally, a blockchain-based security analytics firm, recently shared a report indicating that so far in 2025, investors have lost approximately $2.5 billion worth of cryptocurrency due to various scams and hacks. The report further highlights that two large-scale incidents accounted for over 70% of these losses.

The report also mentioned that wallet compromises and phishing scams were identified as the most common attack vectors. These methods often involve deceptive social media posts, malicious links, and convincing impersonations of legitimate crypto services.

In addition, crypto scams and hacks are increasingly being linked to the ongoing geopolitical tensions between Russia and Ukraine.

On June 29, 2025, a report surfaced that a Russian influencer known as “Bitmama” had been sentenced to 7 years in prison for orchestrating a fake crypto investment scheme that defrauded investors out of $21 million. Authorities revealed that part of the stolen funds may have been transferred to support Ukraine’s military efforts.

With over $2.5 billion already lost to crypto scams in 2025 so far, it appears that this year is shaping up to be the worst year yet for crypto security breaches.