- Ethereum ETFs see $435M inflows despite losses, with major funds averaging cost basis well above current price.

- Whales add over 1 million ETH in 48 hours, signaling renewed confidence amid price consolidation.

- SEC confirms solo and self-custody staking are not securities, boosting Ethereum’s regulatory outlook.

In the past 48 hours, Ethereum addresses holding between 100,000 and 1,000,000 ETH have added more than one million ETH. The asset was trading above $2,480 at the time of writing.

Meanwhile, ETF inflows have resumed, and the SEC has made clear that solo and self-custody staking are not securities. If ETH breaks the $2,720 resistance level, it could pave the way for higher price levels.

Whales Load Up Over 1M ETH as Technical Breakout Looms

According to on-chain analytics from Santiment, large Ethereum wallets have added more than one million ETH in just 48 hours.

The buying pressure comes as ETH trades within a clear ascending triangle pattern on the daily chart. Bulls are trying to break above the $2,720 resistance while price holds support near $2,480.

A breakout of this level with enough volume could see Ethereum rally to $3,000 in the short term and $3,600 by mid-June.

Indicators indicate that selling pressure is reducing, and the chart structure continues to show higher lows and strong base formation. This view is supported by bullish positioning in derivatives, with $1.67 billion of open interest and a put/call ratio of 0.83.

Meanwhile, Ethereum’s exchange reserves are near record lows, indicating continued withdrawal of assets from trading platforms.

This supply trend decreases the amount of selling pressure available and is usually viewed as a bullish indicator. It seems that smart money is stacking ETH for the next market leg.

Regulatory Clarity on Staking Strengthens Ethereum’s Foundation

The U.S. Securities and Exchange Commission (SEC) gave Ethereum a huge regulatory boost by clearing up its stance on Proof-of-Stake.

Solo staking, self-custody staking and agent staking are not securities, the agency confirmed. The only thing that is still under review is staking as a service, mostly provided through centralized exchanges.

Ethereum and the wider staking ecosystem see this as a major win. It takes the regulatory uncertainty away from individual stakers and supports the decentralization ethos of the network. This means more ETH would be locked in staking contracts, which would further constrict liquid supply.

The announcement has already begun to change sentiment, particularly among long-term holders who now have fewer compliance risks. Given that staking rewards continue to remain competitive and accessible, Ethereum’s network security and participation rates may continue to grow. This also supports ETH’s use case as a yield generating asset.

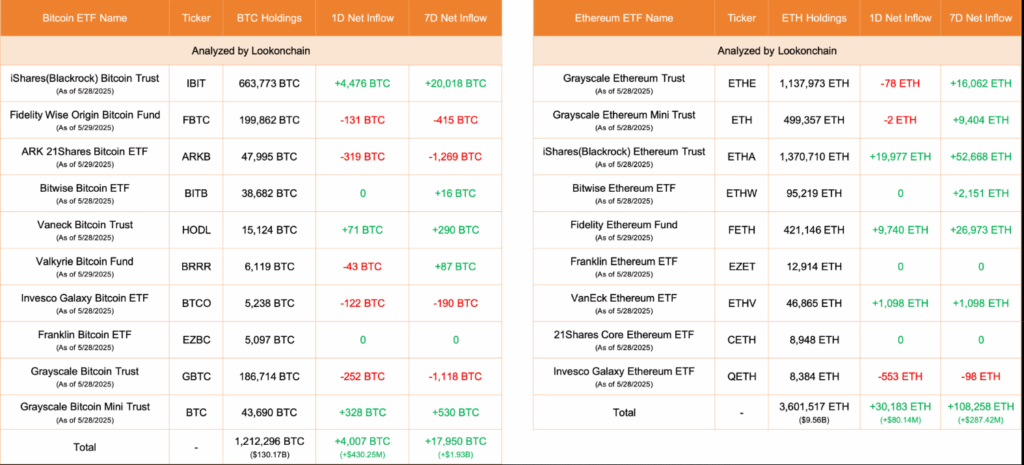

ETF Flows Rebound Despite Smart Money Losses

Over the past nine days, U.S. Ethereum ETFs have seen net inflows of over $435 million, reversing earlier outflows. Even though top funds like BlackRock and Fidelity are holding ETH at an average cost basis above current prices, this signals renewed institutional interest.

According to Glassnode data, BlackRock’s average entry was $3,300, Fidelity’s was $3,500 and ETH was $2,620. These institutions are 20–25% in the red and have not exited their positions, but instead added more exposure. This means being long-term convicted in the face of near-term losses.

In addition, the latest ETF chart shows that outflows only started to spike when ETH fell below these cost bases earlier in the year. Funds seem to have stabilized their allocations since the rebound.

The behaviour of this activity is similar to that of long-term retail holders, who are also withdrawing ETH from exchanges and moving to cold storage.

With whale accumulation, regulatory clarity, and institutional support converging, ETH appears to be gathering steam. If the price breaks $2,720 with follow-through, it could be the start of the next phase of Ethereum’s market cycle.