Key Insights:

- Bitcoin price is currently stalling near $110,000, under the influence of macroeconomic factors like upcoming U.S. inflation data and Nvidia’s earnings report.

- Despite the price pause, futures and options market data show strong confidence among elite investors.

- Institutional investors are aggressively accumulating Bitcoin according to on-chain data.

Bitcoin’s price rally is currently stalling just underneath the $110,000 zone.

This is interesting because the cryptocurrency is holding its ground so well, in the face of economic uncertainty and anticipation around major market data.

However, while some short-term traders are getting flushed out by volatility, institutional investors and long-term holders are quietly scooping up more Bitcoin.

Here’s how this is playing out, and what it means for you.

Bitcoin Pauses as Investors Wait

After reaching a high of $110,000 on 26 May, Bitcoin has dipped slightly to a current price of around $109,700 at the time of writing. Analysts generally believe that the pause in momentum is likely coming from a few macroeconomic factors including the upcoming U.S. inflation data and the earnings report from tech giant Nvidia.

President Donald Trump’s decision to delay 50% tariffs on European Union imports until 9 July also brought some relief to markets, as shown by how well European stocks have recovered so far. However, Bitcoin failed to maintain its upward push, and is causing some unease among investors about whether a fresh all-time high is in sight.

Still, while price action is still somewhat sluggish, data hows the market is far from bearish. In fact, institutional behavior and derivatives trends show that something big could be brewing.

Futures and Options Data Show Confidence

Despite the pullback, Bitcoin’s futures and options market data shows that confidence among elite investors is still strong. For example on 26 May, the annualized premium on Bitcoin two-month futures increased from 6.5% to 8%, which is currently in the neutral-to-bullish range of 5% to 10%.

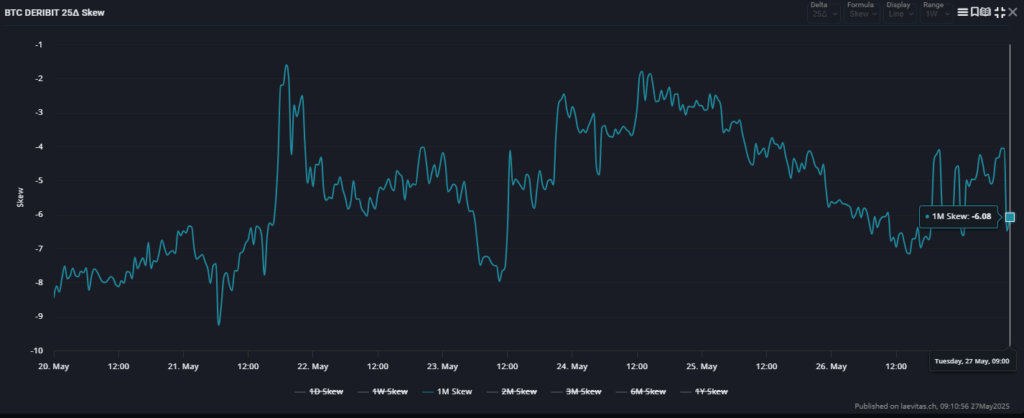

Options data also supports the idea that whales and market makers are expecting upward movement. For example, the 30-day delta skew (the difference in demand between buy options and sell options) sits at -6.5%.

When the number turns negative like this, it shows that sell options are cheaper, and this is a common signal in bullish markets. In short, the futures and options markets show that traders are not panicking, despite Bitcoin stalling.

Institutional Investors Are Accumulating Aggressively

Even as prices seem to have lost steam, institutional appetite for Bitcoin is showing no signs of weakness. Between 19 and 25 May, MicroStrategy purchased $427 million worth of BTC at an average price of $106,237. This trend has been seen in several other parts of the market.

For example, Spot Bitcoin ETFs saw inflows of nearly $3 billion during the same period according to data from Farside. JPMorgan also made headlines by allowing its clients to buy spot Bitcoin ETFs.

While the bank is unlike asset managers and doesn’t offer custody or directly recommend crypto investments to its customers, its moves show a major change in Wall Street’s attitude toward Bitcoin. These developments show that Bitcoin is increasingly being recognized among legacy financial players. Bitcoin is becoming a major asset, especially in uncertain economic times.

Long-Term Holders Quietly Increase Exposure

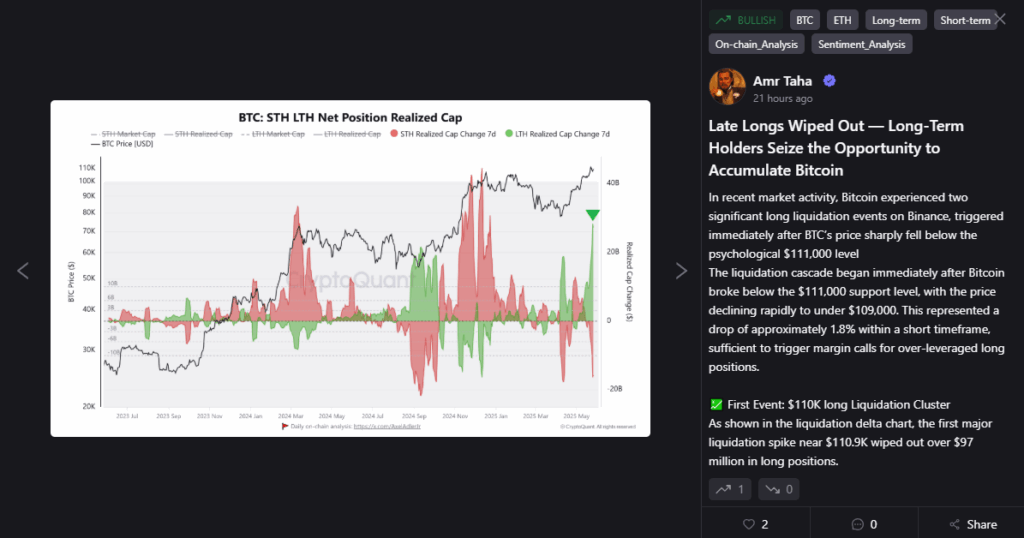

While short-term traders continue to react to every price dip, long-term holders (LTHs) are doing the opposite. According to data from CryptoQuant, LTHs have been steadily buying during this pullback.

Coinglass data shows that there have been two major liquidation events recently.

The first happened when Bitcoin dipped below $111,000, and wiped off $97 million in long positions.

The second wave wiped out another $88 million in long trades as the price dropped under $109,000.

However, while the retailers are either selling or being kicked off their positions, long-term holders have been quietly capitalizing on the opportunity. CryptoQuant data shows that long-term holder realized capitalization has broken above the $28 billion mark, which is its highest level since April.

Overall, whether Bitcoin breaks above $112,000 in the coming days or takes a little longer, the ball for the next rally is already rolling.