Key Insights:

- Dogecoin price surged over 4 percent today, moving past the $0.23 mark with daily trading volume rising above $2 billion.

- The price has remained tight between $0.22 and $0.25, with strong resistance at the $0.25 level.

- Crypto analyst Ali Martinez identified $0.239 as a key breakout point that could lead to a rally toward $0.265.

Dogecoin price climbed past $0.23 today, gaining 4% as market momentum strengthened. Trading volume surged 12%, surpassing $2 Billion. This spike reflects growing optimism among investors.

Despite regulatory concerns, bullish sentiment remains strong. The price movement reflects growing optimism about the meme cryptocurrency’s short-term trend. It also hints at possible breakout scenarios ahead.

Dogecoin Price Eyes Breakout Above $0.239

Dogecoin price has been trading within a narrow range between $0.22 and $0.25 for several weeks. The price has stayed 38% higher on the monthly chart despite hitting resistance at $0.25.

Although distribution pressure at this resistance has capped upward movement, momentum indicators indicate a potential shift. Crypto analyst Ali Martinez has identified $0.239 as a critical breakout level for the Dogecoin price in the near term.

He also said that overcoming this resistance could improve momentum to $0.265. Market data support this: there was growing buy pressure while short liquidations rose in May.

Dogecoin price taking off has made short sellers’ lives tough, with a lot of volatility around the key levels.

Since March, the coin has been between $0.12 and $0.22, with decreasing price swings. The latest rally, however, may have fuelled renewed interest in believing there’s still life left in the series.

DOGE ETF Delay and Historical Patterns Support Rally Expectations

Grayscale Investments filed for a spot Dogecoin ETF, following its DOGE Trust launch earlier this year. In March, the SEC acknowledged the ETF proposal and is expected to rule on it by June 17.

More recently, the SEC delayed the process, but market participants are laser-focused on what an eventual approval might mean. Crypto analyst Javon Marks pointed to historical trends. This suggests Dogecoin price could rise by over 215% based on previous bull cycles.

The current setup also appeared similar to past rallies, he added, and if momentum carries on, could drive the price toward $0.73905. Analysts are evaluating structural similarities across market cycles, which results in this projection.

‘Meanwhile, analyst “Trader Tardigrade” has also spotted a possibly long-term pattern known as ‘the cup and handle.” Dogecoin’s chart suggests it’s shaping its third cup and handle, a strong bullish indicator.

This pattern hints at potential long-term upward momentum. If this pattern is complete, the logarithmic projection points to price targets going into the $6.00 area.

Despite regulatory delays, technical setups and historical data indicate a favorable outlook for the Dogecoin price.

Narrowing price bands with rising volume allows for a breakout, adding strength. The patterns such things form only reinforce their expectations for a huge move in the coming weeks.

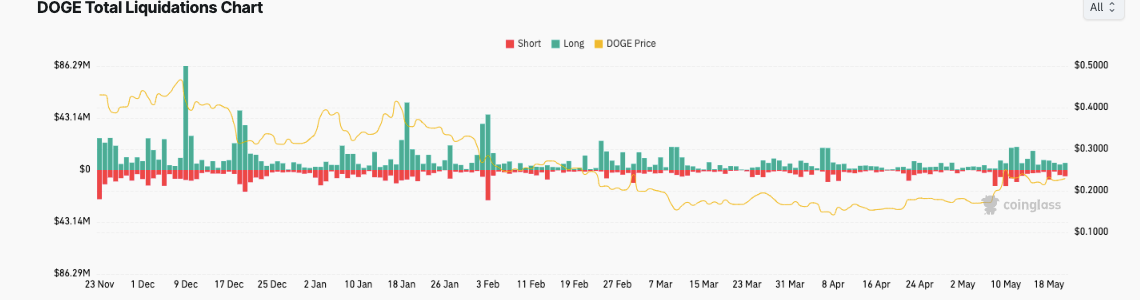

Dogecoin Liquidations Spike with Price Swings

Over the past six months, Dogecoin liquidations have shown sharp spikes amid steep price changes, particularly in December and February. A drop from above $0.08 to near $0.06 was responsible for the record liquidation volume in February.

The volatility of the events can also be explained as shifts in sentiment that are macroeconomic and market-specific. Varying long vs. short liquidation counts showed DOGE liquidations remained moderate throughout March and April.

However, May saw a spike in short liquidations as the Dogecoin price pushed toward $0.16, catching traders off guard. Such was the price trend upward that further pressure to the downside was kept off the short positions.