Highlights:

- Whales bought over $4.5M in ETH and WBTC as price moved past $2,000.

- Accumulation addresses now hold over 20M ETH—an all-time high.

- $2,380 remains a major resistance as most ETH holders are still at a loss.

Ethereum has taken back the $2,000 mark after a slow couple of weeks, driven by increased whale activity and on-chain accumulation.

Although smaller investors’ sentiments are still cautious, big wallets keep on buying, which is setting the stage for a crucial test near the $2,380 level.

Whales Make Bold Moves as ETH Climbs Above $2,000

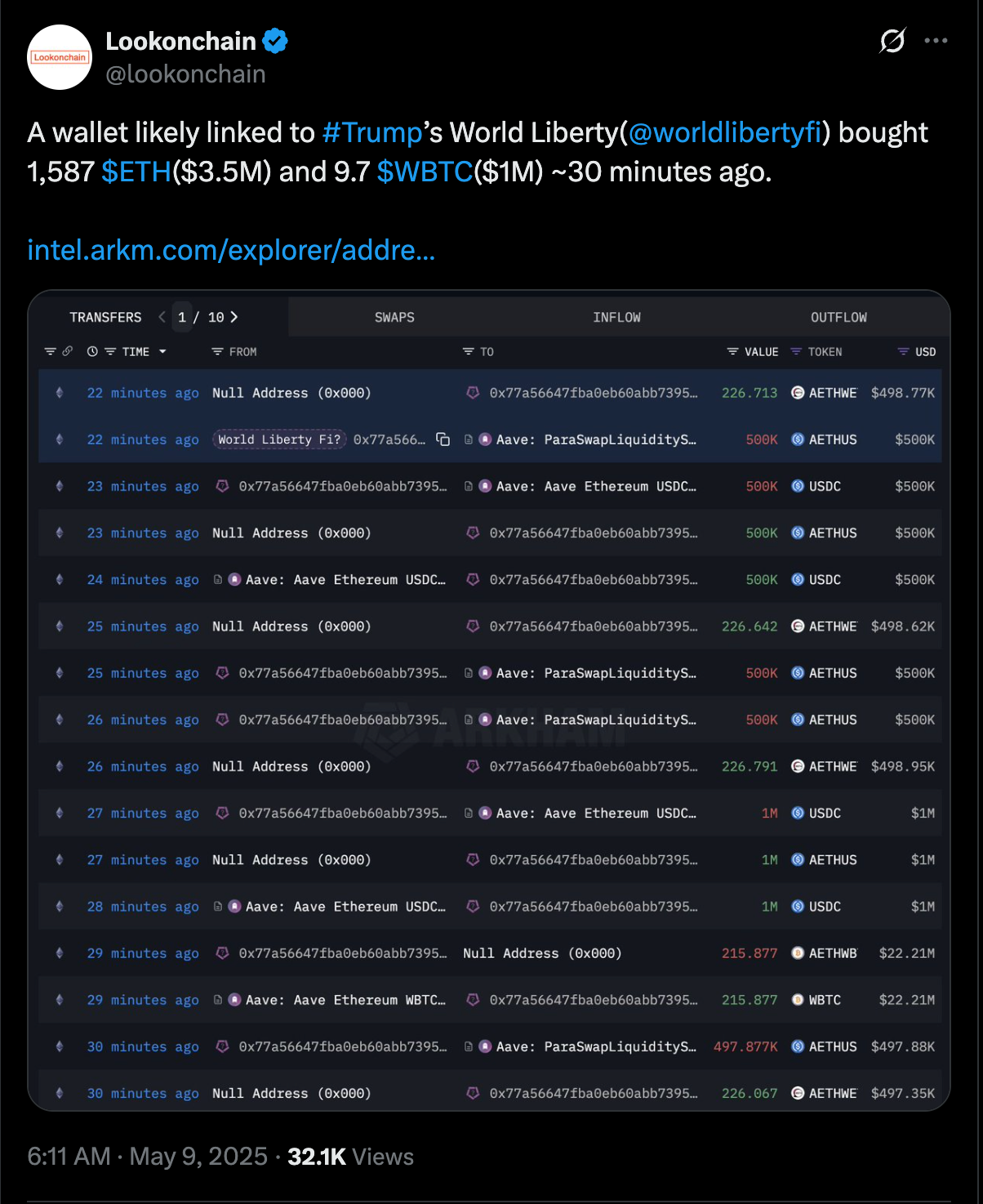

A wallet associated with Trump’s World Liberty initiative recently purchased 1,587 ETH worth approximately $3.5 Million. It also bought 9.7 Wrapped Bitcoin (WBTC) valued at about $1 Million as reported by Lookonchain.

The wallet in question has been active on a number of decentralized finance platforms such as Aave and ParaSwap.

The purchase followed not long after Ethereum (ETH) broke the $2,075 level, a price that it had not seen for over six weeks. The timing implies confidence by large holders, “whales,” who typically take advantage of the current weakness in the market among smaller retail traders.

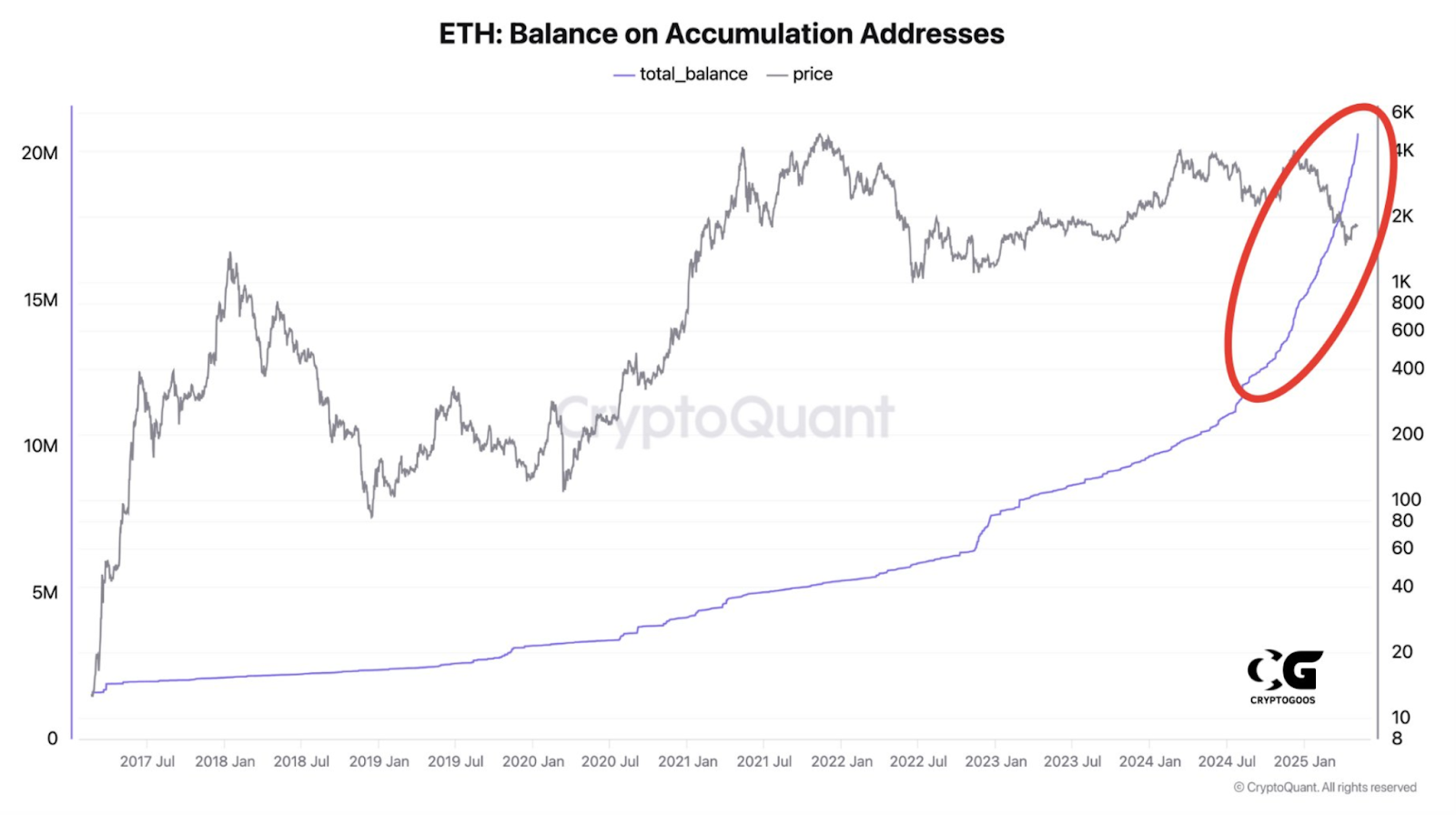

Additionally, data from CryptoQuant shows, Ethereum accumulation addresses have increased at the highest rate in the network’s history. Between early 2024 to date, the total ETH held by these wallets has skyrocketed, from less than 15 million ETH to more than 20 million ETH.

This consistent buying has continued despite corrections on ETH’s price. The accumulation trend suggests that big holders may be setting up for a future price increase.

They’ve continued to purchase even when the price dropped, indicating they’re not so focused on short-term volatility.

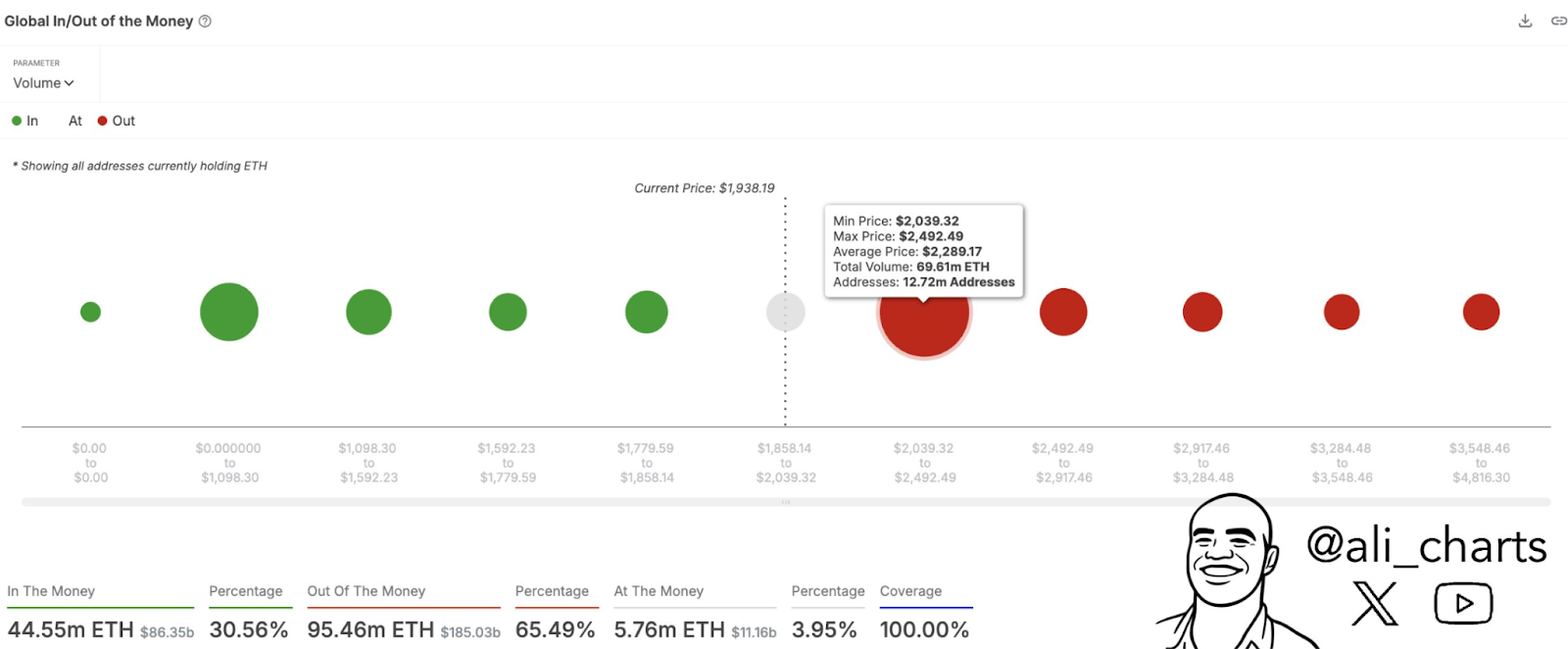

At the same time, the general market has demonstrated some hesitations. The majority of the addresses that own ETH are in a red.

According to the IntoTheBlock data, 65.49% of ETH addresses are currently “out of the money” – they purchased ETH at higher prices than the current level. Only 30.56% are in profit, 3.95% break even.

The biggest cluster of addresses that bought ETH was between $2,039 and $2,492, which included 12.72 million addresses holding more than 69 million ETH.

This range now serves as a supply barrier. The possibility of a continued uptrend is unclear if ETH does not break above $2,380.

Social Sentiment Shows Fear Amid Uptrend

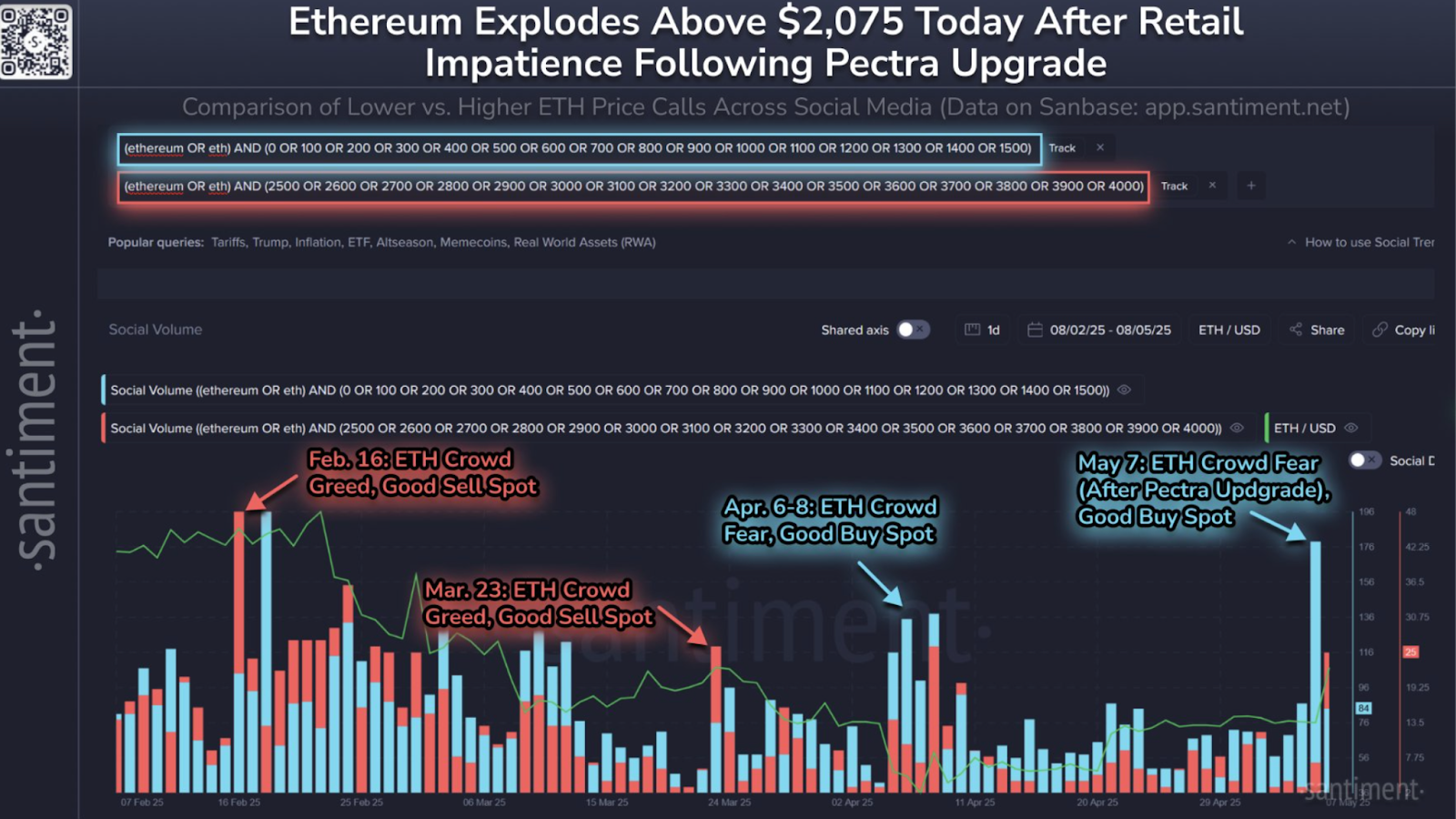

Market behavior has also been influenced by social media activity. Social volume around low ETH price targets was boosted around May 7, after the Pectra upgrade, as per Santiment’s recent data.

The crowd leaned heavily bearish during this time. Most traders on social platforms were discussing ETH in the $1,400–$1,900 range.

Such crowd fear has usually meant local lows in the past. For instance, peaks in negative sentiment on February 16 and March 23 were short-term peaks, fear on April 6–8 and again on May 7 were good entry points for long-term holders.

Santiment reported, “Ethereum has cruised above $2,075 for the first time in over six weeks… rewarding those who have been patient”. This recent surge occurred despite wider retail sell-offs and increased interest in meme coins as they analyzed.

This trend indicates an increasing disconnection between retail sentiment and actual price movements.

$2,380 Emerges as the Real Resistance

Although ETH has taken back the $2,000 level, analysts cite $2,380 as the next test. This is the price range where many of these holders previously bought ETH, and a lot of them are still underwater.

A breakout above this level could turn many of those holders from losers into winners and thus help to reduce the selling pressure. Any rally is still vulnerable to being capped until then.

That is why the $2,039–$2,492 range, which was determined in the IntoTheBlock chart, is important.