Key Insights:

- A Hyperliquid whale earned over $13.7M in floating profit after HYPE surged past $44.75 with 4x leverage.

- HYPE price reclaimed $43 support after hitting $44.04 ATH, forming a bullish structure with targets toward $50 and possibly $100 if momentum holds.

- Over 170 traders on Hyperliquid have made more than $10M each, while 1,589 traders earned over $1M..

A Hyperliquid whale has reportedly minted over $13 million in floating profit after HYPE price reached a new all-time high of $44.75. As traders eye the $100 mark, analysts are assessing the structure supporting this upward movement.

Whale Netted Over $13.7M as HYPE Price Hit $44.75

According to data from HyperDash, a whale trader on the decentralized exchange Hyperliquid gained over $13.7 million in unrealized profits.

The position, executed with 4x leverage, benefited from the sharp rise in HYPE price, which broke past the $44.4 level before touching a peak of $44.75.

Notably, the trade was one of the most profitable single-position gains reported recently, demonstrating the role leveraged exposure has played in the current rally. The transparency of Hyperliquid allowed tracking of the whale’s entry point and margin size.

Consequently, this confirmed a large long position taken ahead of the HYPE price breakout. The surge coincided with increased interest in Hyperliquid’s decentralized derivatives platform, partly driven by growing speculation around centralized exchange listings.

Bullish Market Structure with Targets Toward $50

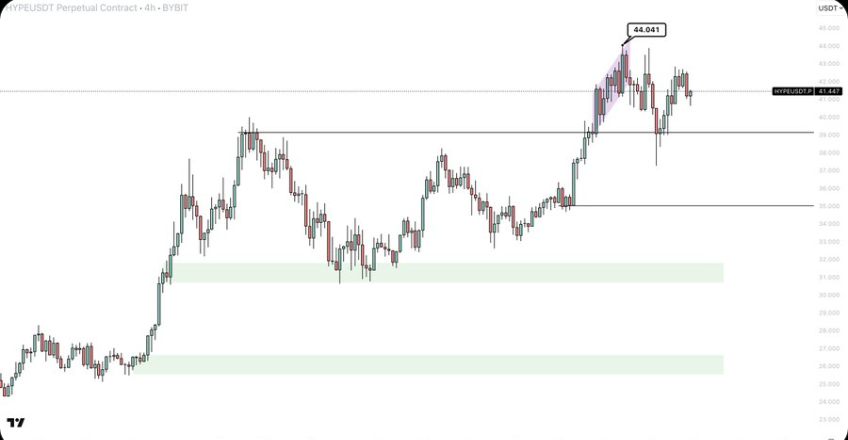

Meanwhile, a technical chart pattern shared by analyst Crypto Gerla suggested that HYPE price has reclaimed support near $43 after briefly correcting from its peak.

The HYPE/USDT 4-hour chart showed a clear ascending trendline with consistently higher lows, establishing a structure associated with continuation moves.

Additionally, the analyst noted the $45–$46 range for breakout confirmation. If buying interest continues to rise above this zone, analysts project the next possible target near $50.

More so, Arthur Hayes, has in the recent past shared a forecast pointing to a long-term target of $100 for HYPE price.

Current structure, along with favorable market momentum, supports the possibility of further upside if trading volume sustains current levels.

Trader Gains Continue to Grow on Hyperliquid

Data showed that over 170 individual traders on the Hyperliquid platform have each earned more than $10 million in profits.

Additionally, 1,589 traders have registered earnings exceeding $1 million since the current rally began. These numbers reflect the broader interest in the HYPE token and its use in leveraged trading strategies.

Returns for top traders were not always based on extreme price gains. Most wallets with profits above $10 million show gains under 200%, suggesting that many participants began with high initial capital.

The pattern indicated that experienced traders used controlled leverage to scale into large positions over time, with risk management contributing to profitability.

Open Interest and Liquidations Reflect Surging Activity

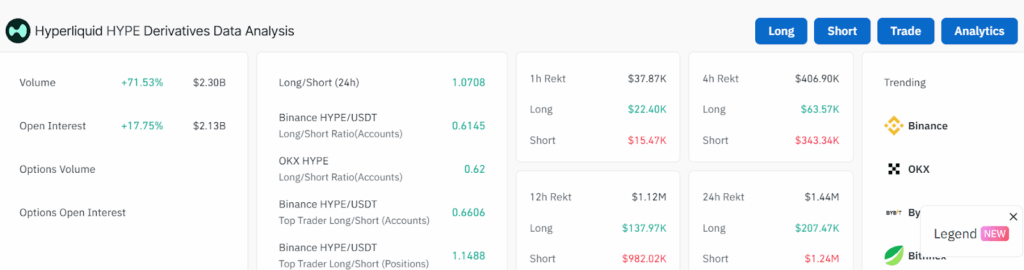

Moreover, the surge in trading activity has also been mirrored by growth in futures market metrics. According to data from CoinGlass, HYPE futures open interest has increased by 17% over the past 24 hours, rising to over $2.1 billion.

This growth in open interest indicates new capital entering the market, supporting both long and short positions at higher price levels.

During the same period, liquidations across HYPE futures exceeded $11 million. This sharp increase suggests higher volatility and aggressive positioning by traders attempting to capitalize on the price movements.

Furthermore, the presence of both high leverage and increased funding rates on open contracts suggested continued competition between bulls and bears. This adds potential for possible swings..

At the time of writing, HYPE price traded at $44.94, up over 9% in 24 hours. The crypto surged from $40.97, forming a strong intraday uptrend.

Trading volume rose over 71% to $364.5M, supporting the rally. The bullish structure is intact above $43, with resistance near $45 and support near $42.