Key Insights:

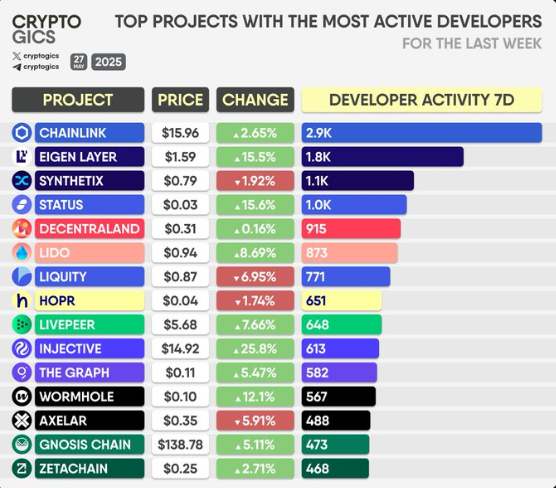

- LINK tops dev activity charts with 2.9K commits, ahead of Eigen Layer and Synthetix, indicating growing innovation.

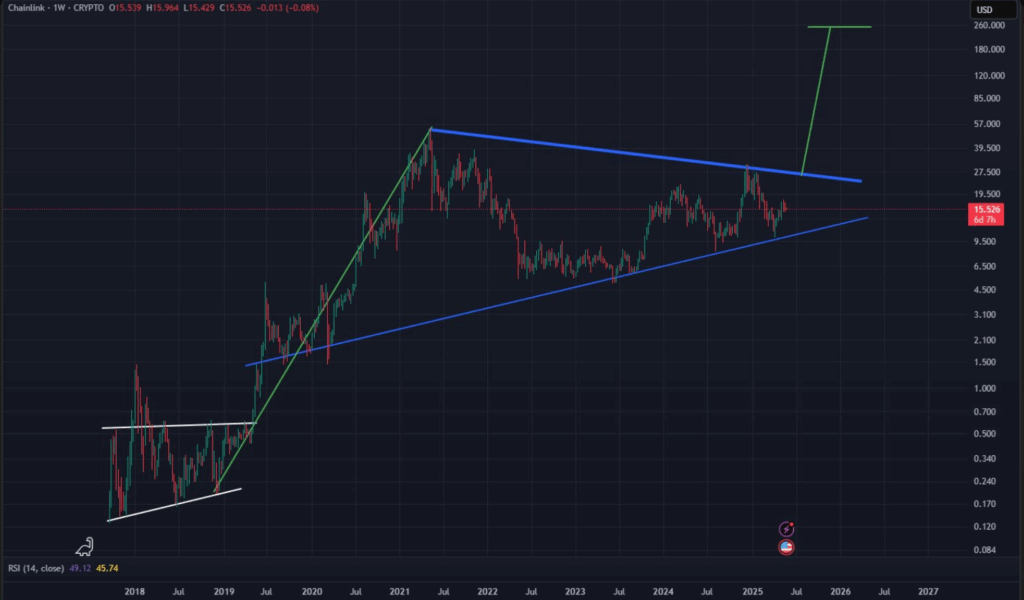

- A bullish pennant since 2021 suggests a breakout could push LINK to $250 if confirmed with volume and broader market support.

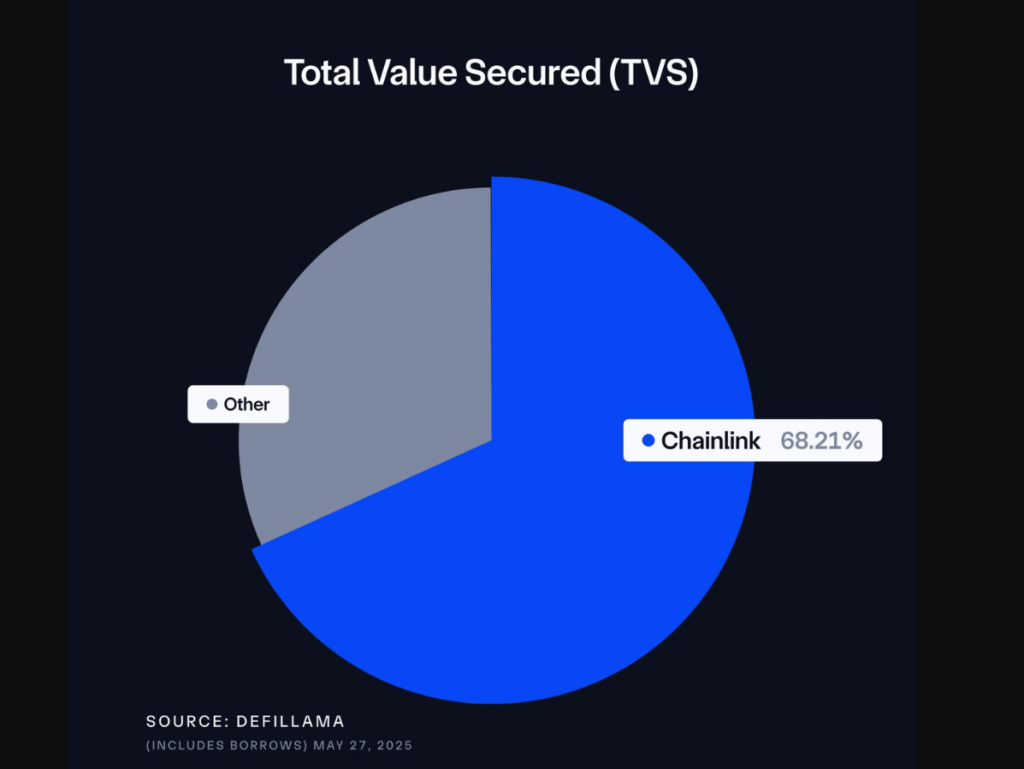

- Chainlink’s TVS exceeds $65B as protocols like Kamino, Jupiter, and TRON integrate its oracles to secure major DeFi assets.

Chainlink (LINK) is gaining attention as it leads all projects in developer activity with 2.9K commits, showing its continued innovation and expansion. Despite short-term price dips, the token is forming a long-term bullish pennant.

Meanwhile, Chainlink’s TVS has surpassed $65 billion, fueled by integrations across major protocols on Solana, TRON, and beyond. This growth in Oracle adoption underscores LINK’s expanding role in securing the DeFi ecosystem and maintaining relevance across blockchains.

LINK Faces Pullback After Pennant Setup While NVIDIA Beats Q1 Expectations

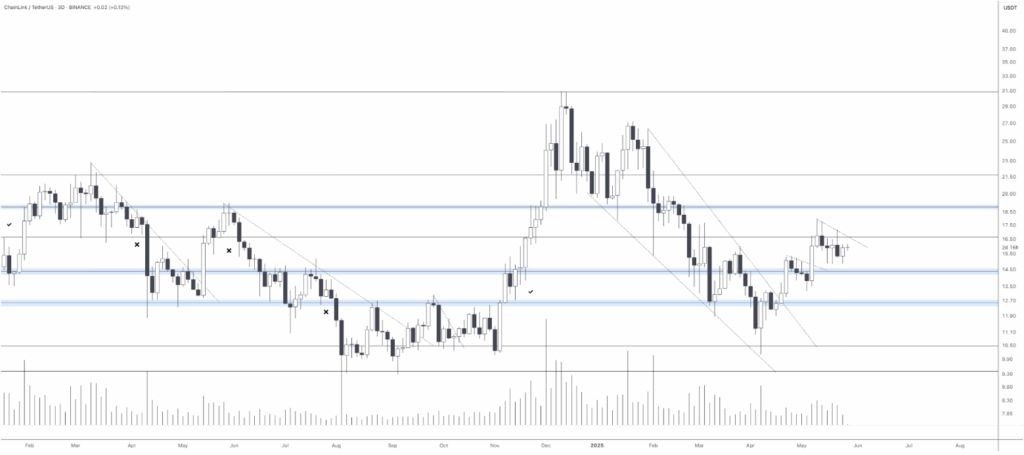

Short term volatility has returned to the market, with LINK trading at $15.34, down 3.67% over the last 24 hours. LINK has been in a strong multi-month consolidation phase, trying to break out from the $16 range. On higher timeframes, LINK has been bullish despite today’s decline.

Analyst TimeFreedomROB has a long-term technical chart from the weekly timeframe showing LINK forming a giant pennant pattern that dates back to 2021. A breakout above the resistance trendline could indicate a measured move to $250 on the height of the previous rally.

But this pattern still requires a confirmed breakout with volume, as the price hasn’t closed above the trendline resistance.

Furthermore, Crypto Rand also posted a closer 3-day chart of LINK consolidating between $14.50 and $17.50, which forms a potential bull flag. If broader market strength returns, the consolidation appears orderly with no large wicks or panic selling, which supports the view of a continuation.

Meanwhile, NVIDIA has reported its Q1 FY2026 earnings. The company also beat analyst expectations, delivering adjusted earnings per share of $0.93.

Revenue hit $43.31 billion, in line with Wall Street estimates. NVIDIA guided to revenue of $45.9 billion and EPS of $0.99 for the July quarter.

Solid performance may also help inform overall market sentiment and risk appetite, which can indirectly help crypto prices, including LINK, if confidence remains high.

Developer Activity Shows Chainlink’s Growing Focus

This week, Chainlink took the lead with 2.9K tracked commits. That put it ahead of Eigen Layer (1.8K) and Synthetix (1.1K). The steady pace of development suggests that Chainlink isn’t just maintaining core infrastructure, but is also adding new features.

More code equals more functionality, and partnerships and developer activity are often a good indicator of future growth potential. And when coupled with the more than 50% increase in total value secured (TVS) in May, this becomes even more important.

Major DeFi protocols are also using Chainlink’s growing integrations. For instance, Chainlink now secures TRON’s $5.5 billion in DeFi TVL.

Moreover, Chainlink’s data services have been adopted by Solana-based protocols such as Kamino Finance ($2B TVL) and Jupiter Exchange ($2.7B TVL).

Total Value Secured Sees Broad Uptick Across Chains

In May, Chainlink’s TVS exceeded $65 billion, with strong growth on multiple chains. Others integrations with TRON, Solana and Aave were what drove the jump. At this time, Kamino Finance, the largest lender on Solana, adopted Chainlink’s oracles.

Jupiter Exchange is using Chainlink data streams in perpetual markets, and CIAN Protocol with $900M TVL has joined the ecosystem. With these additions, Chainlink becomes more relevant across DeFi and, in turn, more demanded as a core oracle layer.

Meanwhile, TVS growth indicates that smart contracts are increasingly using Chainlink to access secure external data. This $65B+ figure is the total of assets supported by Chainlink-powered services and includes borrows.

Ecosystem Stability and Market Dynamics Remain Intact

Over the last month, LINK’s funding rate has been close to neutral, indicating that leverage is not overheated. Despite the price getting close to local highs, traders are showing restraint which can lessen the risk of sharp corrections.

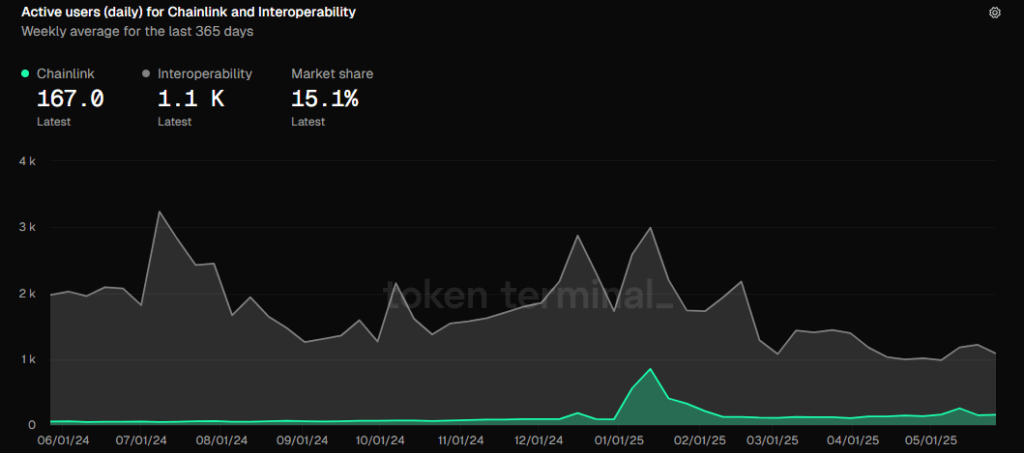

In the interoperability sector, Chainlink has a 15.1% market share with 167 active protocols tracked. This year, market share has remained mostly stable, but the token still leads in this category by a wide margin.

Additionally, Chainlink’s long-term fundamentals are neutral in global regulatory debates. As a recent community post pointed out, LINK is not subject to tariffs because it is a blockchain infrastructure. Regardless of political dynamics, Chainlink’s utility may rise as nations adopt smart contracts.