Key Insights:

- Litecoin price prediction could remain bullish as long as it holds the key support level of $95.

- Litecoin (LTC) is garnering significant attention from experts — some believe it could hit $150, while others think LTC below $100 is worthless.

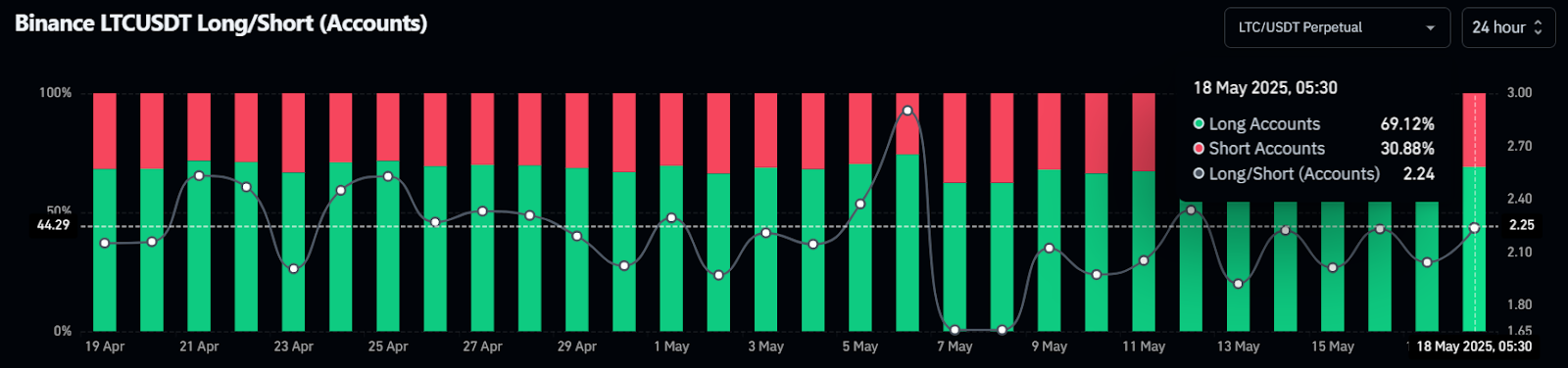

- Looking at the current market sentiment, 69% of traders on Binance are taking long positions on HBAR.

Amid the ongoing price correction, Litecoin (LTC) has continued to consolidate for the past eight consecutive trading days. On the daily chart, the asset appears to be forming a bullish price action pattern while holding the 200-day Exponential Moving Average (EMA) as support.

Current Price Momentum

At the time of writing, LTC was trading near $98.35, up by 2.75% over the past 24 hours. This surge in price, while maintaining key support, has garnered significant attention from crypto enthusiasts, leading to a 25% jump in trading volume, as revealed by CoinMarketCap data.

Litecoin (LTC) Price Action and Technical Analysis

According to the TradingView chart, the Litecoin price prediction appears bullish and is poised for a massive upside rally. Based on the price action, the asset seems to be potentially waiting for a sentiment shift to gain upward momentum.

On the daily chart, Litecoin has formed a bullish flag and pole pattern, with the current price holding support at the 200-day Exponential Moving Average (EMA).

Litecoin Price Prediction

Based on recent price action and historical patterns, if market sentiment shifts, the correction ends, and LTC breaks out of the flag and pole pattern, Litecoin’s price prediction suggests that LTC could see a 32% increase, potentially reaching the $135 level in the near future.

Besides the rally, the asset could face resistance near $110, which might pose a challenge during the upcoming move.

The Litecoin price prediction could turn bearish only if the correction continues and LTC falls below the key support at $95 and the 200-day EMA. If this happens, there is a strong possibility that the asset could drop by 8%, reaching the next support at the $86.50 level.

With the ongoing price correction, LTC’s Relative Strength Index (RSI) has dropped from the overbought zone to near-neutral territory and currently stands at 58, suggesting that bullish momentum is cooling off.

The asset is likely to resume upside momentum or end the correction only if strong buying pressure returns.

Experts Comments on Litecoin

The current price action of Litecoin has been garnering significant attention from crypto enthusiasts. Some believe that an LTC price below $100 is absolute nonsense, while others think the price could soon hit the $150 mark in the coming days.

Bullish On-Chain Metrics

Besides all this, the on-chain analytics firm Coinglass reveals that traders and investors are seizing the current price correction and appear to be betting on the bullish side, actively accumulating.

$16 Million Worth of LTC Outflow

Data from spot inflows and outflows reveal that exchanges have witnessed a consistent outflow of LTC during the correction period. Over the past seven days, $16.07 million worth of LTC tokens have moved out of exchanges.

This substantial outflow indicates potential accumulation by long-term holders and investors, which could create buying pressure and further upside momentum.

68% of Traders Bets on Long Positions

Not only investors and long-term holders are seizing the current opportunity, but traders are as well. Data reveals that Binance LTCUSDT’s long/short ratio currently stands at 2.24, indicating strong bullish sentiment among traders. This metric further shows that 69.12% of top Binance traders are betting on the long side, while 30.88% are on the bearish side.

When combining these on-chain metrics with the technical analysis, it appears that bulls are currently dominating the asset and could soon trigger a rally as sentiment shifts.