Key Insights:

- PI crypto rebounds 7% post-Pi2Day, but macro downtrend remains intact.

- The upcoming token unlock may trigger over $215M in sell pressure.

- Negative funding and failed resistance retests highlight bearish market control.

On June 28, the price of PI crypto gave some signals of life when it slightly rose above an intraday low at $0.52102 to reach a higher value at $0.55973.

This positive intraday jump of 7.4% correlates with new global trading activity after the update of the Pi2Day, as denoted already with an increased volume and price action of the 15-minute candle on the Gate.io chart.

In spite of this local bull run, the asset is still under pressure to trade at $0.54114 with a loss of 5.12% over the last day. Pi crypto has no chance of returning to prices near March, exceeding $2.

Looking at the 15-minute chart moving averages, short-term consolidation can be expected. The MA5 (0.53484), MA10 (0.53426), and MA30 (0.53239) have converged and flattened ahead of the spike, which is indicative of a short equilibrium zone.

The overnight market saw the breakout candle go green rather abruptly, easily driving the price even above those levels, which might point to speculative long leverage.

In fact, a look at trading on MEXC shows a 75x long on the PIUSDT perpetual contract. It fetched 73.97%, which indicates high volatility and leveraged interest coming back into the token.

Year-to-Date Decline Persists on Pi Crypto

When we look at the 12-hour chart, the situation with PI/USDT is much less rosy. The token has been declining in a clear trend since it reached close to $3.00 in February.

The downward trend is not over, either, with the green diagonal trendline showing lower highs and lower lows.

The token is currently trading at 0.5348, which means that it has declined by almost 82% since its YTD high.

The bigger pattern indicates sporadic yet puny recoveries that could not regain substantial resistance levels. Every pump, the most recent one not being an exception, is accompanied by rejection, a bullish indicator.

Historical parallels to Pi2Day (June 28) indicate that even though some traders expected it to behave as a bullish catalyst, they might have been wrong.

History shows unlocks have been followed by losses as significant as 30-77% and the next unlock in July (where 276 of 7.3 billion tokens, 3.7% of the supply, are unlocked, valued at over 2.15B), may bring a lot of down pressure.

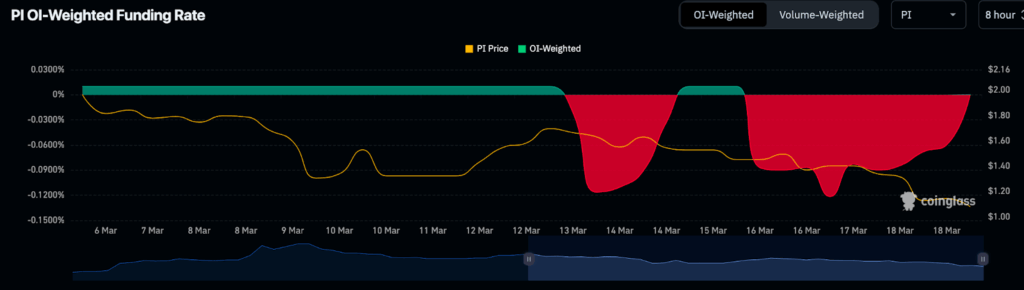

CoinGlass funding rates data in March raises this alarm. The PI crypto OI-weighted funding rate continued to be negative all through the second week of March, reaching its lowest at -0.15%.

It indicates that the short positions were significant in the market, and traders used to bet against the up-momentum of PI.

Negative funding most often implies that the short sellers are paying longs to hold their short position, which exposes the shorts as a bear force rather than a bull force.

The imbalance may continue or increase with time as we wait for unlocking pressures to bearish funding structures.

On-Chain and Exchange Flow Dynamics Raise New Questions

A X expert observed that there was no fundamental selloff. Still, instead of dipping below the previous support at $0.56 to the current support at $0.52 following Pi2Day, it was an artificially initiated dump by some early buyers or market makers.

The theory is that the Pi coins will now commence leaving the exchanges and return to the ecosystem. This is likely because of staking or protocol involvement. This conflicts with observable low price momentum at price charts and could be an indication of positioning by whales.

Nonetheless, such a redistribution narrative remains to be challenged. There is an outstanding possibility that this movement is a temporary action before the lock expires in July, without any background material to attest to those ecosystem interactions or on-chain locking.

According to Gate.io’s 24-hour data, the volume of transactions in 70.18M PI and 37.73M USDT has an extremely strong speculative background, but there is no evidence of long-term accumulation.

Also, what undermines any bullish sentiment linked to ecosystem strength is the price’s inability so far to sustain itself above the resistance level marked by around $0.56.

In the same manner, the volume on OKX is also active, equaling 77.68M PI crypto. However, the impossibility of breaking the $0.60 barrier confirms that the overhead resistances are still under the sellers’ control.

The PI crypto is currently coiled in a narrow trading band between $0.52 and $0.56, so market players are expected to expect more volatility. The Pi2Day event did not bring a long-term reversal despite the short-term price increase.

Although the story of market maker manipulation and demand recovery provides part of the explanation for the short bounce, the current technical and on-chain statistics remain alarming.