Key Insights:

- Whale places $1.71M in shorts on Hyperliquid (HYPE) near the $18.90 resistance zone.

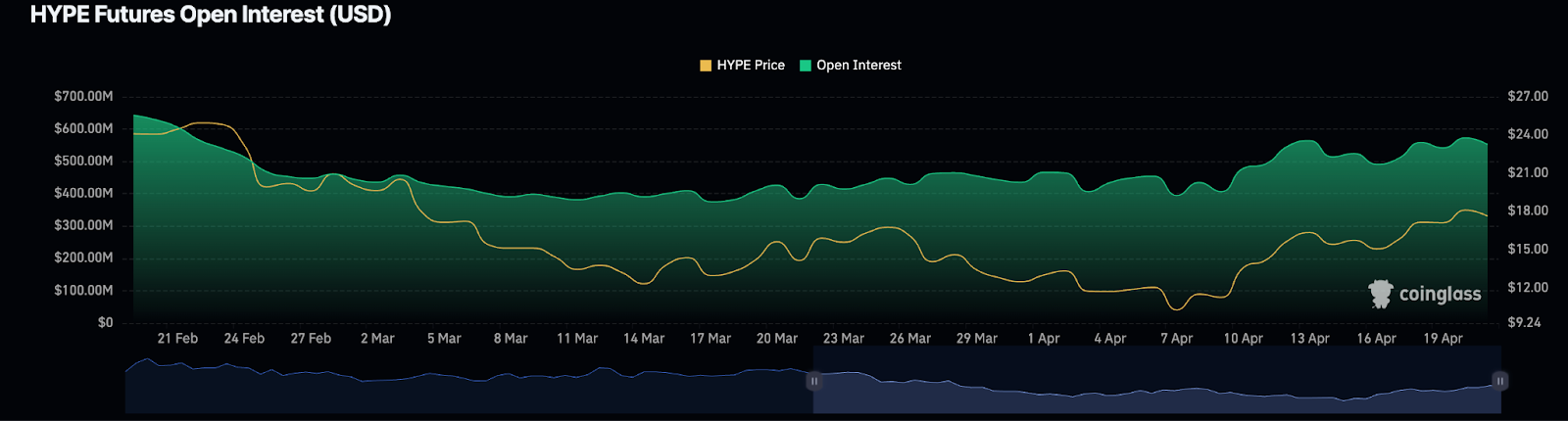

- Futures open interest climbed to over $600M as HYPE price recovers.

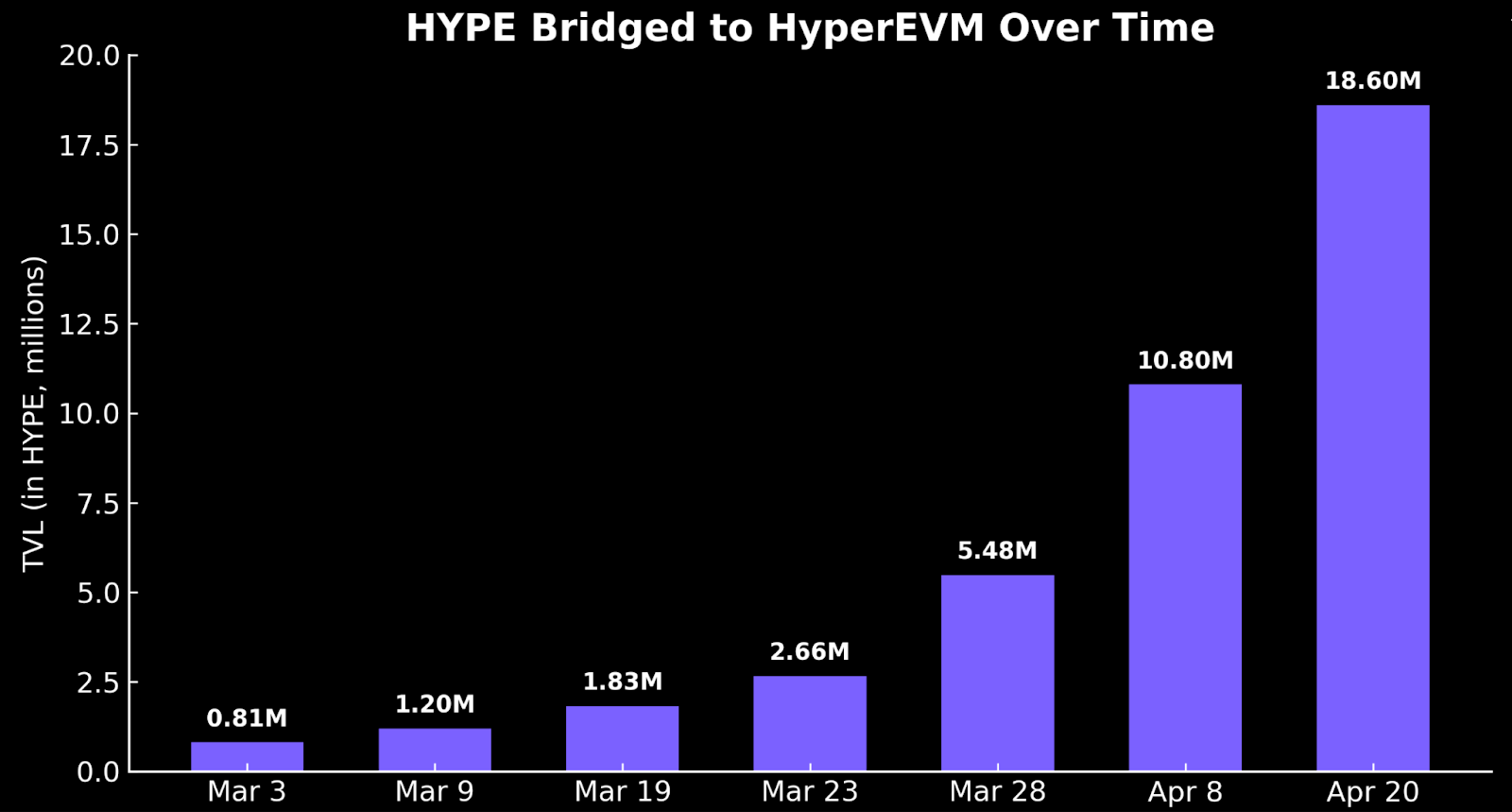

- 18.6M HYPE bridged to HyperEVM, signaling fast-growing ecosystem use.

A major whale placed short orders worth $1.71M, impacting market movements. Following this, HYPE Price is now seeing discovery near $17.50.

Open interest has surged to $600M, reflecting strong market momentum. Meanwhile, HyperEVM adoption is accelerating, with over 18.6M HYPE bridged in just six weeks.

Futures Activity Grows as HYPE Price Approaches Key Zone

Open interest in HYPE’s futures market has steadily grown from under $400 million on April 1 to over $600 million on April 19. The increase indicated rising trader participation from new speculative entries or hedging. HYPE price rose from around $11 to over $17.50 during the same time.

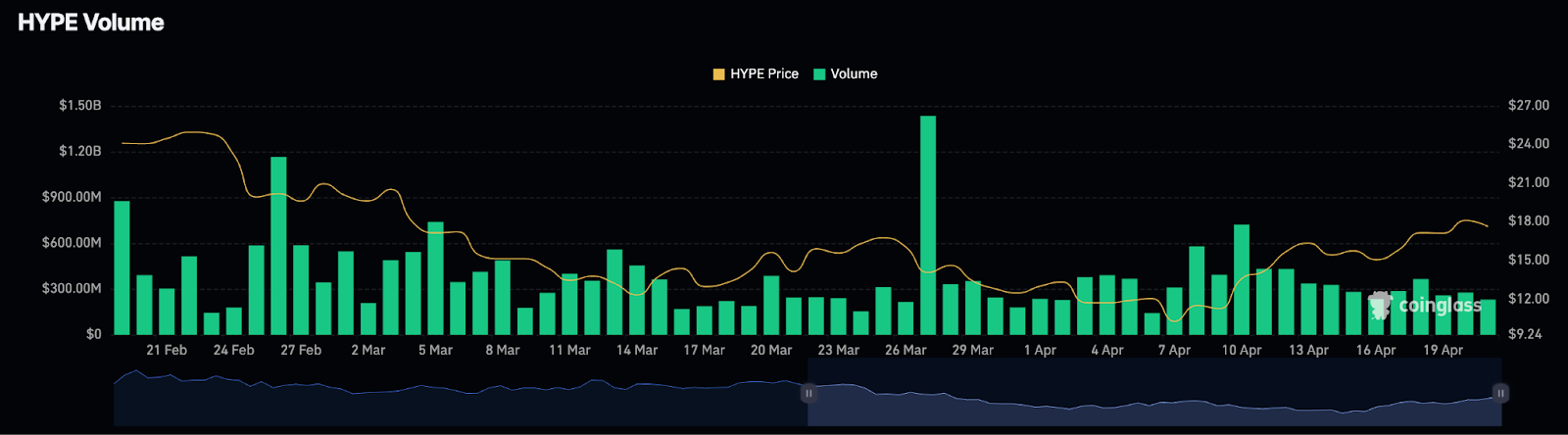

Open interest rising in tandem with price rising usually means momentum building. However, it can also draw in short sellers looking for a reversal. Daily volume has supported this move. It has consistently traded between $100 million and $400 million in the past two weeks.

On April 10, there was a notable spike with volume exceeding $600 million. This pattern is a strong participation pattern, but also sets up potential volatility at current price levels.

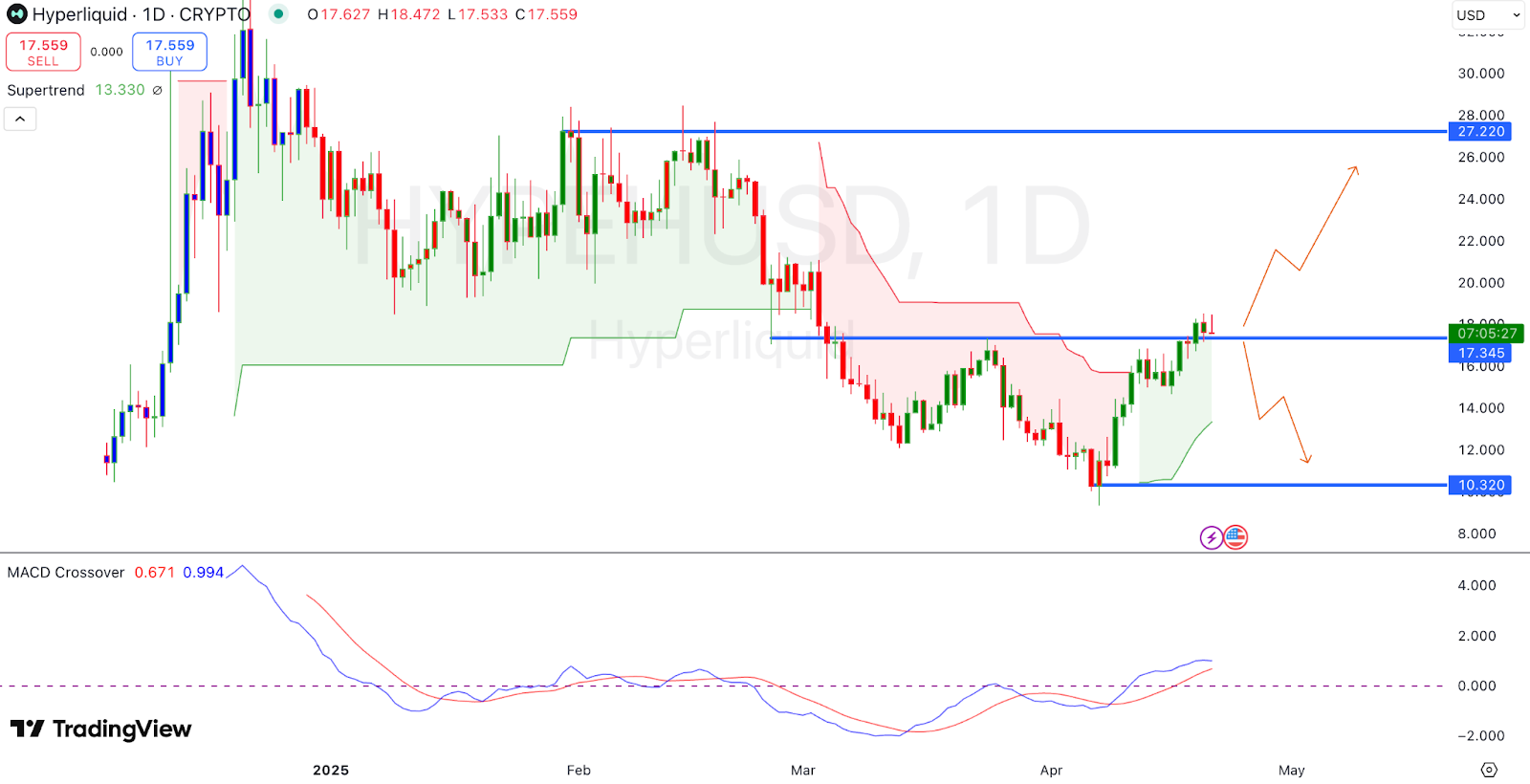

HYPE Price Meets Resistance as Bearish Setup Forms

Hyperliquid bottomed near $10.32 earlier this month and was recovering, reaching a high around $17.55 on April 20. The daily chart showed that HYPE price was testing resistance between $17.30 and $18.90. This is the same area that has capped upward moves in the past.

Two possible outcomes appear. A move above $18.90 could start a move to $27.22. However, HYPE price could return towards $14 or lower if current levels cannot be held.

Upward momentum is supported by the MACD crossover earlier this month, but the resistance zone is a key decision point.

Whale Short Triggers Sentiment Shift Near Local High

Spot On Chain highlighted that a whale deposited $5.1 million USDC into HyperLiquid on April 20. Shortly after, the whale placed short orders for 91,267.52 HYPE, valued at approximately $1.71 million.

These orders were executed at price levels ranging from $18.50 to $18.90. These orders were placed at the upper end of the recent HYPE Price range. This suggests anticipation of a local top or a potential downswing.

The price has stalled near a resistance level. Short positions have formed at this stage, potentially contributing to downward pressure.

The whale’s move brings caution to a steadily rising price trend. In the coming days, price will determine whether this will trigger further selling or be reversed by a short squeeze.

Adoption Growth Adds Long-Term Strength

Although short-term positioning may change, the adoption of HyperEVM is growing. As of April 20, 18.6 million HYPE tokens have been bridged into HyperEVM. On March 3, this figure was just 0.81 million. Demand for bridging has increased more than twentyfold in under two months.

The more HYPE is used within applications, the more it can support long-term value. The rise in futures interest also brings context to the recent surge as more users participate in trading and ecosystem usage.

Technical resistance holds in the short term, but continued usage may support the price in the long run.

Bitcoin Adds Broader Market Support

A MACD crossover and a falling wedge breakout have helped Bitcoin break above a long-term descending trend. The move has improved overall market sentiment, often resulting in inflows into alternative assets such as HYPE.

Even as large players turn bearish near current levels, the strength in Bitcoin could be a support factor for HYPE. With ecosystem activity growing, traders may see dips in HYPE as buying opportunities if Bitcoin continues to rise.