Key Insights:

- AI crypto coins are among the hardest hit, with top assets like TAO, NEAR, and RENDER continuing to bleed and forming bearish patterns.

- Amid this market uncertainty, investors are steadily dumping these leading AI crypto coins.

Amid the ongoing market uncertainty, AI crypto coins have been hit the hardest, recording a notable decline in their value.

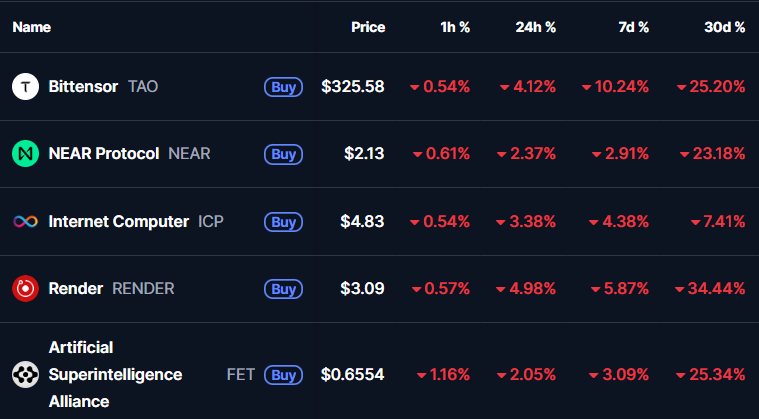

Data from CoinMarketCap shows that major AI crypto coins, including Bittensor (TAO), Near Protocol (NEAR), Render (RENDER), and Artificial Superintelligence Alliance (FET), have lost 26%, 23%, 35%, and 25% of their value over the past month.

The potential reasons behind this significant drop in AI crypto coins are the ongoing geopolitical tensions between Israel and Iran, as well as recent tariff policies.

Ai Crypto Coins Continue to Bleed

However, these are not the only tokens that have been witnessing a price decline. Top assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have also recorded notable price drops. The current market structure appears weak, as the prices of TAO, NEAR, RENDER, and FET seem to be continuing their downward trend.

To see where AI crypto coins is headed in the coming days, let’s explore it thoroughly.

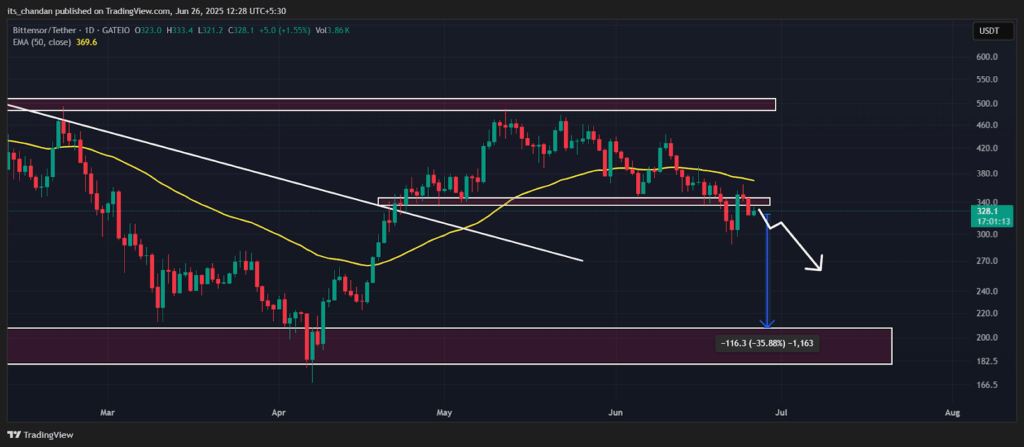

TAO Current Price Momentum and Upcoming Levels

TAO, the native token of Bittensor, is currently trading near $325 and has lost 4.25% of its value in the past 24 hours. During the same period, participation from traders and investors plummeted, leading to a notable 15% drop in trading volume compared to the previous day.

Given the current market structure and overall sentiment, investors and long-term holders appear to be dumping their holdings, as reported by the on-chain analytics firm Coinglass.

Data from spot inflow/outflow reveals that exchanges across the crypto landscape have recorded an inflow of $5.55 million worth of TAO in the past week.

This notable inflow of TAO suggests potential dumping, which could help the asset continue its downward momentum in the coming days.

According to expert technical analysis, TAO appears bearish as it has successfully retested the breakdown of the key support level at $340 and has formed a bearish engulfing candlestick pattern. The formation of this candlestick at the resistance level signals a bearish trend.

Based on recent price action, if TAO fails to regain the $340 level, there is a strong possibility that the price could drop by 35% and reach the $208 level in the near future.

When combining these metrics with technical analysis and current market sentiment, it appears that TAO is bearish and may continue its downward momentum, which could influence other AI crypto coins.

NEAR and RENDER Appears Bearish May Continue Price Dip

Looking at NEAR, it is currently trading near $2.13 and has lost over 2.45% of its value in the past 24 hours. With this drop, NEAR appears to be struggling at a strong resistance level and has formed a bearish harami candlestick pattern, which suggests a potential price decline in the coming days.

The same has also been observed in RENDER, which has lost 5.12% of its value in the past 24 hours and is trading near $3.09. With this notable drop, it has formed a doji candle at the resistance level of $3.10 and appears to be forming an evening star candlestick pattern, which suggests that the downside momentum could continue in the coming days.

Considering the notable price drops over the past 24 hours and in recent days, investors and long-term holders appear to be continuously dumping their NEAR and RENDER holdings, as reported by Coinglass.

Data reveals that exchanges have recorded an inflow of $593K and $741K worth of NEAR and RENDER tokens, respectively, in the past 24 hours, suggesting a potential sell-off and signaling a bearish outlook for investors and the overall AI crypto sector.