Key Insights:

- Two long-dormant Bitcoin wallets became active and moved a total of 3,422 BTC worth approximately $324.2 million.

- Wallet 1NWPS transferred 2,343 BTC after being inactive for 10.5 years, marking one of the largest whale movements in years.

- Wallet 1PiEK moved 1,079 BTC after nearly 11.75 years of inactivity, continuing a trend of decade-old wallets reactivating.

Two long-inactive Bitcoin wallets have reactivated after more than a decade, moving a combined 3,422 BTC valued at $324.2 Million. The transfers occurred early Tuesday morning and reflect one of the largest whale reactivations in recent years.

The reason for the movement remains unclear, but it has raised speculation across the digital asset community.

Bitcoin Wallet Reactivates After 10 Years

Wallet “1NWPS” executed a Bitcoin transfer worth 2,343 BTC, equating to a value of about $222.2 Million under current market prices.

The wallet sat vacant throughout 2014, following a period when Bitcoin prices rested under $1,000. The movement represents the conclusion of years of inactivity.

Spot On Chain identified this transaction on its on-chain tracking platform as statistically abnormal because it came from wallet “1NWPS.”

The wallet owner remains unidentified, yet the wallet’s reactivation has intensified public interest. Market actors believe the movement points to profit-taking because current Bitcoin prices are favorable.

These funds remained off-exchange, indicating that a sale transaction has not occurred. The data reveals that the transaction was either a security-related upgrade or an internal funds relocation. The present data limits analysts’ ability to determine the purpose of this transaction.

Old Bitcoin Holder Moves Large BTC Amount

Another Bitcoin wallet, “1PiEK,” held 1,079 BTC worth an estimated $102.5 million for nearly 11.75 years before the transfer. In early 2013, Bitcoin reached its initial value but experienced massive depreciation from its current market price at the time of the wallet’s most recent activity. This wallet joins numerous others in an expanding trend where extended inactive holders reengage with their wallets.

The wallet owner takes advantage of current price rates based on the wallet’s size and timing behavior. The BTC has not reached an exchange or a known trading desk yet. These activities suggest both a careful reordering of asset holdings and non-diversification events.

The wallet movement occurred when the Bitcoin address operation decreased throughout this period. Historical records show that early Bitcoin adopters are now transferring their funds because their profitability numbers are improving.

The trajectory of this trend remains unclear, though the total amount moved has shown an abrupt upward shift.

Long-Held BTC Reenters Market Strongly

CryptoQuant’s data reveals that dormant Bitcoin activity has grown by 110% since last year. Data shows that between January and March 2025, more than 62,800 BTC older than seven years shifted to new wallet addresses.

The market growth in Bitcoin between Q1 2024 and Q1 2025 reached a 110% increase after BTC spread from 28,000 to 62,800.

The substantial transfer of legacy coins demonstrates robust portfolio evolution and reflects investor confidence growing in the market.

User wallets have been dormant for over ten years and have been seen across multiple wallet transactions over the last three months. One wallet activated in late March transferred 3,000 BTC from a 2016 acquisition worth $250 Million.

Last month, 50 BTC with an initial purchase price under $0.10 actively moved on the network after lying dormant for 15 years.

A single transaction’s theoretical return surpassed 93,000,000%, demonstrating the vast extent of capital reservoirs entering the market. Since its origin, Bitcoin has experienced enormous growth, evident through these major marketplace developments.

Bitcoin Profit Ratio Exceeds Historical Average

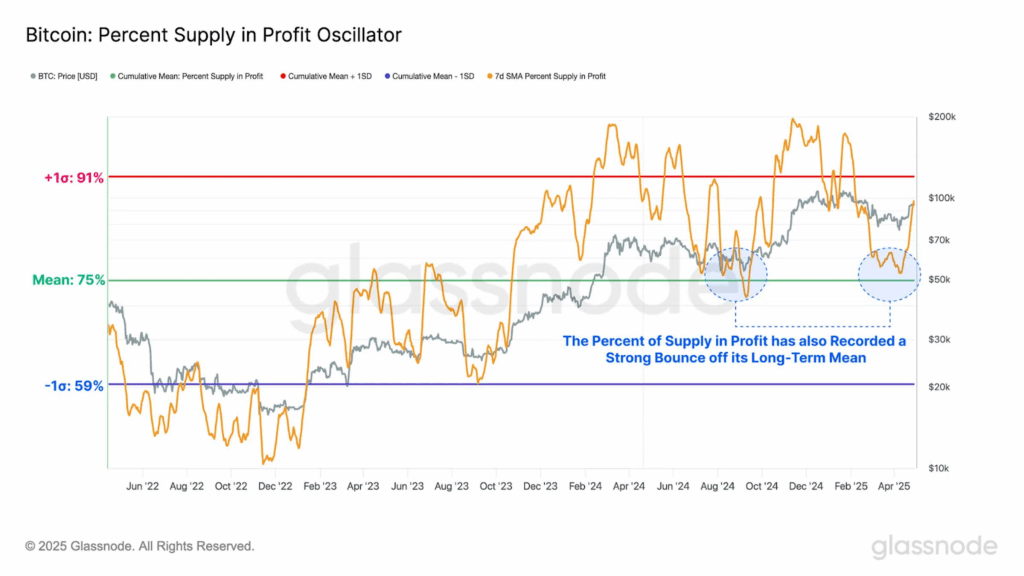

According to analytics firm Glassnode, current blockchain data demonstrates that profit-oriented investors currently control Bitcoin’s supply.

Most Bitcoin in circulation has gained more value than its initial purchase cost, as software records show that approximately 88% of Bitcoin’s value surpasses its acquisition price.

The biggest losses stem from people who acquired their Bitcoin at market levels between $95,000 and $100,000.

Bitcoin’s Market Value to Realized Value ratio has reached its historical standard point of 1.74. Historically, this market indicator signalsthat major participants adjust their trading positions during consolidation periods. Investors currently have a Realized Profit/Loss Ratio (RPLR) of greater than 1.0.

RPLR data points to increased profit activity and an enhanced market attitude. The rise in owners looking to cash out their gains will likely cause price dips through temporary market selling pressure. Analysis of long-term data demonstrates continuous Bitcoin market participation as capital continues to move into the ecosystem.