Federal Reserve officials are facing mounting challenges in overcoming the inflation trajectory, prompting uncertainties over the timing and necessity of interest rate adjustments.

As the two-day policy meeting concludes on Wednesday, policymakers confront the question of whether progress on inflation has stalled, potentially prolonging the need to maintain the current interest rate range of 5.00% to 5.25%.

Inflationary Pressures and Economic View

Despite expectations for a sustainable downward path in inflation, Fed officials have encountered persistently rising service prices, robust job growth, and ongoing escalation in housing costs.

These developments have raised doubts about the efficacy of previous policy measures and sparked debates over the necessity of further rate adjustments to address inflationary pressures.

The upcoming release of fresh economic projections will shed light on policymakers’ outlook regarding interest rate reductions for the remainder of the year.

Amidst conflicting signals and divergent views among economists and investment firms, there is uncertainty over how much the Fed will commit to rate cuts in response to prevailing economic conditions.

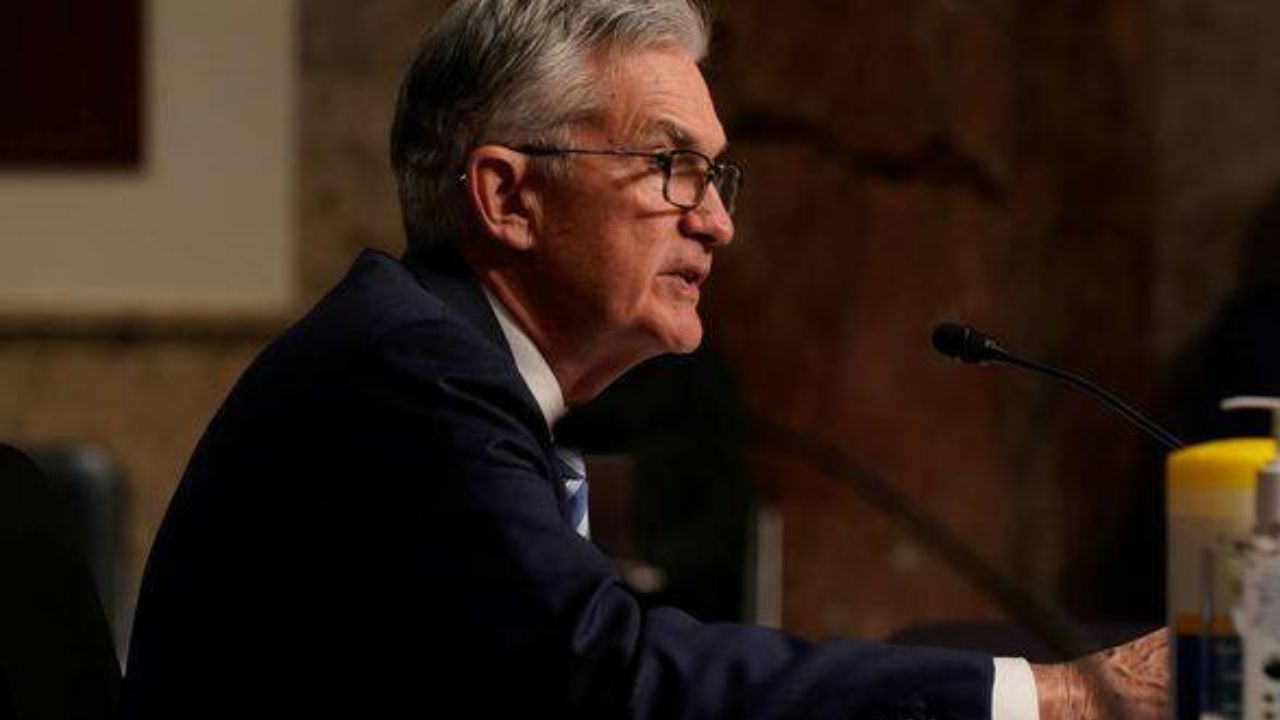

Fed Chair’s Response and Political Pressures

Fed Chair Jerome Powell faces scrutiny during the post-meeting press conference, where he is expected to provide insights into the policy statement and address concerns about the timing of rate cuts.

Political pressures add another layer of complexity, with some lawmakers advocating for rate reductions to mitigate risks to economic expansion, particularly in the housing market.

As the Fed grapples with inflation dynamics and economic outlook, differing interpretations of recent data underscore the challenges of forecasting and policy formulation.

While some economists foresee persistent inflationary pressures, others anticipate a slowdown in economic growth and hiring, further complicating the Fed’s decision-making process.