Key Insights:

- Bitcoin holds a $74.8K neckline in a parabolic pattern structure.

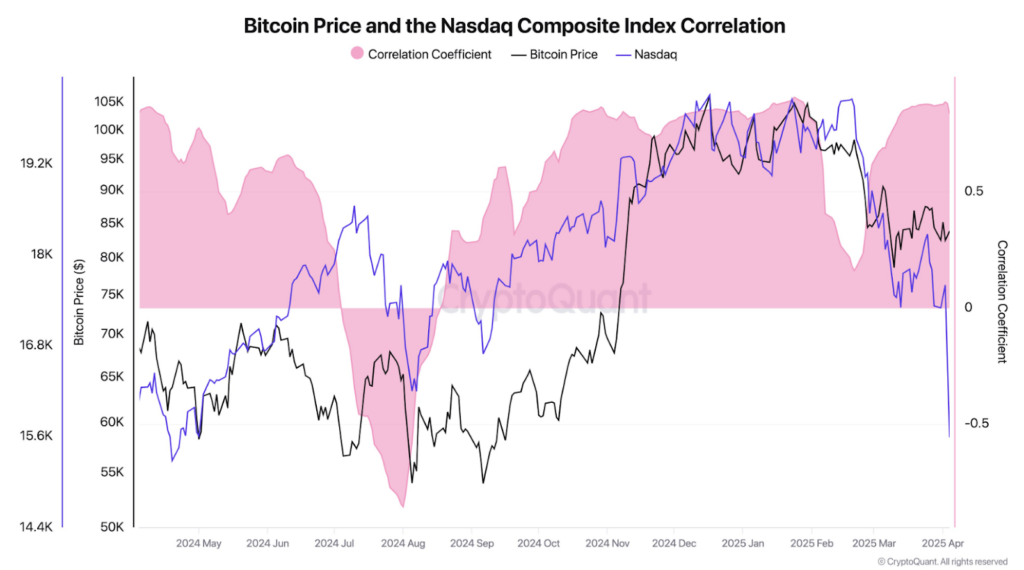

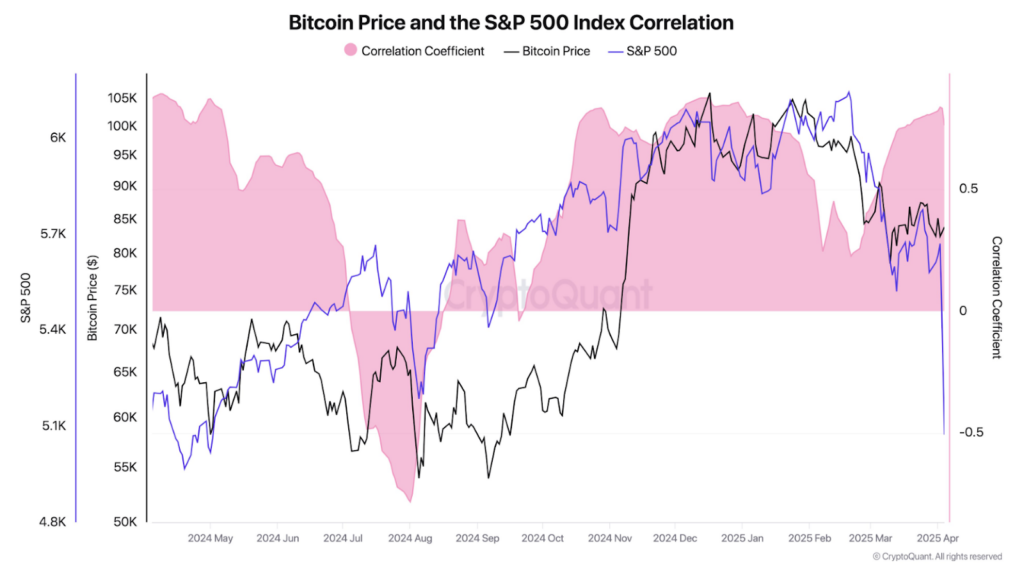

- Correlation with the Nasdaq and S&P 500 remains near 0.8.

- BTC price mirrors equity moves amid recent tech market pullback.

Bitcoin remained in sync with the U.S. stock market. Recently, CryptoQuant’s data revealed that BTC has maintained a strong correlation with the S&P 500 and Nasdaq Composite Index.

This trend has persisted since late 2024, highlighting its connection to traditional markets. Both indices have a high degree of connection, and the correlation coefficient is around 0.8.

The OG token followed a similar move when the S&P 500 started recovering in late September 2024. Their paths were aligned as both assets climbed into early 2025.

Also, Bitcoin and the indices fell almost in tandem, even during the recent correction. This pattern has persisted for several months, showing consistency. Bitcoin continues to respond to overarching risk trends in the financial markets.

In particular, the Nasdaq has had a more consistent relationship with Bitcoin. Since mid-August 2024, the correlation has remained close to 0.8.

Bitcoin mirrored the move when the Nasdaq rose sharply through the final quarter 2024. Both assets peaked around the same time. Conversely, BTC also corrected when the Nasdaq corrected. This implied that Bitcoin behaved more like a tech asset in the current market.

Bitcoin Retests $74,800 Support Amid Long-Term Bullish Setup

The current pullback in Bitcoin has tested a significant support level at $74,800. This is the neckline of a long-term inverse head and shoulders (iH&S) pattern.

Gert van Lagen, a technical analyst, stated that this neckline has been a central part of BTC’s ongoing four-year structure. Bitcoin bounced from this zone recently, and the trend is still intact.

The iH&S pattern started forming in 2021 and has continued through several market phases. It shows four clear bases for the step-by-step development of a parabolic trend.

Bitcoin recently broke out through the Base 4 region, pulled back, and retested the neckline as support. This structure supported the ongoing bull trend’s momentum.

It remained intact as long as Bitcoin avoided closing below this critical level on the weekly chart. The parabolic curve and the wave counts indicated the possibility of upward movement if the support is held.

Measured moves and historical patterns indicated that the projected price path could hit near $300,000. However, the strength of the setup relies on Bitcoin keeping the neckline in the near term.

Equity Market Volatility is Reflected in Short-Term Moves

After a strong run from its 2024 lows, the price of Bitcoin topped nearly $100,000 in early 2025. Since then, it has corrected to just under $80,000.

This correction coincided with similar declines in the S&P 500 and Nasdaq. This further validated the fact that Bitcoin is acting like a high-risk asset.

For the past 12 months, Bitcoin fell when U.S. stocks fell. When stocks rallied, Bitcoin followed. This relationship demonstrates how macroeconomic conditions like interest rate expectations and investor sentiment drive crypto prices.

BTC is no longer an isolated digital asset but part of a broader market cycle. The charts indicate that it is often during large market moves when Bitcoin and stock indices are highly correlated.

Bitcoin and both indices almost moved in lockstep from October 2024 to February 2025. The connection between price trends was, in fact, visible, even when the correlation dipped briefly.

This pattern indicates that Bitcoin will probably continue reacting to changes in the wider financial markets.

Bitcoin Price Outlook Depends on Support and Market Direction

If Bitcoin can hold above the $74,800 level, its next move will depend on it. This zone has been the technical foundation of the current trend.

If the price is above it, the bullish structure that started in 2022 remains intact. A level failure could lead to a deeper correction or delay further upside moves.

Investors are closely monitoring equity markets and Bitcoin for stabilization cues. Both the S&P 500 and Nasdaq are currently undergoing a correction phase.

Bitcoin’s short-term trajectory remains closely linked to the performance of stock markets. Its strong correlation with indices like the S&P 500 and Nasdaq underscores this connection.

Bitcoin could rebound if stock prices recover. If equities are sold under pressure, Bitcoin could also remain under pressure.