Key Insights:

- Nvidia stock surged as AI equities outpaced crypto token performance.

- AI crypto tokens dropped sharply, facing liquidity and adoption concerns.

- Bitcoin dominance climbed, capturing nearly 66% of crypto market capitalization.

Market data shows that Nvidia stock (NASDAQ: NVDA) hit a new all-time high, closing on June 27 at 157.75, a 1.72% increase on the day. This share has reached its highest mark in intra-day trading at $158.71 and is a radical upswing from the April low, which stood at $93.31.

This is after experiencing a cataclysmic 37.6% crash in Q1 2025 because of intense competition over interminable prices supplied by the Chinese DeepSeek and the pressure caused by the tariffs introduced by the Trump administration’s policy of Liberation Day.

In spite of the geopolitical turbulence earlier this year, the statement by CEO Jensen Huang at Nvidia’s annual shareholder meeting was bullish.

Basing his argument on the fact that AI and robotics are characterized as “multitrillion-dollar growth opportunities,” the optimism expressed by Huang seems to have translated into investor confidence in the semiconductor market in general.

Philadelphia Semiconductor Index (SOX), which monitors the movements of the top semiconductor shares, has been performing similarly to that of Nvidia, having risen by almost 20 percent in the last month.

The fundamentals of the market also cement Nvidia’s position. Currently, the company has a market cap of 3.85 trillion, 52 52-week high of 158.71, and a low of 86.63.

The 1-day chart depicts a steep morning pump and a gradual consolidation of the price around the points of $157, which shows that there is strong support on the higher end of the pricing.

AI Tokens Falter Despite AI Equity Rally Amid the Nvidia Stock Move

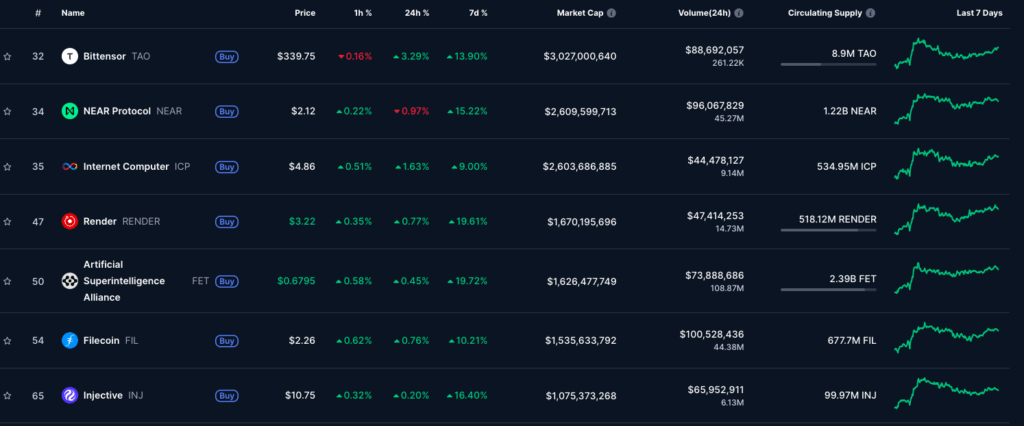

In sharp contrast to the restoration of Nvidia stock, AI-oriented cryptocurrency tokens face an impressive downturn. Statistics demonstrate the fact that such tokens as the Bittensor (TAO), Fetch.ai (FET), Render (RNDR), Near Protocol (NEAR), or Worldcoin (WLD) have registered relatively small gains in today’s session.

This discontinuity is a significant detachment between equity-based and blockchain-based AI discourse.

Nvidia continues to dominate AI infrastructure technology. The chip giant is way ahead of decentralized AI tokens in terms of either adoption potential or revenue generation capacity.

It is based on stories and visions and not actual revenue generation, as has been observed by Ram Ahluwalia, the CEO of Lumida Wealth.

One issue that he reveals comes to mind: the product market is a fit that will not go on these tokens successfully.

A notable figure is Interactive Strength (NASDAQ: TRNR), which said in early June that it would convert its crypto treasury to hold FET tokens.

Since then, TRNR stocks have crashed by 53.37%, with FET garnering losses by 19.18%, which increases losses to the stakeholder in both assets.

Chart Spotlight: Bitcoin’s Market Domination Surges

Away from Nvidia stock, the other sphere of disagreement is the greater market makeup of crypto. The current yCharts data revealed that Bitcoin’s dominance has increased dramatically, up to 65.91% of the total crypto market cap ($2.13 trillion of the total $3.39 trillion).

This strengthened control is representative of a capital flight out of altcoins, such as AI-related tokens, into Bitcoin, which is usually considered a safer trade in volatile activities.

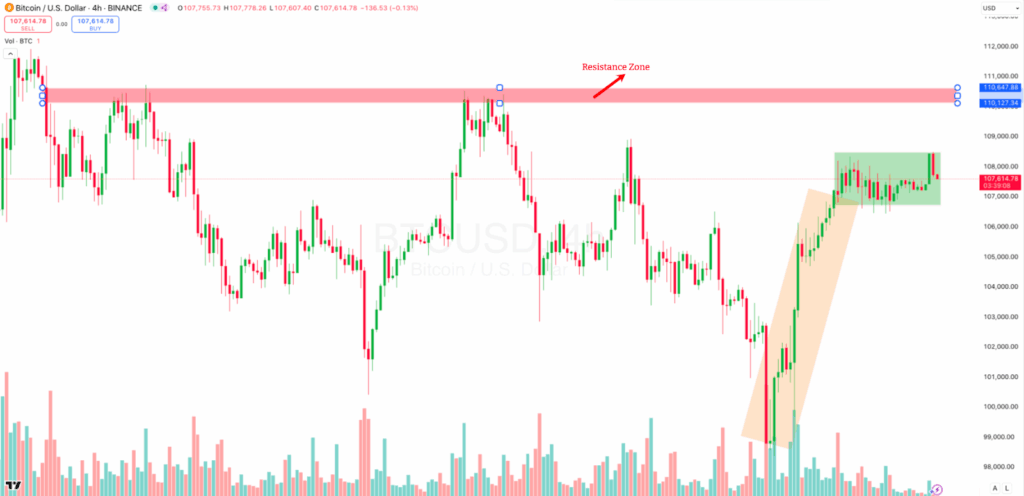

This is reassured by a 4-hour Bitcoin chart on Binance. The chart indicates that the current price of BTC/USD is at $107,614.78, and the coin is consolidating around the price top after a recent rally.

The sharp rise that started at around the level of 98,000 has resulted in a green rectangular consolidation zone that goes all the way up to 107,000 to 108,000.

Nevertheless, Bitcoin has been hitting a strong resistance area of between 110,127 and 110,647, over which there are rejections on late sunsets and early June.

Analysis of volume reveals that the buying force increased initially in the first breakdown, but it has now leveled off, suggesting a reprieve or a correction.

The next sign of a break above the $110K resistance area would necessitate a new supply of volumes and bullishness.