Key Insights:

- Notcoin price could soar by 100% if it holds above the $0.00168 support level.

- Additionally, Notcoin has reduced its circulating supply by 3%, which appears to be another bullish catalyst for the asset.

Telegram-linked Notcoin price has plummeted significantly over the past few weeks and has now reached a crucial support level at $0.001680.

The daily chart reveals that this level has previously acted as strong support and could trigger a potential price reversal.

Notcoin (NOT) Current Price Momentum

Historically, since the launch of the NOT token, the price has reached this level nearly three times, and each time it recorded a reversal, raising hopes for a potential rebound this time as well.

At press time, the Notcoin price was struggling to gain momentum and is currently trading near $0.0018, reflecting a modest decline of 0.26% in the past 24 hours.

During the same period, investor and trader participation has also decreased, leading to a 7% drop in recorded trading volume.

This drop in trading volume, along with the price decline, suggests weak downside momentum, which could soon shift if buying pressure increases or if the bulls become active.

Are Investors Buying Notcoin?

Given the current market sentiment, investors and traders appear to be seizing the dip, as they have been observed strongly accumulating and betting on long positions, according to the on-chain analytics tool CoinGlass.

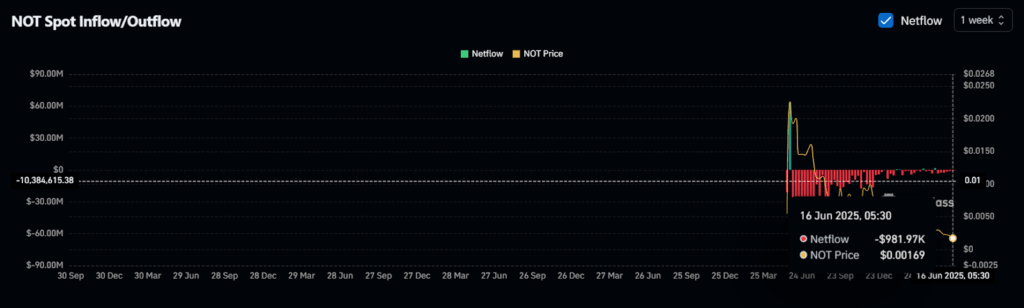

Data from the on-chain metric Spot Inflow/Outflow reveals that exchanges across the crypto landscape have recorded an outflow of $981K worth of NOT tokens.

This substantial outflow, recorded over the past week, indicates growing investor interest and suggests potential accumulation, which could increase buying pressure and further reduce selling pressure in the coming days.

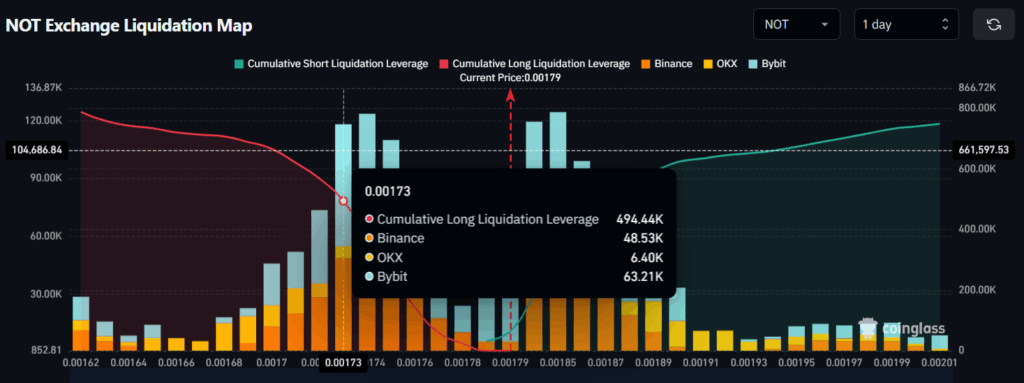

In addition to investors, traders also seem to be following the same trend, as they are over-leveraged at $0.00173 on the lower side (support) and $0.00185 on the upper side (resistance).

At these levels, traders have built $494K worth of long positions and $309K worth of short positions, clearly indicating that long positions are dominating.

When combining these metrics, it appears that the bulls are back and are starting to push the asset’s price to higher levels.

Notcoin Price Action and Key Technical Levels

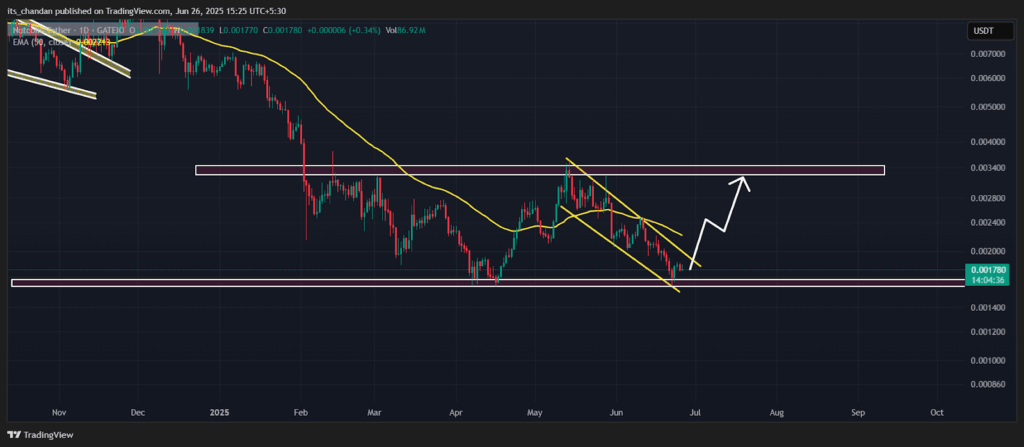

According to expert technical analysis, Notcoin has been trading within a descending channel pattern between the lower and upper boundaries for the past one and a half months. With the recent price dip, the asset has now reached the lower boundary of the pattern and a key support level at $0.00168.

The daily chart reveals that this level has a strong history of price reversals, and whenever Notcoin’s price has reached this level, it has shown upside momentum, something experts are currently anticipating.

Based on recent price action and historical patterns, if sentiment shifts and Notcoin’s price holds above the key support level, there is a strong possibility that the asset could experience a price reversal and may see a price jump of 100% in the future.

On the other hand, if Notcoin’s price falls below the key support level, it could pave the way for a significant price drop, and a new low may be witnessed in the near future.

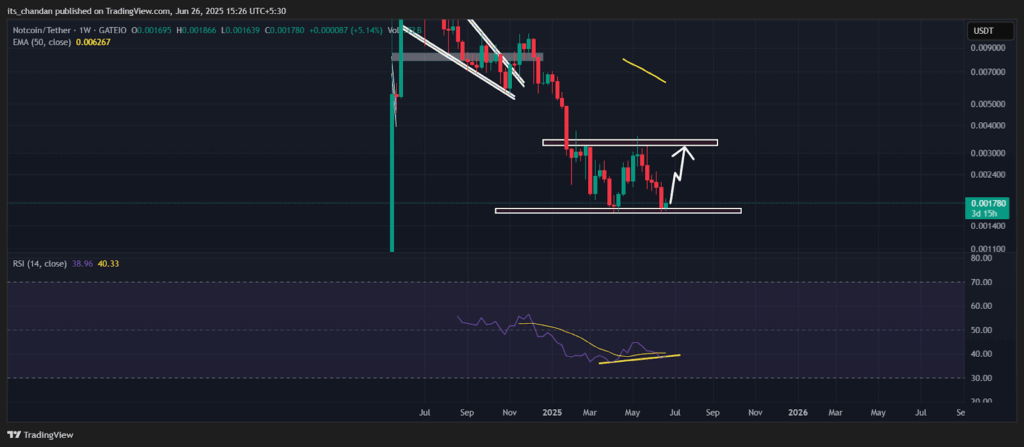

In addition to the daily chart analysis, on the weekly timeframe, the asset appears to be forming a bullish double-bottom pattern. A bullish divergence is also visible on the weekly chart, suggesting a potential price reversal in the coming days.

In addition to these bullish developments by investors and recent price action, Notcoin recently made a post on X (formerly Twitter) that garnered significant attention from the crypto community. In the post, Notcoin stated, “NOT circulating supply has been reduced by 3% after a recent unintended burn, jfyi.”

This 3% reduction in circulating supply could help propel the asset once market sentiment improves.