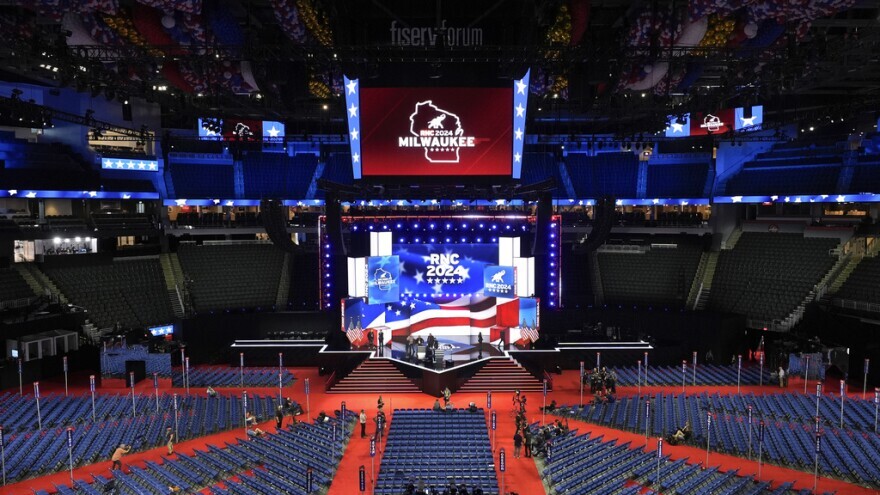

At the Republican National Convention in Milwaukee, health care topics were notably absent from prime-time speeches, despite the substantial role health care plays in the federal budget and the U.S. economy. This lack of focus contrasts with the 2016 convention, where repealing the Affordable Care Act and overturning Roe v. Wade were prominent themes.

The shift reflects political calculations, as the GOP’s failed attempt to repeal Obamacare in 2017 led to a significant loss in the 2018 elections, and with broad public support for the ACA and widespread opposition to a national abortion ban, these issues have become politically risky for Republicans.

Instead of addressing health care in detail, the GOP’s 2024 platform, largely shaped by Trump’s views, includes a pledge to protect Social Security and Medicare without proposing new health care initiatives.

Trump’s acceptance speech promised to protect Medicare and find cures for diseases like Alzheimer’s and cancer but lacked specific health care proposals. This aligns with the GOP’s strategy of focusing on issues like inflation, crime, and immigration, which are seen as more advantageous for the party according to polling data.

Immigration, a prominent topic at the convention, intersected with health issues such as the opioid crisis and public insurance. Speakers, including Rep. Marjorie Taylor Greene and Rep. Monica De La Cruz, linked immigration to drug overdoses and alleged misuse of government benefits by unauthorized immigrants.

However, these claims are often disputed by data showing that most fentanyl enters through legal ports and most traffickers are U.S. citizens. De La Cruz’s assertion that the Biden administration cut Medicare Advantage was also misleading, as federal spending on these plans remains higher than on traditional Medicare.

The GOP platform reflects a broader trend of avoiding detailed health care discussions. It promises to expand veterans’ health care options and access to affordable health care and prescription drugs but lacks specifics.

The platform’s stance on abortion has also shifted, omitting the long-standing call for federal limits and instead suggesting the 14th Amendment prohibits abortion while supporting state-level decisions on the issue.

This marks a significant departure from the 2016 platform, which included multiple references to abortion and comprehensive health care policy proposals.

During the convention, a video surfaced of a conversation between Trump and independent candidate Robert F. Kennedy Jr., highlighting Trump’s alignment with vaccine skepticism. Despite his administration’s efforts in developing COVID-19 vaccines, Trump’s comments reflected a growing vaccine skepticism within the Republican Party.

KFF polling indicates low confidence among Republicans in the safety of COVID-19 vaccines and a preference for parental discretion in vaccinating children against diseases like measles, mumps, and rubella, even at the risk of public health.