Key Insights:

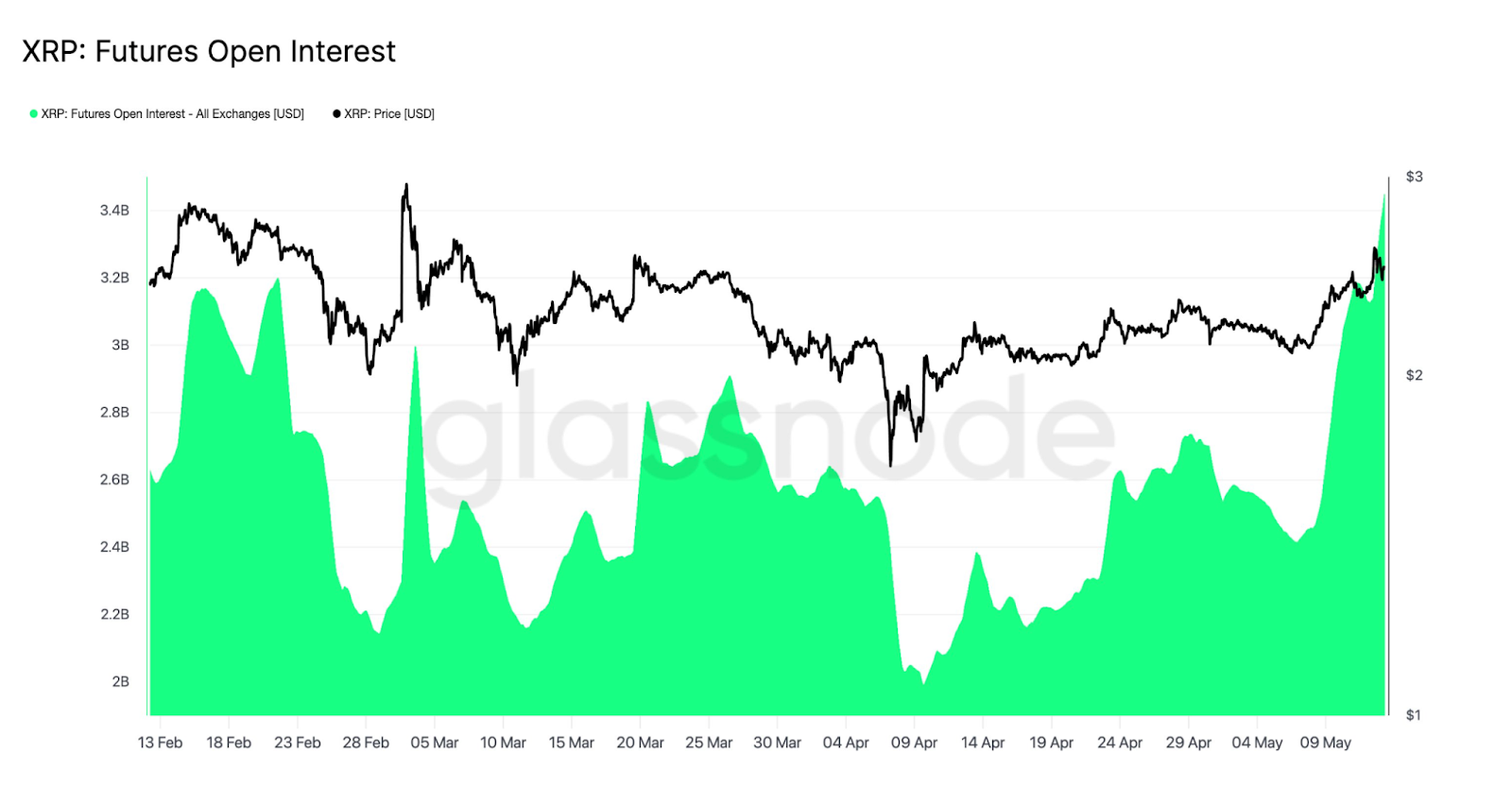

- XRP futures open interest jumped from $2.42B to $3.42B in just seven days.

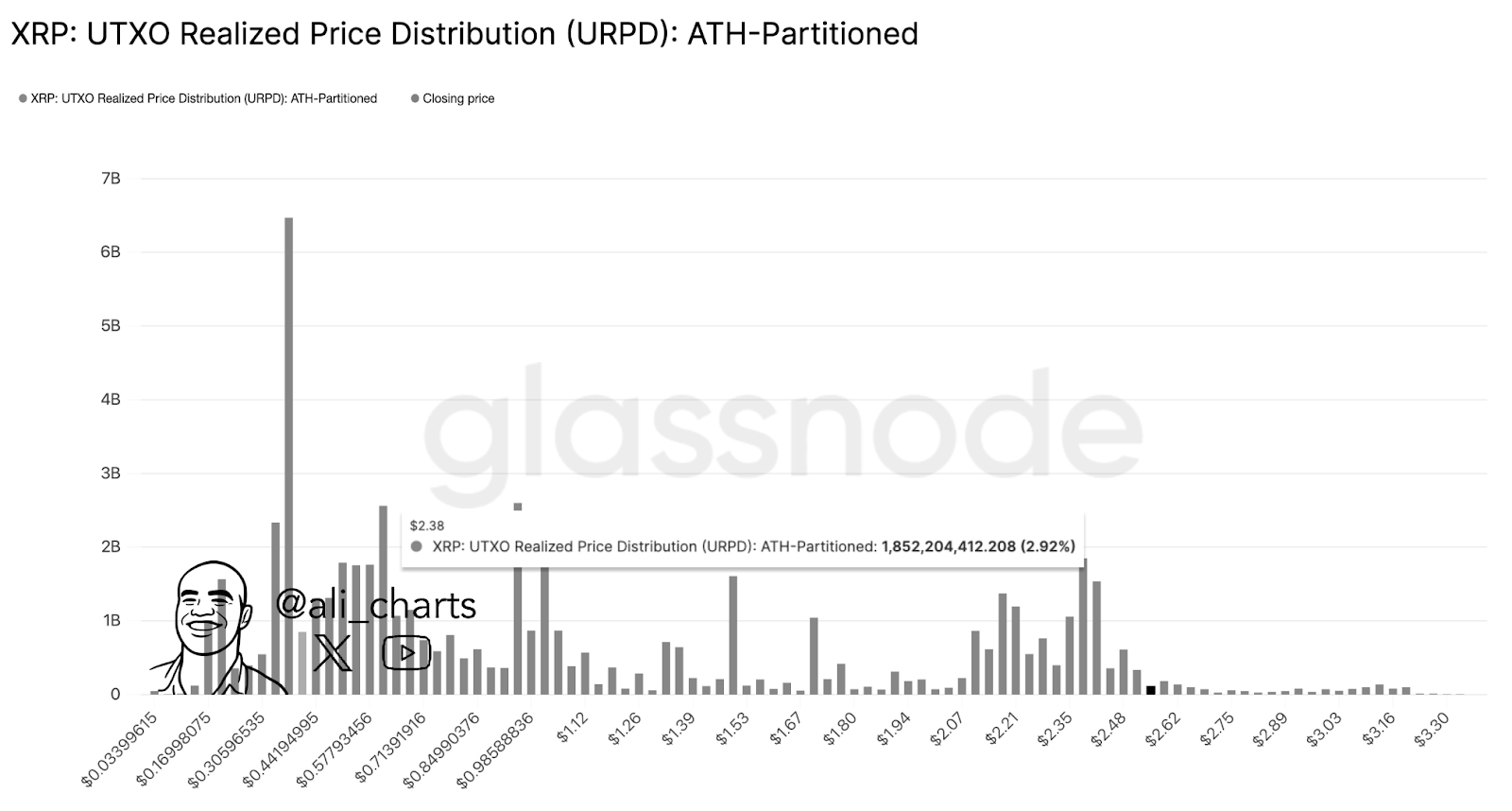

- Key support sits at $2.38 with no major resistance ahead on-chain.

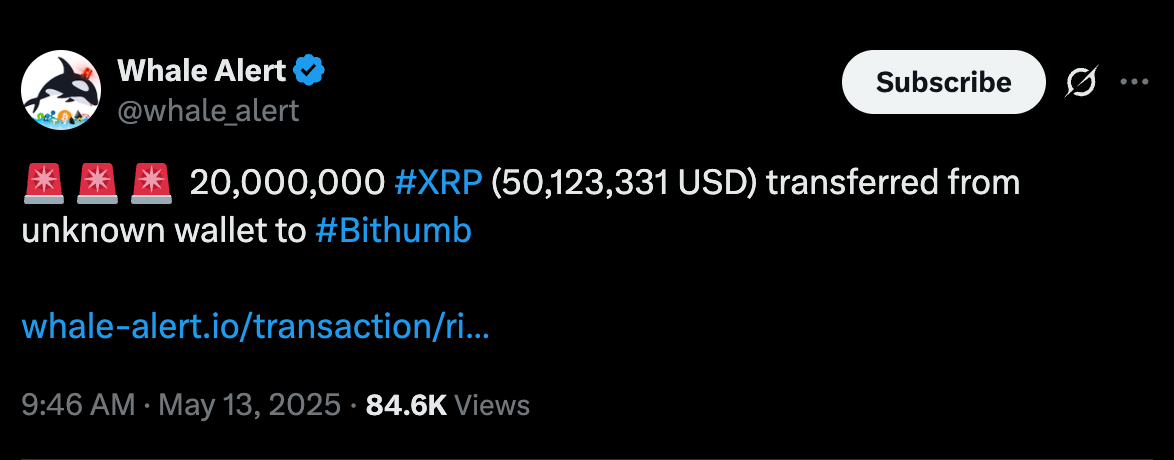

- 20M XRP ($50M) transferred to Bithumb, raising short-term liquidity focus.

XRP futures open interest grew by 41.6% in a week as the price broke out of a falling wedge. Since there is little resistance and $2.38 is a support, XRP maintains a bullish outlook. Moreover, a notable 20M XRP transfer to Bithumb highlights rising liquidity, bringing the $5 level into focus.

Open Interest Climbs Over $1 Billion in One Week

The futures data points to a quick increase in interest from speculators in XRP. Glassnode reports that XRP’s futures open interest rose from $2.42 billion to $3.42 billion in a single week. This 41.6% rise shows a sharp rise in leveraged positions on exchanges.

At the same time, XRP’s price went up from $2.14 to $2.48. Higher prices and more open interest show that more traders are involved. It usually means traders anticipate the price will move even further.

Moreover, XRP has moved past a falling wedge pattern, a technical setup that is usually seen as bullish. The breakout caused the token to go past resistance lines and approach the $2.50 mark.

Current on-chain data shows that XRP does not face any big resistance clusters soon. Support is likely to be found at $2.38, according to the realized price distribution.

Additionally, 2.92% of the XRP supply, which is 1.85 billion tokens, was most recently moved at this level, so traders may try to defend it if prices fall.

Many technical analysts believe the price could reach $5 in the short term. It fits with the current positive trend after the wedge breakout. The pattern will stay in place as long as the price does not drop below the important support zones.

Whale Transfer Raises Liquidity Watch Around Bithumb

Meanwhile, 20 million XRP, worth more than $50 million, were moved to Bithumb from a wallet. According to Whale Alert the transaction came from an unidentified wallet.

If the tokens go to a centralised exchange, this kind of transfer often raises the amount of tokens available for sale. If the tokens are sold, it may cause the price to drop for a short time.

However, If the tokens are kept or used for staking and liquidity, the market may not have a negative reaction.

Higher trading activity on exchanges such as Bithumb in South Korea has been linked to more retail buying. The transfer might show that regional traders are becoming more active, which can help trading volume during consolidations.

Bullish Setup Builds With Sentiment Turning Positive

Meanwhile, a confirmed break above the falling wedge has led to more bullish predictions. CryptoCove predicts the price could hit $5, but this would depend on ongoing buying and a stable market.

Since early April, the price has kept making higher lows, and volume has stayed high. If open interest keeps going up fast, the possibility of price swings becomes greater. On the other hand, a fast change in sentiment might cause many traders to be liquidated.

At the same time, traders are more confident because XRP’s technical chart and on-chain structure look good. The trend can continue to grow because of the leverage and support levels below.