Key Insights:

- ONDO crypto has broken out of a falling wedge and is eyeing a potential rally to $1 with strong volume support.

- ONDO price surges above $0.80, targeting $0.95–$1.00 as breakout confirms bullish trend.

- Increased volume and rising open interest suggest growing market confidence in ONDO’s upward momentum.

The ONDO crypto recently broke from a falling wedge pattern, sparking speculation about a potential rally toward the $1 mark. The price action has been following a consistent downtrend, yet signs of a reversal are now apparent. Analysts are closely watching for confirmation of this bullish breakout, which could drive ONDO’s price higher in the near future.

ONDO Crypto Technical Breakout from Falling Wedge

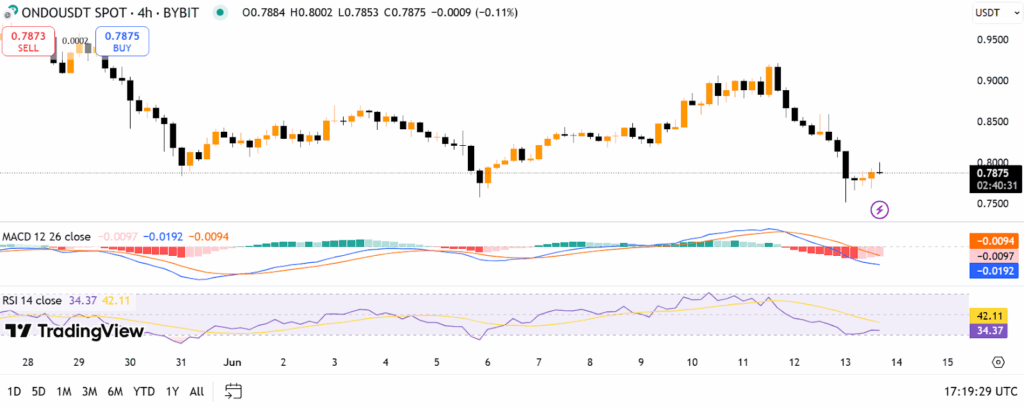

ONDO crypto’s price has recently managed to break out of a falling wedge pattern on the 4-hour chart. A falling wedge typically signals a reversal or continuation of the trend after a period of consolidation.

As the price action compressed within this wedge, the breakout above the upper trendline indicates that the previous downtrend might be coming to an end.

The breakout from the falling wedge occurred around the $0.85 level. This level had acted as a significant resistance point during the consolidation phase.

Breaking through this level shows that the bullish momentum is gaining strength. Furthermore, the breakout is accompanied by an increase in trading volume, which adds to the validation of the move.

A falling wedge pattern often indicates that buyers are starting to gain control, with the potential for further upside. The target for such a breakout usually involves projecting the height of the wedge from the breakout point. In this case, traders are now looking toward the $1 level as a key target. However, further confirmation is needed before considering it a certainty.

Volume and Market Sentiment Impacting ONDO/USD Price

The current CoinMarketCap statistics indicate a decrease of ONDO crypto’s price by 7.23%, which is a bearish indicator. ONDO is currently trading at $0.7903, having suffered a deterioration since $0.8476, indicating the market’s negative perception. The 24-hour trading volume, however, spiked up by 58.12 percent to $238.6 million. This increase in volume is expected to lead to greater market activity, profit-taking, or liquidation in the decline.

The increase in the open interest implies an increasing market involvement, indicating that traders are getting more engaged in the price trend of ONDO. Even though the increase in volume is an indication of an increase in activity, we must be careful because the volume increase was seen in a downward price move, and it may represent profit-taking.

However, if ONDO does not manage to regain the $0.80 0.85 zone, it may proceed with its decline to the $0.75 area. On the other hand, the increased trading could also be a sign of possible support at the $0.78 -$0.79 area, and should the support hold, ONDO might turn around and change its trend

ONDO Crypto Price Targets and Trading Strategy

According to TradingView, ONDO is in a neutral-to-bearish cycle, and the price movement is ranging between $0.78 and $0.80.

The price is currently at $0.7875, with weak momentum since the asset has been declining since June 12, falling off a high of $0.80. The MACD remains in a bearish region, illustrating minimal downside momentum.

At the same time, the RSI is close to 34.37, indicating almost a neutral situation, and there is no evident indication of oversold or overbought.

The recent support at $0.78 -$0.79 has held. However, should ONDO be unable to trade above these levels, we may see a further drop to the $0.75 area. On the upside, we have bullish resistance at $0.80.

A move above this area would be a positive sign of a short-term bullish reversal with targets at around $0.82- $0.84. Traders must remain conservative and look out for confirmation signs such as a MACD crossover or RSI reversal.

As the volume indicates severe market involvement, the price of ONDO can be supported to reach $1 in case the bullish trend persists.

A close above $0.80 would signal a potential breakout. However, traders must watch the levels and resistances and observe correct risk management with stop-losses in the $0.78 area.