Key Insights:

- US Bitcoin ETFs recorded a single-day inflow of $381.3 Million on April 21, the highest in nearly two months.

- The inflow occurred as Bitcoin briefly surpassed $91,000 before stabilizing around the $90,000 level.

- ARK 21Shares Bitcoin ETF led the surge with $116.1 Million, followed by Fidelity Wise Origin Bitcoin Fund with $87.6 Million.

On April 21, the Bitcoin ETF in the US recorded its highest single-day inflow in nearly two months.

Deviation from weekly data showed decreasing US market participation despite an unforeseen increase in Bitcoin ETF inflows during that day.

A significant positive uptick occurred on that day, while the extended US performance stayed in negative territory.

The $381.3 Million flowed in as the highest level since Bitcoin hit its previous high in late January.

During market activity, Bitcoin tested and surpassed $91,000 until it stabilized near $90,000.

Several significant ETF providers participated in the net inflow, demonstrating that investors returned their interest to Bitcoin-based products.

The US market witnessed a general $71 Million outflow throughout the week, even though April 21 brought substantial gains to investors.

The large inflow broke the usual pattern of the week instead of reversing previous trends. Digital asset investment worldwide recorded a minor growth of $6 Million during the analyzed period.

Bitcoin ETF Inflows Boost ARKB FBTC

ARK 21Shares Bitcoin ETF (ARKB) secured the largest inflow share, attracting $116.1 Million on April 21.

FBTC announced its entrance into the market after ARK 21Shares Bitcoin ETF (ARKB) by bagging $87.6 Million in investments.

The two funds received over 50% of all the money that had entered crypto exchange markets throughout the day.

A surge of investor demand occurred at the same moment Bitcoin regained its position at $88,000 before reaching an elevated peak above $91,000.

Financial markets agreed with digital asset participants, who used price movements as opportunities to enter the market.

Action during the day revealed a direct link between price increases and fund streaming activities.

ARKB and FBTC thrived by leading the market while flows pulled in the opposite direction throughout the week.

During their recent performance, the stocks displayed increasing self-assurance about their selected products.

Moreover, ARKB and FBTC strengthened their positions as dominant players in the Bitcoin ETF space.

IBIT Maintains Lead Despite Lower Inflows

The total inflows for Grayscale’s Bitcoin Trust (GBTC) combined with Bitcoin Mini Trust ETF (BTC) came to $69.1 Million.

Recent inflows proved a turning point for Grayscale following its transition to an ETF structure, which caused a period of outflows.

Insights from these inflows indicate that market participants might be changing their reaction to Grayscale’s product line.

BlackRock’s iShares Bitcoin Trust ETF (IBIT) received $41.6 Million in new investments, although it fell behind its previous investor levels.

The observed financial movement amounted to significant figures, although slightly less than weekend totals.

Assets under management leadership of IBIT remained unchanged as the fund held on to its dominant position.

The day’s asset manager activities confirmed that the market still paid attention to their movements. The funds produced varied results, yet substantial support for the day’s progress.

These well-established financial institutions contributed to maintaining the general increase in ETF investments.

HODL and EZBC Add Modest Gains

HODL and EZBC funding sources deposited $11.7 Million and $10.1 Million into accounting entities on April 21, respectively.

Even though the figures were small, they extended the breadth of total incoming funds. Numerous positive signs verified that the inflow surge encompassed various parts of business activity that day.

The overall increase in money flow occurred simultaneously with diminishing weekly movement in US cryptocurrency markets.

The Bitcoin products managed by CoinShares experienced a small overall outflow of approximately $6 Million throughout the week.

Short Bitcoin products sustained their decline by experiencing a $1.2 Million loss in withdrawals.

For seven consecutive weeks, the investments within short positions relentlessly withdrew funds, leading to a 40% depletion of total assets.

This market trend made the decreasing interest in betting against Bitcoin evident. ETF investors showed a short-lived tendency for inflows on April 21 despite other market changes.

Europe Leads Digital Asset Inflows Surge

The European market expressed higher acceptance of digital assets than the US during this same period.

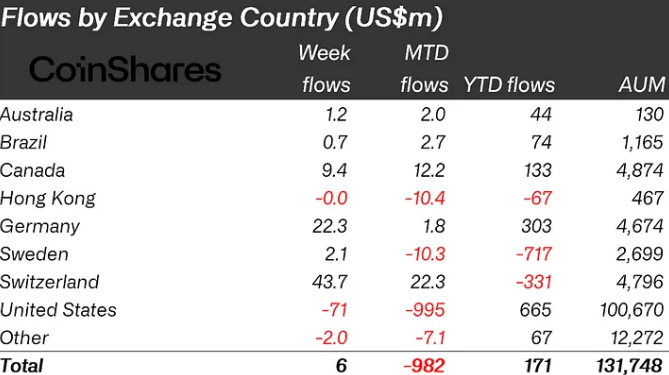

During the same period, Switzerland received $43.7 million in inflows, followed by Germany with $22.3 Million.

Regional strength appeared through Canada’s net inflow of $9.4 Million during this period.

Compared to expectations, weaker economic performance from 21 to 27 July led to market fluctuations based on CoinShares’ tracking data.

A $146 Million deficit occurred during mid-week when investors withdrew funds from worldwide digital asset funds as a result of the retail sales data.

Macroeconomic indicators triggered moving responses, which caused these fluctuations in the capital flows.