Key Insights:

- The SUI ETF filing signals institutional interest in Sui’s growth.

- Sui’s DeFi volume surged, reaching $13.5 billion in 30 days.

- Approval of the SUI ETF could drive institutional capital into Sui.

Sui might be making headways towards traditional financial (TradFi) markets with the recent SUI ETF filing by 21Shares with Nasdaq. With its ongoing development, the volumes of DeFi trading transactions and the development of the platform, Sui could be setting up for a bullish long-term.

The SUI ETF Filing: A Game Changer for Sui

This ETF filed on the 23rd of May 2025 by the SEC tracks the performance of the Sui token. In case of its approval, such an ETF will provide traditional investors with access to Sui without the necessity to purchase and store its token itself and expand its applicability and reach.

The SEC examination will last no more than 240 days after which a decision will be made, and it is projected to be made on January 18, 2026. Such an approval would put Sui in a small pool of altcoins that have an ETF and could provide a serious boost to the market.

On one hand, the filing of the SUI ETF attracts spotlight, and on the other hand, the Sui blockchain also experiences roaring success in the DeFi segment.

The trading volume of decentralized exchanges (DEXs) on Sui has been incredible — total trading of 13.5 billion over the previous 30 days — indicating an increasing appetite by traders on the Sui ecosystem. This amount of trading growth shows the growing interest in Sui decentralized applications. This may continue to grow with the release of the SUI ETF.

Moreover, the decentralized lending protocol of Sui, SuiLend, also saw a tremendous increase in Total Value Locked (TVL). Within a month, the TVL on SuiLend soared to a whopping half a billion dollars, where a major indicator of the increased liquidity and the intensity of interest among investors are considered.

These DeFi applications have also performed strongly, hence making Sui quite an appealing token, which will certainly blossom further, particularly when the SUI ETF is launched.

Sui’s On-Chain Activity Thriving Amid SUI ETF Anticipation

The rise in the momentum of Sui is also observed in on-chain activity data. The figure of daily active addresses shows that the increase in active users at the end of March and at the beginning of April 2025 was short-lived, as the network was rocked by a 75.3 percent decline in active users by mid-June.

Even though this decline was significant, the number is not too low at 321,000 active addresses currently, so as long as user activity may be subject to changes, Sui still maintains a strong user base.

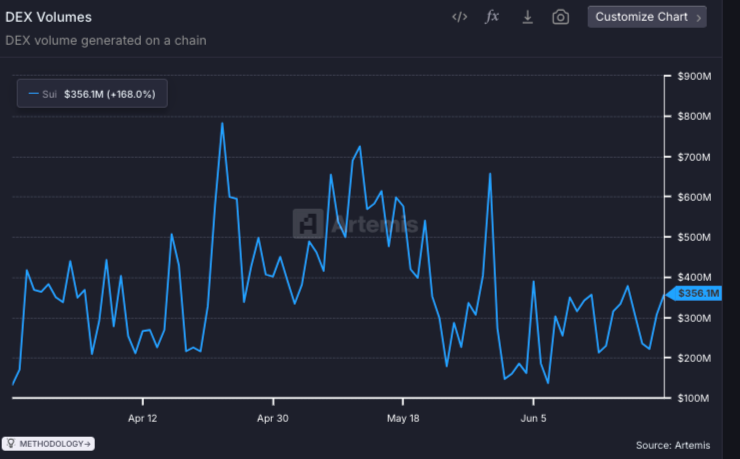

In comparison, the chart on DEX volume provided by Sui indicates a significant growth in trading activities, where the total amount based on the volume it had in the last month reaches $356.1 million.

This is a 168 percent increase in DEX volumes, which means that although active users might be tending to concentrate, more trading activity is being recorded by people who are staying active.

The separation between the number of active traders and the trading volume alludes to the fact that there are fewer active traders who actively execute deals during Sui decentralized exchanges.

Such a strategy can become one of the main driving factors of the further rise of the token, in case the SUI ETF will assist in attracting additional institutional attention.

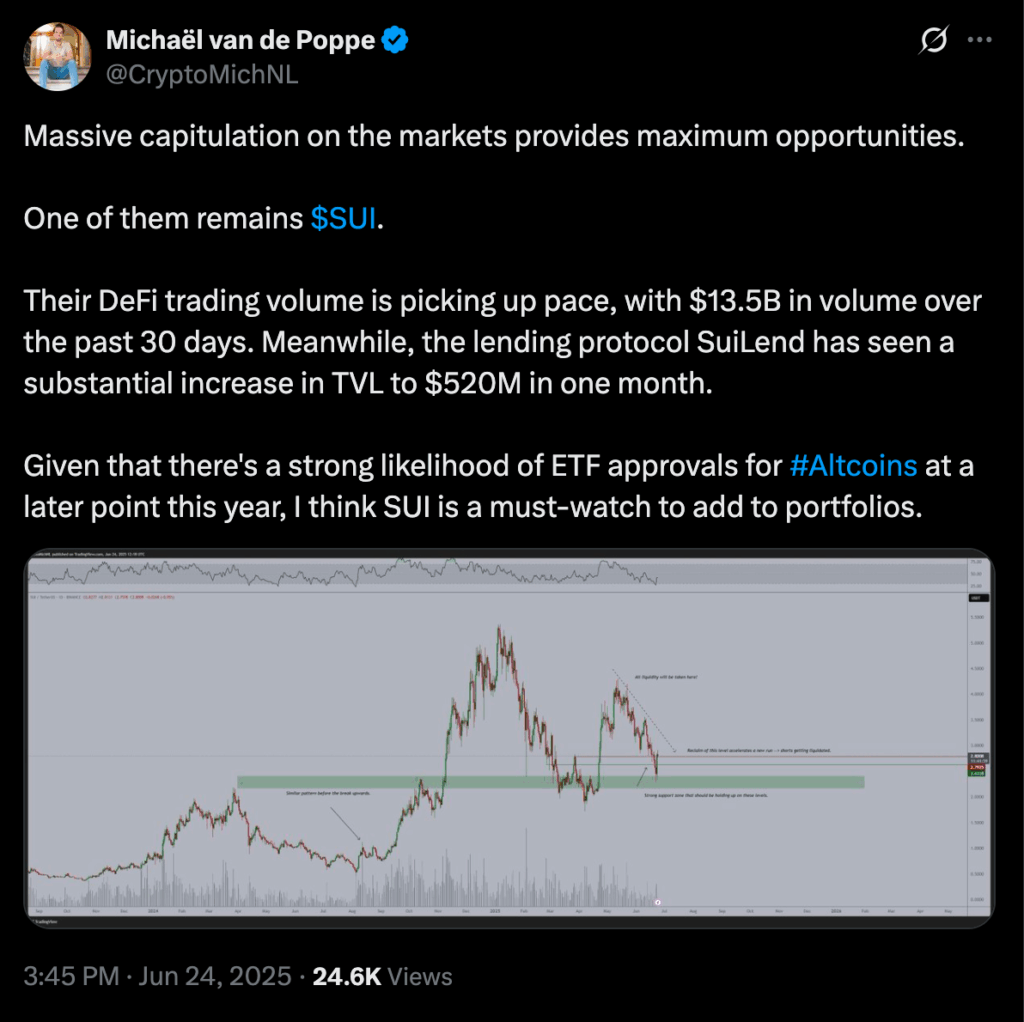

SUI ETF submission is also made when the token is going through a barren price trend. The SUI ETF may however be a major catalyst of changing this trend to see institutional money flowing into the ETF which may see prices increase.

With the SUI ETF being already in motion of the SEC approval, there are opportunities to see the growth of the token to a wider audience interested in an approved cryptocurrency investment instrument.

The existing support of Sui at $2.63-2.80 as seen in the quoted tweet above succeeded in staying. The token touched this area several times when it dipped.

Lastly, the reclamation of this important zone of support would precede a price rally, especially when the SUI ETF is approved and there is an influx of institutional investors.