The turmoil that engulfed three regional banks in March 2023 has inflicted wounds upon hundreds of smaller financial institutions, as the pace of merger activity — a critical avenue for survival — has dwindled to nearly nothing.

Despite the receding memory of last year’s regional banking crisis, one might be tempted to believe that the industry has weathered the storm.

However, the persistent presence of elevated interest rates, which precipitated the downfall of Silicon Valley Bank and its counterparts in 2023, continues to exert its influence.

With the Federal Reserve having raised rates a staggering 11 times up to July, there’s been no indication of a reversal in their stance.

Consequently, the specter of hundreds of billions of dollars in unrealized losses stemming from low-interest bonds and loans looms large over the balance sheets of many banks. This, coupled with potential losses on commercial real estate investments, leaves significant portions of the industry in a precarious position.

According to an analysis by consulting firm Klaros Group, out of approximately 4,000 U.S. banks scrutinized, 282 institutions are grappling with both substantial exposure to commercial real estate and significant unrealized losses from the surge in interest rates.

This potentially toxic combination may compel these lenders to seek fresh capital infusion or explore merger opportunities.

According to Graham, these banks have two main options: either they must secure capital, likely from private equity sources as New York Community Bank did, or they must merge with stronger banks.

This was the route taken by PacWest last year; a smaller rival acquired the California-based lender after experiencing deposit losses during the March upheaval.

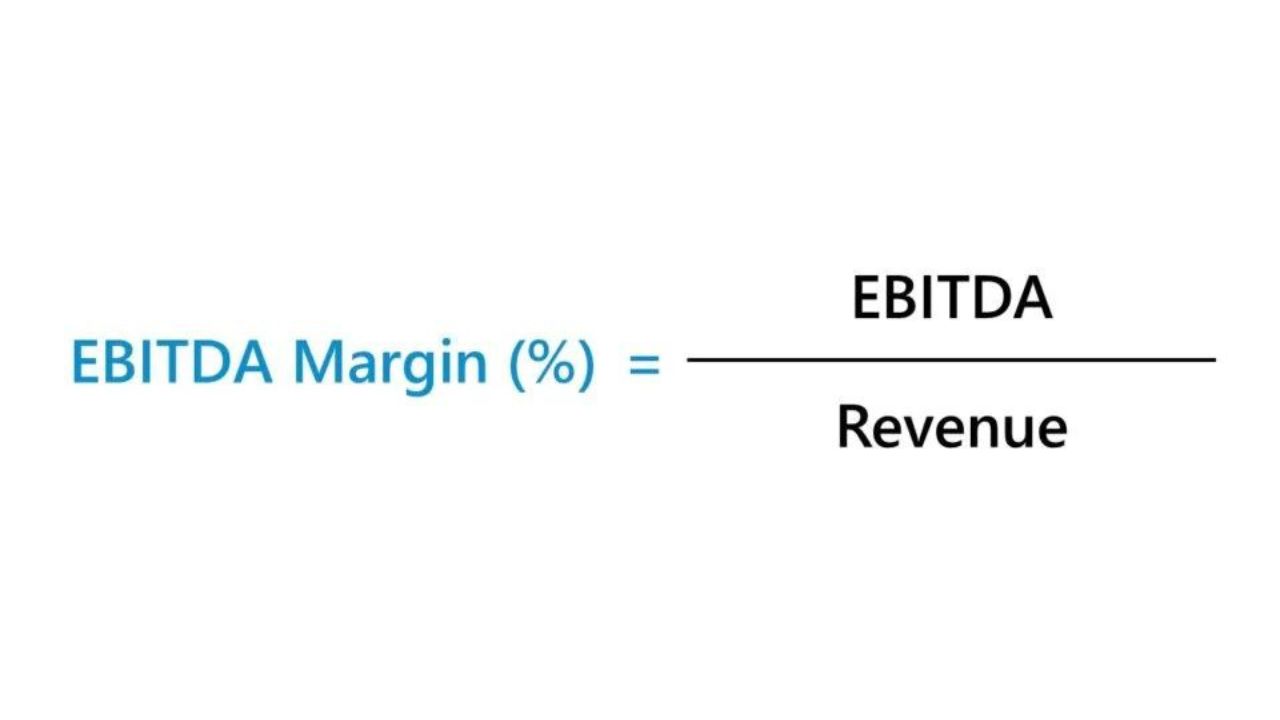

Alternatively, banks can opt to wait as bonds mature and roll off their balance sheets. However, this approach entails years of operating at lower earnings compared to their competitors, effectively functioning as “zombie banks” that fail to support economic growth in their communities.

Moreover, this strategy exposes them to the risk of being overwhelmed by increasing loan losses.

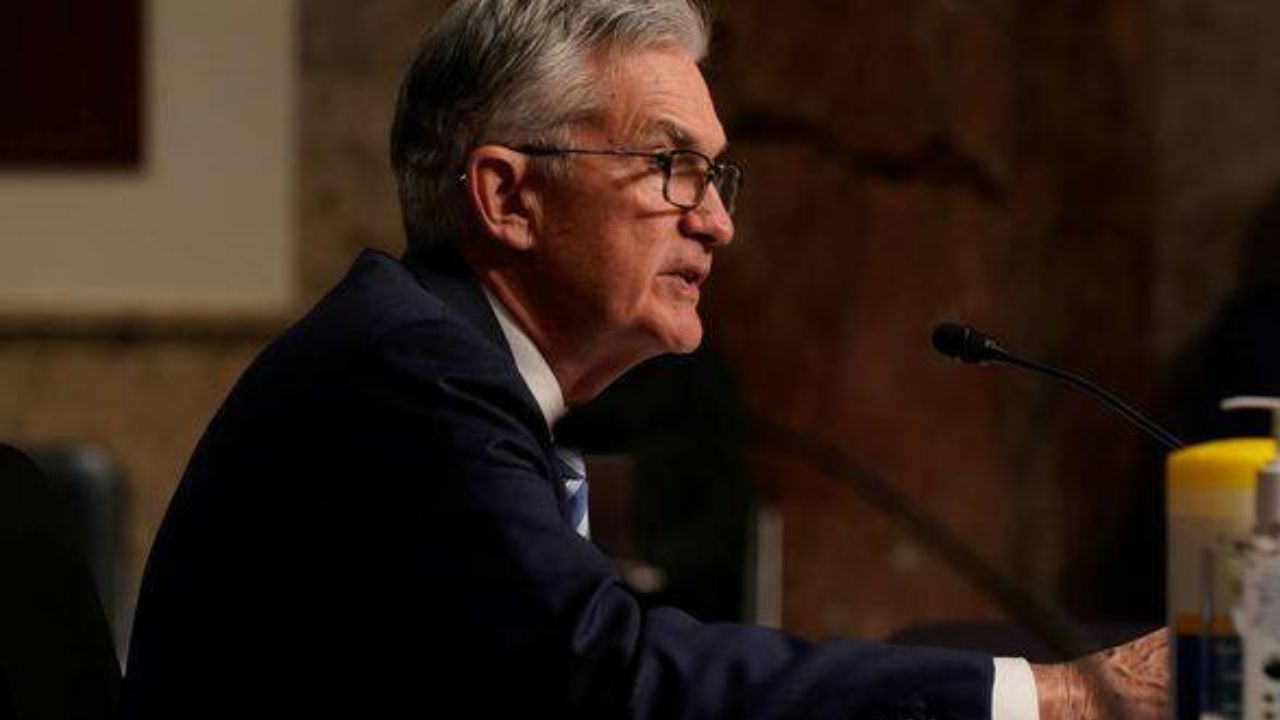

Federal Reserve Chair Jerome Powell recently addressed the looming challenges in the commercial real estate sector, acknowledging that such losses are likely to sink some small and medium-sized banks.

Powell conveyed to lawmakers that this issue will require continued attention for years to come, and he anticipates there will indeed be bank failures. However, he expressed confidence that the situation is manageable with ongoing efforts.

There are further indications of mounting stress among smaller banks. In 2023, Fitch analysts reported that 67 lenders exhibited low levels of liquidity, indicating a decrease in cash or securities that can be quickly sold when necessary, compared to just nine institutions in 2021.

These distressed institutions varied in size, ranging from $90 billion in assets to under $1 billion.

Regulators have also expanded their “Problem Bank List” in the past year, adding more companies with the poorest financial or operational ratings.

Currently, there are 52 lenders on this list, with a combined $66.3 billion in assets, representing an increase of 13 from the previous year, according to the Federal Deposit Insurance Corporation.

While the challenges faced by the banking system persist, Graham maintains that compared to other banking crises he has experienced, the current situation does not entail the insolvency of hundreds of banks, offering a glimmer of optimism amidst the turbulence.

Requirement of Young CEOs

Another factor contributing to the anticipated increase in merger activity is the advancing age of bank executives. According to data from executive search firm Spencer Stuart in 2023, a third of regional bank CEOs are over 65 years old, surpassing the group’s average retirement age.

This demographic trend suggests a potential wave of retirements in the coming years, the firm noted.

“There are many executives who are feeling the strain,” remarked Frank Sorrentino, an investment banker at boutique advisory firm Stephens.

“The banking industry has been challenging, and there are numerous willing sellers eager to engage in transactions, whether that entails an outright sale or a merger.”

Sorrentino played a role in the January merger between FirstSun and HomeStreet, a Seattle-based bank that saw its shares plummet last year following a funding crunch.

He anticipates a surge in merger activity among banks with assets ranging from $3 billion to $20 billion as smaller institutions seek opportunities to scale up.

However, one obstacle to mergers has been the significant markdowns on bonds and loans, which could erode capital for the combined entity in a deal since losses on certain portfolios must be realized during a transaction.

This concern has somewhat abated since late last year as bond yields retreated from 16-year highs.

Taking into account the recovery of bank stocks and the diminishing markdowns, Sorrentino expects increased merger activity this year.

Other industry experts suggest that larger deals are more likely to be announced following the U.S. presidential election, which could bring about a new cohort of leaders in key regulatory positions.

Facilitating a wave of mergers among U.S. banks would fortify the banking system and foster competition against the megabanks, according to Mike Mayo, a seasoned bank analyst, and former Federal Reserve employee.

“It’s time for bank mergers to take center stage, particularly with stronger institutions acquiring weaker ones,” Mayo asserted. “The restrictions on mergers within the industry have effectively acted as the Jamie Dimon Protection Act.”