Key Insights

- Pudgy Penguins (PENGU) is consolidating between $0.029 and $0.038 after a pullback earlier this week.

- Whale accumulation and community support have been substantial lately, and a breakout could be the result.

- ETF delays and NFT market weakness are significant risks to the bullish case.

Pudgy Penguins (PENGU) has become one of the most talked-about tokens for the year. After a strong rally over the year, the cryptocurrency consolidates between $0.029 and $0.038. Also, traders are watching this price level because a breakout could lead to further increases.

ETF Delay Creates Pressure on PENGU

The Securities and Exchange Commission (SEC) recently postponed its Canary Spot PENGU ETF ruling until October 12.

This ETF proposal combines PENGU tokens and NFTs and is one of the first hybrid products of its kind. The delay created a wave of selling pressure, since many investors had expected an approval earlier.

Optimism around the ETF significantly influenced PENGU’s 43% rally in July. If the SEC eventually rejects or delays the proposal, PENGU could face more downside.

NFT Market Weakness Adds to the Downtrend

The NFT market has been under pressure recently, too. The general market cap dropped 12% last week to $8.1 billion, and Pudgy Penguins’ floor price fell 17% to around 9.3 ETH.

Ethereum’s 9% decline also added to the slide since NFTs are priced in ETH. This was an essential development for PENGU. Its token value is linked to the success of the Pudgy Penguins NFT collection.

When floor prices fall, they reduce the overall brand momentum and discourage whale investors. Even so, institutional interest has been on the rise. Companies like BTCS Inc. have added Pudgy Penguins NFTs to their treasuries, indicating long-term brand confidence.

Technical Setup Suggests Possible Breakout

From a charting perspective, PENGU is holding above the $0.019 to $0.035 range. After the Robinhood listing, this zone now acts as a support level, and traders believe the current formation to be a bull flag.

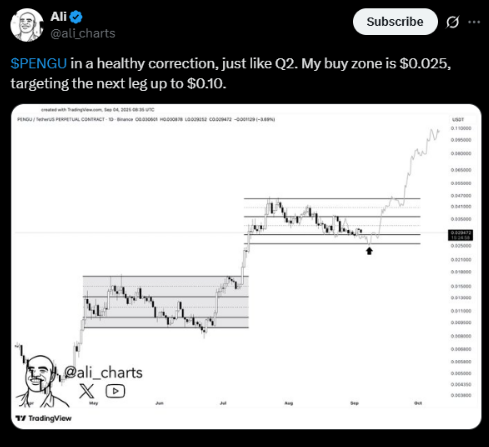

Historically, this tends to come before continuation rallies if confirmed by a breakout. Still, analysts believe the ongoing correction on PENGU is healthy.

Ali Martinez, for example, noted that the cryptocurrency will likely drop further. However, the $0.025 price level could be an attractive buy zone.

The charts show that the Moving Average Convergence Divergence (MACD) recently flipped bearish. On the other hand, the Relative Strength Index (RSI) is now neutral at 48.7.

That leaves room for either direction, and if PENGU breaks below $0.030, the downside could extend another 10–15%. If it reclaims $0.038, analysts see a possible move toward $0.12, supported by whale accumulation.

Whale Activity Points to Accumulation

Large holders have been active lately. Whale wallets linked to the project moved over $5.6 million worth of PENGU to exchanges. This created worries about selling pressure. Similarly, data from The Solana Post shows whale holdings at a three-month high.

This said, tising whale accumulation, especially during consolidation, tends to be interpreted as a sign of confidence. If this continues, it could validate the $0.033–$0.035 support zone as a strong base for the next rally.

Balancing The Good And The Bad

PENGU has been a significant source of market attention because of its strong community support and product expansion. However, there are still a few short-term risks. Regulatory uncertainty from the SEC’s recent delays, the NFT weakness, and technical pressure could all limit gains.

Still, consolidation above major support zones and the rising whale interest indicate that PENGU can break out once conditions align. The next few weeks will determine what happens, especially around the SEC’s ETF decision.