Key Insights:

- PEPE coin price prediction depends on the $0.000013 level; if it fails to hold, PEPE could drop to the $0.000011 level.

- Investors are seizing the current opportunity and accumulating. The latest data shows $34.70 million worth of PEPE outflows from exchanges.

- Whale and institutional participation in the meme coin has skyrocketed, indicating a bullish signal.

PEPE coin price prediction is crucial during this correction phase. The chart suggests a possible downward trend. On-chain metrics indicate a potential price increase.

Different perspectives emerge from price action and blockchain data. Traders must weigh both signals to anticipate the next move.

Current Market Sentiment and PEPE Coin Price Momentum

At press time, PEPE coin price was trading near the $0.00001314 level. The token has recorded a price drop of over 6.25% in the past 24 hours.

The price decline is likely due to a correction after a strong rally. The meme coin is nearing a key resistance level, affecting market sentiment.

Traders and investors have reduced participation as sentiment shifts. As a result, trading volume has dropped by 16% during this period.

PEPE Price Action and Technical Analysis

According to the TradingView chart, the PEPE coin price prediction depends on the current support level of $0.000013. Per the daily chart, the meme coin has already faced resistance at a key level of $0.000015.

Historically, this level has acted as an area of selling pressure, causing downside momentum, and it is happening again. Previously, when PEPE’s price reached this level, it witnessed a sharp fall followed by continuous downside momentum.

If PEPE coin price drops below $0.000013, its price trend could turn bearish. This could lead to further downward momentum. It could see a price decline of over 13% until it reaches the next support level at $0.000011.

PEPE coin must break above $0.000015 and close a candle above that level to turn bullish. If it succeeds, the price could rally more than 40% in the coming days.

The next resistance level is at $0.0000216, which could be the new target. A decisive breakout could push the meme coin even higher.

Besides this bullish and bearish speculation, PEPE’s RSI stood at 71, indicating that it is in an overbought area. The memecoin may keep dropping until the RSI dips below the overbought zone. After that, it could start rallying again.

Bullish On-Chain Metrics

Traders and investors are showing optimism as participation surges. On-chain analytics tools, Coinglass and IntoTheBlock, confirm this rising activity.

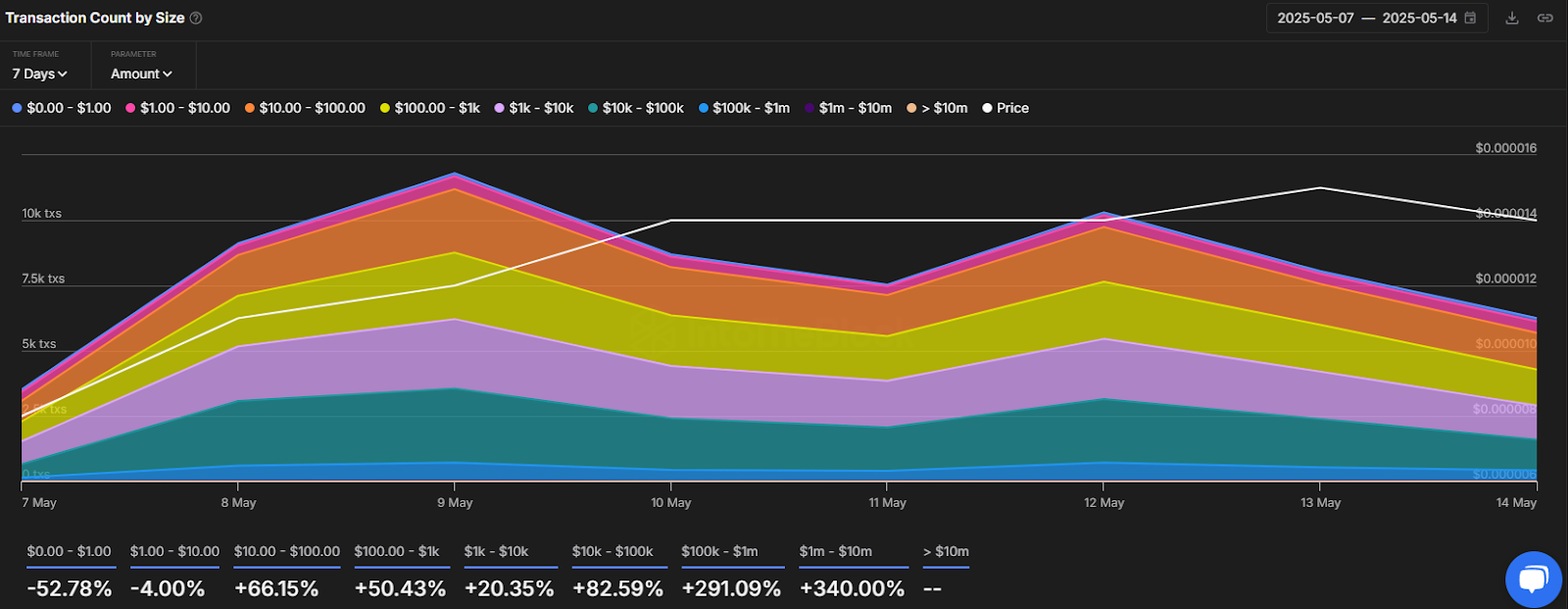

Whale transactions between $100K and $1M have jumped 291.09% in the past week. Similarly, transactions ranging from $1M to $10M have spiked by 340%.

Large whale transactions indicate strong interest and confidence in the meme coin. This activity has fueled speculation about a possible price rally.

At the same time, exchange data shows significant movement in the PEPE coin. A total of $47.34 million worth of PEPE has flowed out of exchanges.

Such outflows from exchanges in the current market conditions indicate potential accumulation. This can create buying pressure and fuel a further upside rally.

When combining these on-chain metrics, it appears that bulls continue to dominate the meme coin, hoping it will sustain its upside momentum.