Key Insights:

- PEPE was exchanged at $0.00000949 and reflected a 5.01 percent loss in the last day following a 24H low of $0.00000946.

- Charts show that the PEPE Futures Open Interest in USD rose by nearly 800 million, reaching just over $100 million in early 2024.

- The Liquidation Map indicated that PEPE was trading at $0.00000952, right in the middle of a very thick liquidation region.

PEPE crypto price prediction showed the meme coin value was at $0.00000949 with a 5.01% loss in the last day following a 24-hour low of $0.00000946.

The loss suggested potential price drop in the future but this was uncertain as price could reverse. Here is why:

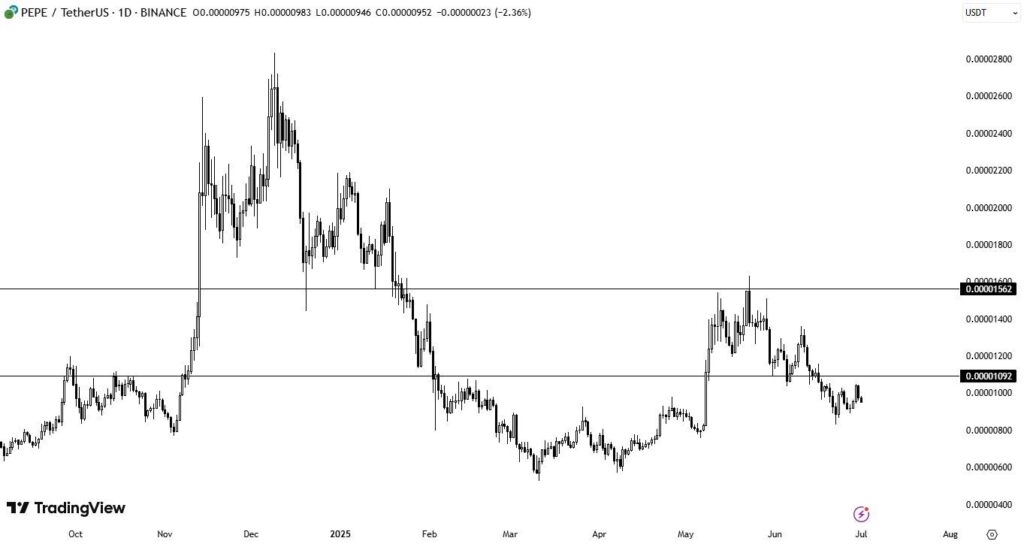

PEPE Price Action

PEPE crypto price prediction showed over-exertion of red momentum on the 15-minute chart, meaning that there is a short-term bearish rate.

The meme coin seemed to be sliding into the range of support at $0.00001092- a level that was once resistance, and it may provide a cushion in the present time.

A slide below the 0.00000946 price may put PEPE at risk of returning even lower down to around 0.00000800.

If it recovers $0.00001092, then a bounce back to about $0.00001200 would be likely, and an additional rebound may seek major resistance at $0.00001562.

Nevertheless, failure to gain ground above the $0.00001200 resistance level may continue to make PEPE range-bound.

The chart showed a declining fading recovery rally, which indicated that a trial of an earlier support could be occurring.

Some of the main levels to consider were resistance at $0.00001562, pivot at $0.00001092, and support at $0.00000946.

Unless the volume of purchases returned above the level of $0.00001092, we tend to keep the numbers on the lower side.

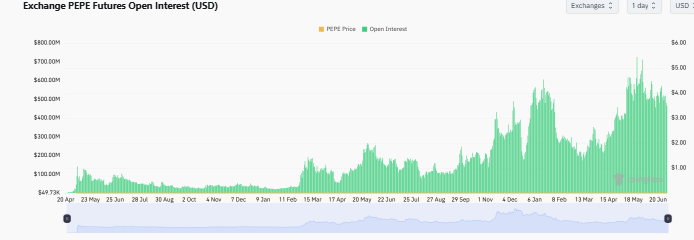

PEPE Open Interest Exchange

On the chart, it was revealed that the PEPE Futures Open Interest in USD had risen by nearly 800 million, reaching just over $100 million in early 2024 to almost $800 million in the middle of June.

Such a consistent increase in Open Interest indicated a growing involvement of the traders.

Open Interest peaked in April and mid-June and was associated with large price movements, suggesting that huge amounts of leveraged long positioning occurred at the time of bull momentum.

The precipitous decline experienced at the end of June could have represented long liquidations or risk-off sentiment, though there is a profitable taking or a capitulation.

The presence of continued large Open Interest without price appreciation may have been caused by crowded trades faced by sharp unpredictable unravels.

Had Open Interest moved in tandem with the price, a solid uptrend could have been seen.

On the other hand, a divergence, that is, a decline on Open Interest with a retraction of price could have been a sign of decreasing conviction. The indicator could have been a sentiment indicator with a pointer on volatility in the future.

The short-term direction that PEPE would take would have been based on the probability of new leverage moving in or unwinding to persist.

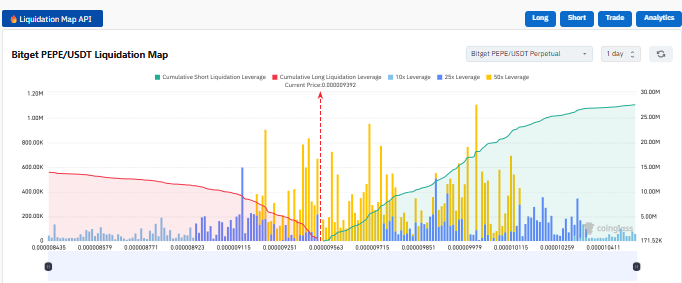

PEPE Crypto Price Prediction: Liquidation Map

PEPE crypto price prediction on Bitget’s liquidation map indicated that PEPE was trading at $0.00000952, right in the middle of a very thick liquidation region.

Thick long liquidations were centered around 0.00000950-0.00000960 where the yellow bars were peaked, hinting that this area was the liquidation magnet of overleveraged longs.

Such pressure could have provoked additional downside risks in case price did not hold. Under $0.00000940, the liquidation activity decreased, meaning the long liquidation flow might run out.

Meanwhile, short liquidations began to accumulate above $0.00000980 and climbed steadily toward $0.00001000, raising the sloping green trendline, which was an indicator of increasing risk to shorts.

Any break above $0.00000980 may cause a short squeeze, whereas any drop below $0.00000950 would intensify long wipeouts.

The powerful concentration near $0.00000952 trapped price between the liquidation zones of equal value.

This showed the possibility of a sudden move to either side, depending on which lever would be resolved. Important levels were at $0.00000940, $0.00000980, and $0.00001000.