Key Insights:

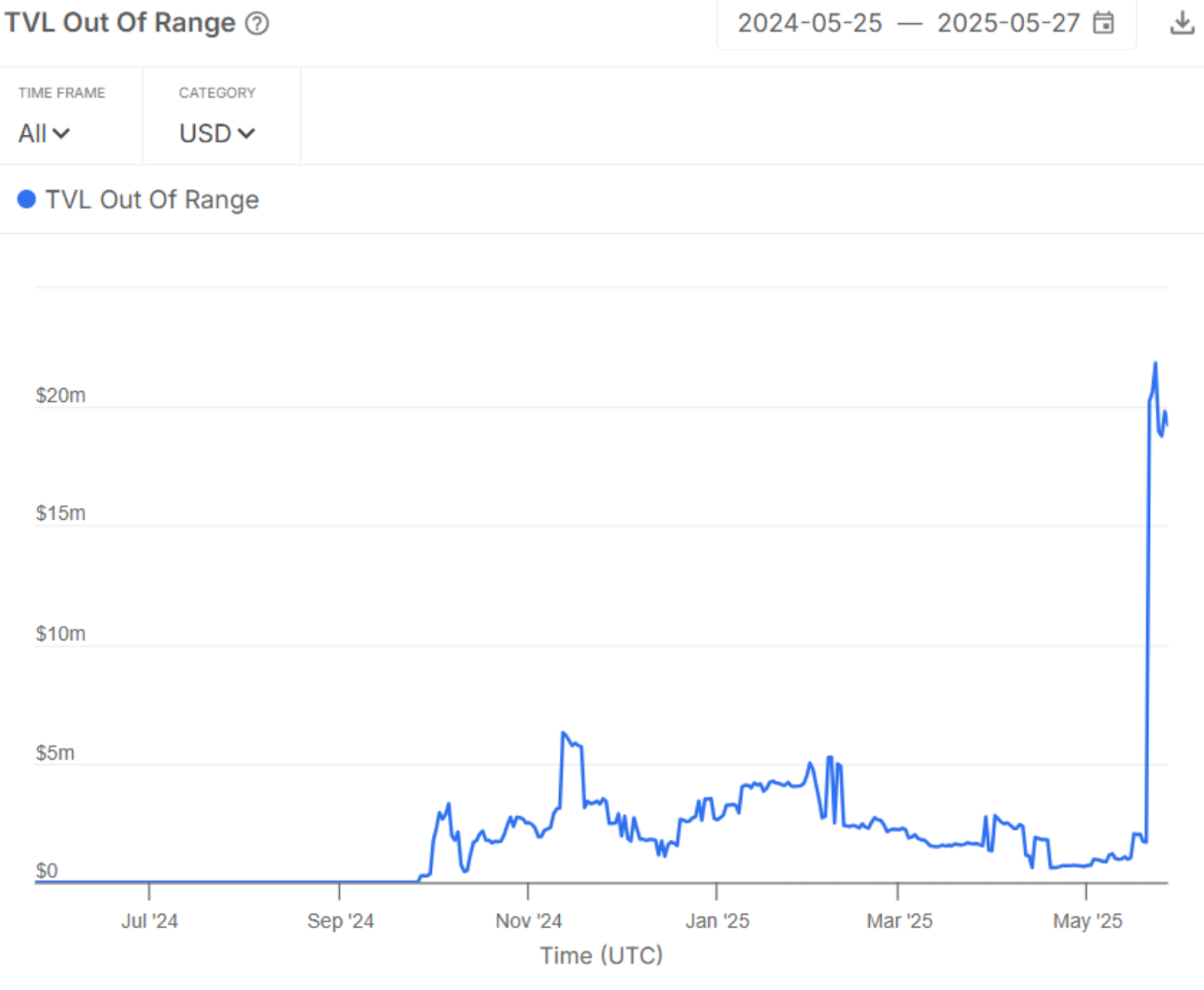

- TVL in EigenLayer spikes from under $5M to over $20M in late May 2025.

- A whale adds out-of-range WETH/EIGEN liquidity, reducing usable pool depth.

- EIGEN price trades at $1.56 with resistance at $1.80 and signs of trend exhaustion.

Market data and on-chain activity of EigenLayer are showing mixed signals. Recently, EIGEN price has been rising in a clear rising channel, and a whale has just added a large amount of liquidity outside of the current trading range. This reduces effective liquidity and may affect trade execution.

Meanwhile, total value locked (TVL) in EigenLayer has spiked sharply to over $20 million, while the entire DeFi ecosystem TVL is trending lower. Also, funding rates, developer activity and price structure on multiple timeframes are flashing short-term signals worth watching.

Whale Liquidity Sits Out of Range as TVL Surges

Sentora says that a large EigenLayer whale has put WETH/EIGEN liquidity outside the current active price range. Most traders cannot use the liquidity because it is set far from the current market price of around $1.56. This is more like a spot position than it is depth for trading.

The real amount of usable liquidity is much lower than the total liquidity when liquidity sits out of range, Sentora reported. Larger trades can move the price more than expected due to this setup, especially if other participants use visible TVL for expectations about execution.

On the same news, data shows that EigenLayer’s TVL increased rapidly from $5 billion to over $10 billion. The rise is the highest level since the project’s launch and may be related to recent liquidity actions or new user inflows. The precise origin of these inflows is not known.

However, EigenLayer’s broader DeFi ecosystem TVL keeps going down. According to DeFiLlama data, the longer-term trend is down from over $20 billion in mid-2024 to under $12 billion by May 2025.

The divergent pattern between EigenLayer’s rapid TVL increase and Ethereum’s overall decline complicates the current sentiment.

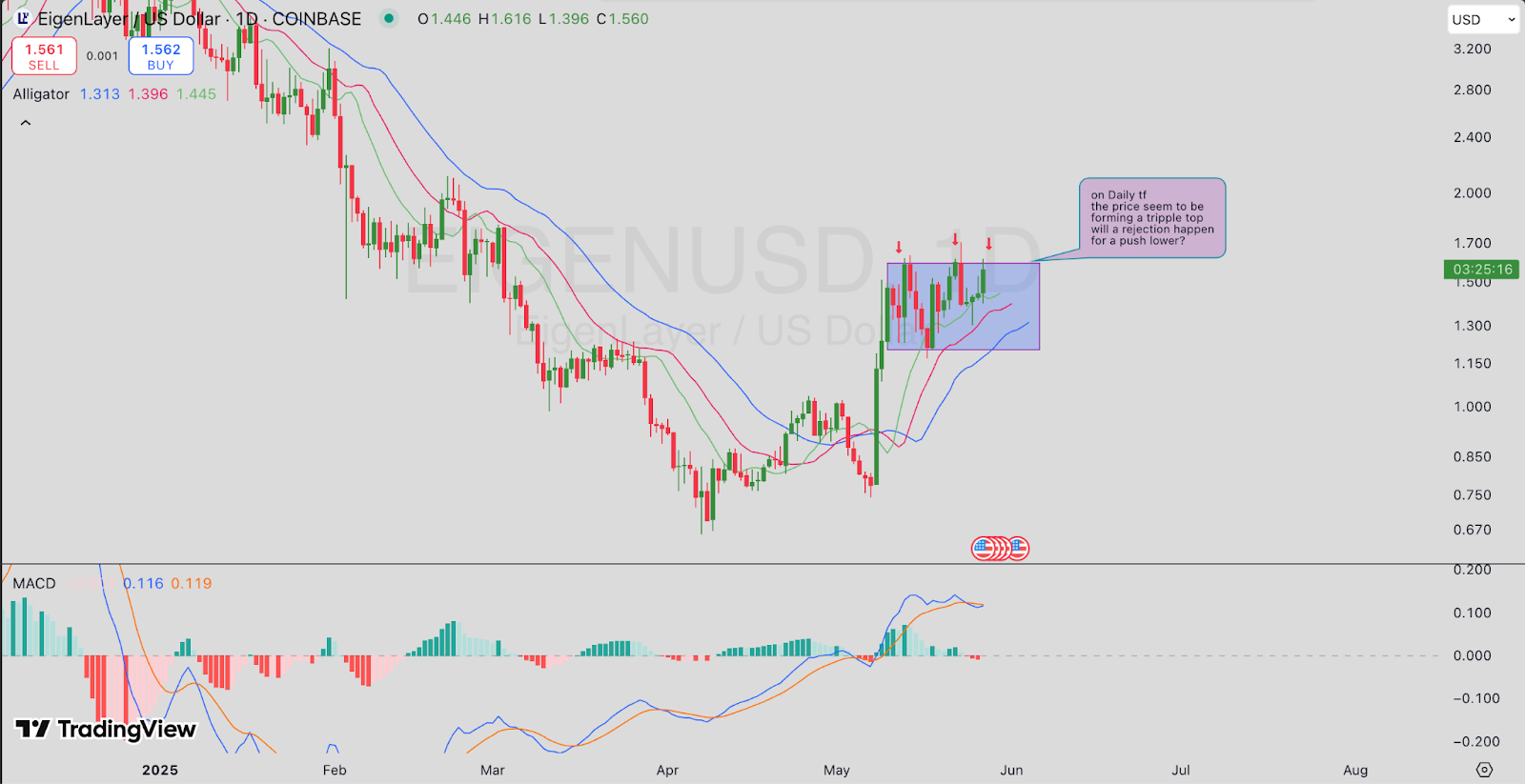

EIGEN Price Faces Resistance Near $1.80 Zone

Meanwhile, according to technicals, EIGEN is moving inside an ascending channel on the 4-hour chart. The current price is nearing the upper resistance line at $1.80. Looking at the chart setup, price has tested this resistance zone a few times but hasn’t broken above it yet.

The RSI (Relative Strength Index) is at 59.96, just below the neutral zone but not overbought yet. There is room for further movement, but momentum is not aggressive.

Alligator indicator also shows that the moving averages are still going up, so short-term support is still intact.

On a daily timeframe, price action is forming a possible triple top formation around the $1.60–$1.65 range. The current level is close to previous two highs and recent candles remain within the horizontal channel.

If price cannot break out, it could be rejected. Triple top is often a sign of a stall in trend continuation.

The daily chart MACD data is positive, but the histogram is flattening. This is a sign of slowing bullish momentum, and a break below $1.50 could allow for downside. But as long as price maintains the support of $1.44–$1.46, the broader structure is still in place.

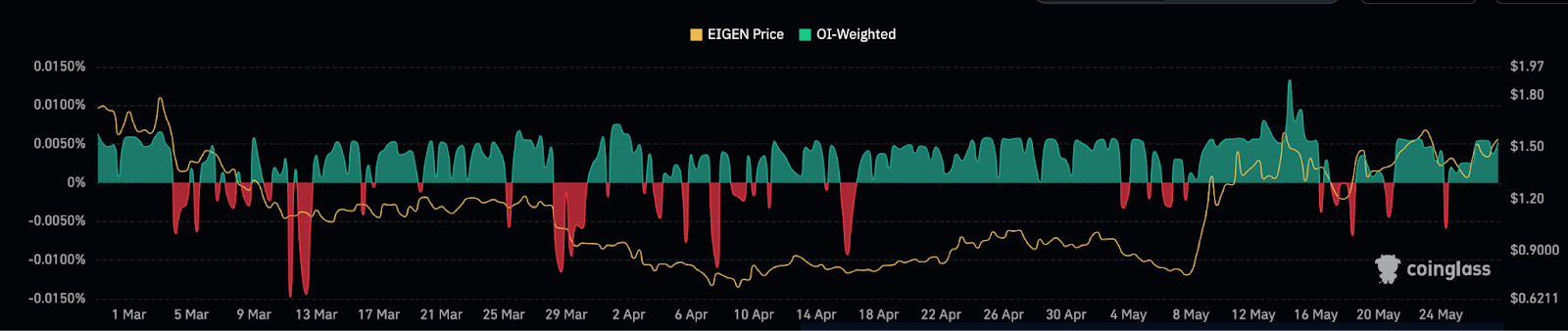

Funding Rates, Developer Activity, and Commit Trends

On the other hand, funding rate data from Coinglass shows traders’ sentiment is mixed. As EIGEN’s price declined, funding rates for most of March stayed negative, meaning traders were paying to hold short positions. This was a reflection of bearish sentiment and low demand for longs during that period.

In April, when prices started to recover, funding rates started to become positive, indicating a repositioning of the market towards longs.

There were brief reversals in early May, when funding rates turned negative again for a short period, indicating a temporary rise in short interest. These instances were, however, short-lived. Funding rates stabilised in positive territory by mid-May as EIGEN’s price moved above \$1.50.

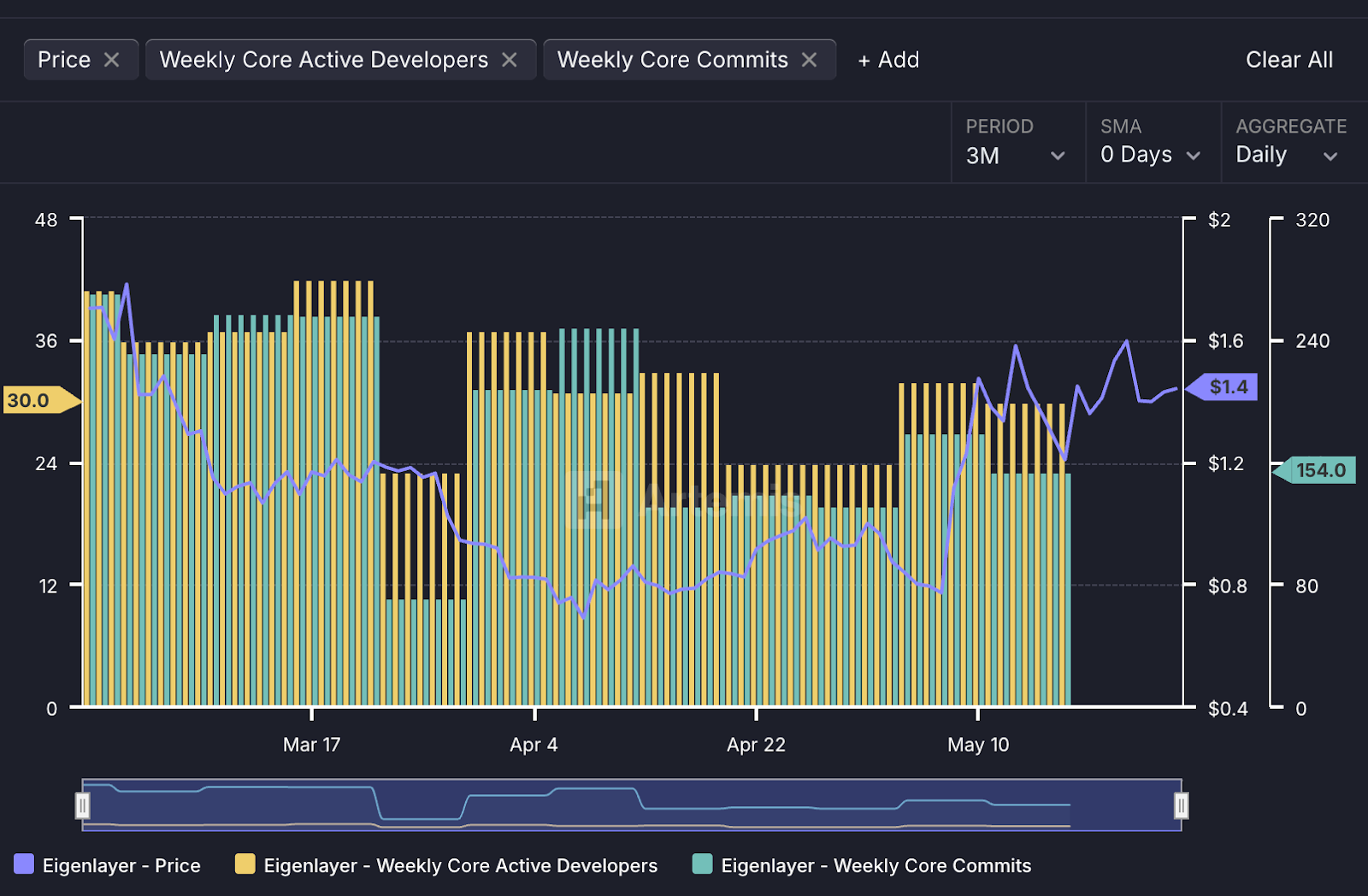

Additionally, consistent activity on EigenLayer is shown by developer data from Token Terminal. Since early March 2025, the project has kept about 30 weekly core active developers.

There are also over 150 code updates in the last week. Also during the same period, the price of EIGEN increased from under $1.00 to $1.40 and beyond, reflecting a correlation between development engagement and market interest.

But earlier in March and April, developer activity had fallen in line with weaker price levels. In May, commits and contributions started to pick up, and so did price.