- Pi Coin rose by 9% in the last 24 hours while the crypto market declined by 1%.

- The coin remains 33 percent down over the week but shows strong gains of 25 percent over the month and 37.5% in two weeks.

- After weeks of downward movement, technical indicators such as RSI and MACD suggest renewed bullish momentum for Pi Coin.

Pi Coin has bounced back strongly, rising 9% in the last 24 hours to $0.798. The wider crypto market, meanwhile, fell 1% over the same period. Pi Coin shows renewed momentum, signaling a potential upward breakout after weeks of losses.

Despite a 33% weekly decline, the digital asset is still up 25% month to date and 37.5% over the past two weeks. Trading volume climbed today, suggesting rising market activity and stronger interest in Pi Coin’s current trajectory. Indicators seem to be shifting, and the coin seems to be starting to regain technical strength after a recent low.

This rebound follows a clear retest of previous resistance, which is now acting as support, with Pi Coin breaking free from a descending wedge pattern. The setup suggests it could all line up in a very bullish fashion, and key momentum metrics have turned positive again. Rising volume levels buttress buyer strength, also indicating growing market participant participation.

Bullish Momentum Builds Around Pi Coin

Technical signals suggest that Pi Coin could enter a new market recovery phase. A key level often signals renewed buying pressure over 56, and the RSI has clawed its way back above that line. On the flip side, the MACD indicator suggests further bullish continuation in at least the short term.

Volume is still above average, meaning there is conviction in what is currently happening price-wise. This steady growth in participation reflects confidence in Pi Coin’s market structure and strength. Things don’t feel as bearish now that we’ve seen recent dips.

Key resistance levels pointed out the previous rally at $1.70 and $3.00. A strong breakout above these points could push Pi Coin into a sustained upward trend. Continuing to escalate, though, market focus could swiftly begin to shift towards higher long term targets.

Ecosystem Growth and Exchange Prospects Fuel Optimism

Recent announcements indicate efforts to expand Pi Coin’s ecosystem utility through structured investment initiatives. As growing support for broader adoption, a new $100 million ecosystem fund launch through Pi Network Ventures fund reflects the growing support for broader adoption. These developments aim to attract applications that use Pi Coin for real-world use cases.

In addition, application utility gains may enable long-term value if adoption continues within developer and user circles. Building projects on the Pi Network may add utility and increase the transactional demand for Pi Coins. Over time, these dynamics could stabilize the price, which could, in turn, boost investor confidence.

Meanwhile, speculation continues over Pi Coin’s potential listing on major exchanges such as Binance and Coinbase. Although claims have not been made, the community sees crafty movements as early warning signs that the order of being might be coming soon. Exchange support would dramatically increase liquidity and price exposure for Pi Coin.

Pi Coin Liquidations Signal Sentiment Shift

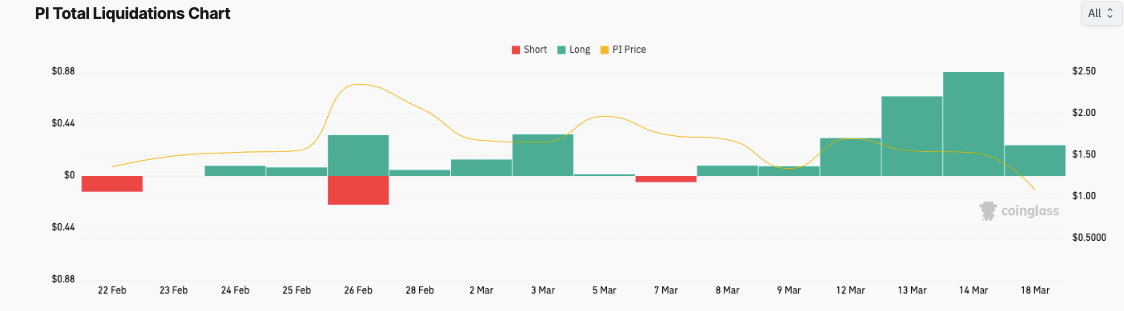

Data from Coinglass highlights liquidation patterns that impacted Pi Coin during its recent correction phase. The longer liquidations went significantly up between March 12 and March 14 as the price dropped from above $2.00 to below $1.50. This was clearly a period of a shift in short-term sentiment and market structure.

The largest single-day liquidation occurred on February 26 when prices spiked hard up to close to a dollar and knocked both longs and shorts. Liquidation volumes increased steadily from mid-March onward, coinciding with the time market prices fell. Long positions on a follow-on overconfidence of earlier bullish bets dominated this trend.

Pi Coin’s recent recovery suggests the liquidation phase may have flushed out weak hands despite this volatility. More stable upward movements appear to have formed stronger support. Key indicators and volume levels in support of growth are laying the foundation for another rally.

Pi Coin Eyes Breakout Toward $100

Pi Coin’s structure shows signs of preparing for a longer-term breakout if momentum continues to build. If the trend continues, $50 and $100 will become more reasonable targets. To achieve this outcome, continued growth of utility and listing exposure is necessary.

Market sentiment may improve rapidly if Pi Coin secures listings on major exchanges, increasing access and visibility. Once that news hits the air, I can imagine momentum accelerating at this point, pulling the price up to the $3 to $4 area, which would be the next milestone. This could also be the launchpad for a more aggressive upward trend.